This Week in the Markets

FOMC is meeting next week, on December 13 - 14, 2022, and is expected to raise the fed funds raise by 50 basis points to 4.25 - 4.50%. CEOs of JPMorgan and Goldman Sachs used various stages to voice their concerns about the inevitability of a recession if the Federal Reserve keeps raising rates. However, On Friday, the U.S. Department of Labor reported that the Producer Price Index advanced 0.3% in November on a seasonally adjusted MoM basis. The index advanced 0.3% in both September and October, which suggests that the Federal Reserve’s fight against inflation might be far from over. The markets finished the week deeply in the red.

🔴 Only four Fintech companies saw their shares advance this week (out of 40 companies that I follow), as the general market selloff was heavily felt in the growth sector. Lenders catering to the low-income / low-to-no-FICO-score customers were hit the hardest, including MoneyLion (NYSE: ), Pagaya (NASDAQ: ) and Affirm (NASDAQ: ).

🟢 I suggest keeping an eye on this week’s gainers, Toast (NYSE: ), Alkami (NASDAQ: ), and Payoneer (NASDAQ: ). These companies have very little in common in terms of their businesses, but their stocks have been showing relative strength since the local bottom in early May 2022 (this was the moment when Fintech companies reported their Q1 2022 results and the new market reality became evident).

✔️ This Stock Strategist Says We’ll See 5% Inflation for the Next Decade✔️ Wall Street Chorus Grows Louder Warning That 2023 Will Be Ugly✔️ Goldman CEO David Solomon Prepares for a Possible Recession✔️ Jamie Dimon says inflation eroding consumer wealth may cause recession✔️ Wholesale prices rose 0.3% in November, more than expected✔️ US Producer Prices Top Estimates, Supporting Fed Hikes Into 2023✔️ Dow tumbles 300 points Friday, posts worst week since September

Robinhood Launches Retirement Accounts, Releases November Operating Results

Robinhood (NASDAQ: ) launched individual retirement accounts (IRAs), which are tax-advantageous accounts allowing individuals to save for their pension. The company announced its plans to launch IRAs earlier in the year in a move to diversify its customer base away from day traders and attract long-term investors. A unique angle to jumpstart the adoption of newly launched accounts: the company is offering to match 1% “on every eligible contribution dollar.” Robinhood also launched stock lending in May 2022 and advanced charts in August 2022, as it uses the market downturn to extend its offering.

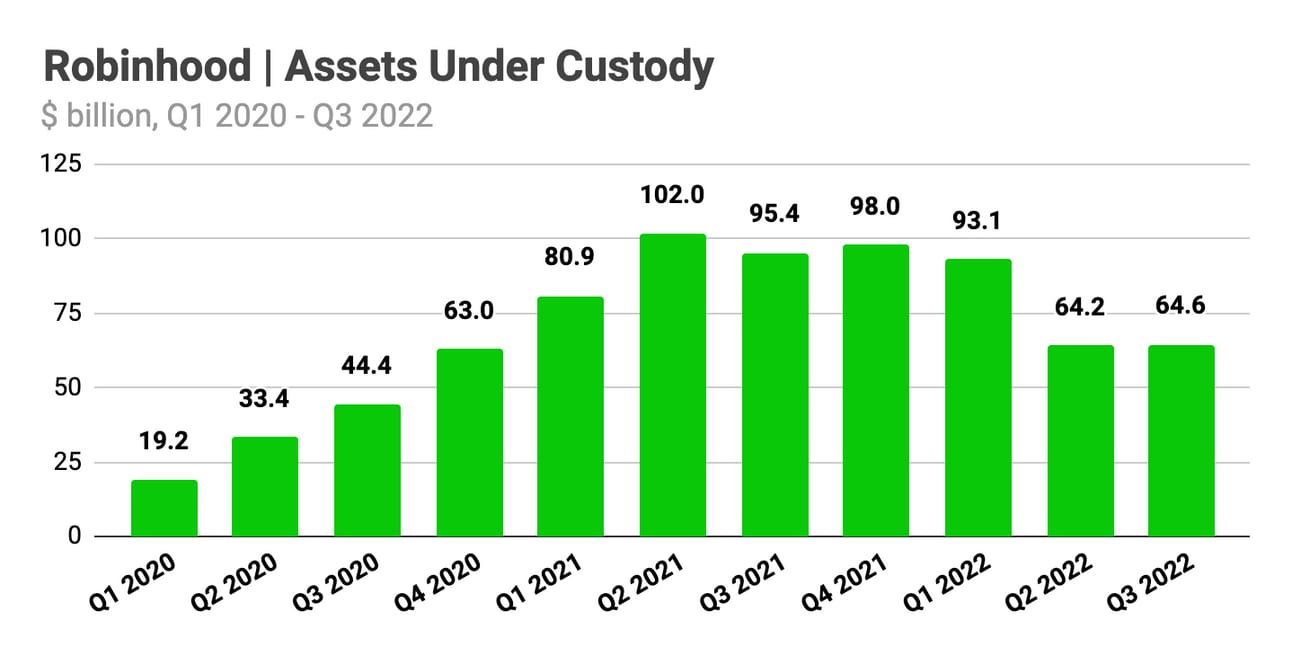

Robinhood also reported its operating results for November 2022 (earlier in the year the company started reporting monthly operating metrics in between its quarterly earnings calls). Thus, the company reported 23 million Net Cumulative Funded Accounts (NCFA), 12.5 Monthly Active Users (MAU), and $70.2 billion in Assets Under Custody, which was almost unchanged compared to October 2022. A positive takeaway from this report was that Robinhood’s customers keep depositing funds to their accounts. Thus, the company reported $1.7 billion in Net Deposits, which brings the total Net Deposits to $17.0 billion this year.

✔️ Introducing Robinhood Retirement✔️ Robinhood Wants Your Retirement Money✔️ Robinhood Rolls Out IRAs. It Wants the Buy-and-Hold Crowd Now✔️ Robinhood Retirement Plan Viewed with Skepticism by Some Analysts✔️ Sam Bankman-Fried’s Robinhood stake is tied up in FTX bankruptcy proceedings✔️ Robinhood Markets, Inc. Reports November 2022 Operating Data

Coinbase CEO Sees Revenue Falling 50% in 2022

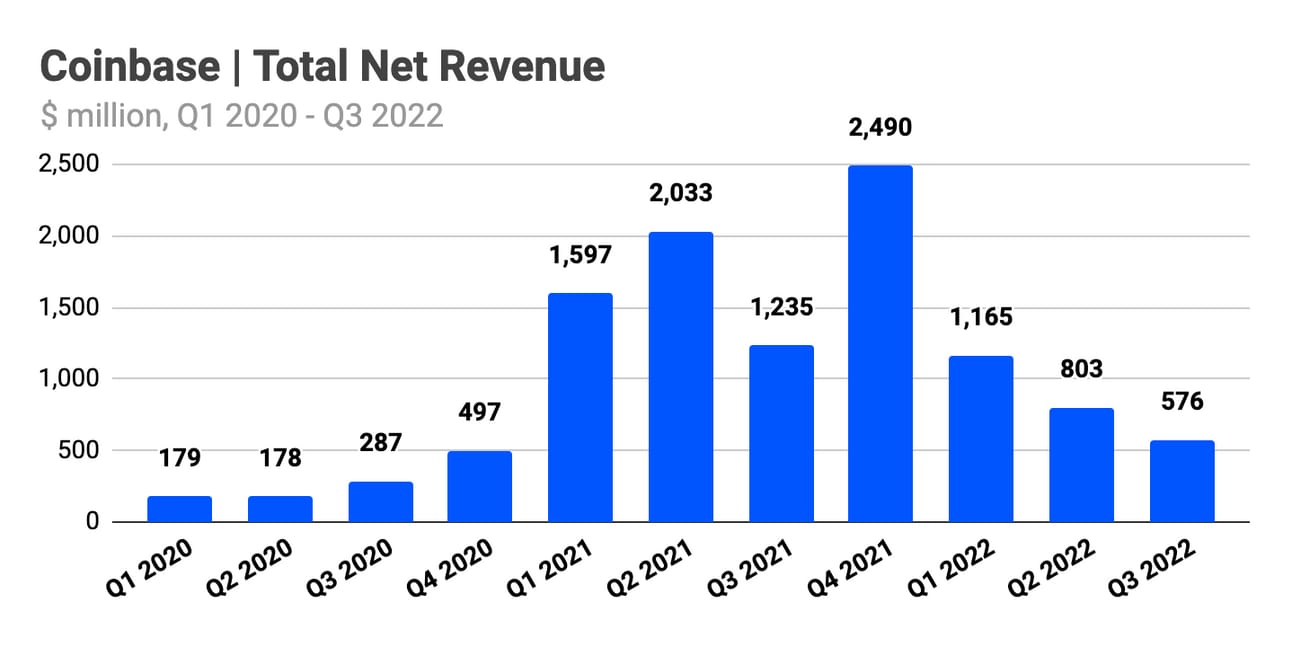

Brian Armstrong, the CEO and co-founder of Coinbase, gave an interview to Bloomberg confirming analysts’ estimates of a 50%+ drop in the company’s revenues compared to 2021. “Last year in 2021, we did about $7 billion of revenue […], and this year with everything coming down, it’s looking, you know, about roughly half that or less,” - said the company’s chief. Coinbase reported $7.36 billion in revenue in 2021, so a 50% drop would imply revenue of $3.68 billion. The company reported $2.54 billion in revenue in the first three quarters of 2022, including $0.58 billion in Q3 2022. Thus, the drop will surely be bigger than 50%.

A sharp decline in revenue was inevitable for Coinbase as the markets entered another “crypto winter”. The company still heavily relies on retail investors to generate revenue, and retail trading volumes were sharply down compared to 2021 (i.e. retail trading volumes in Q3 2022 declined 72% compared to Q3 2021). The company executed a round of layoffs in June 2022, that impacted 18% of its workforce, and set “guardrails” on maximum losses of $500 million in Adjusted EBITDA for the full year. The company finished Q3 2022 with $5.61 billion in cash, cash equivalents, and USDC, so, at least for now, it is not facing a cash problem.

✔️ Coinbase CEO Sees Revenue Falling 50% or More on Crypto Rout✔️ Coinbase Revenue Will Be ‘Half or Less’ of Last Year’s: CEO Brian Armstrong✔️ Coinbase Confirms a Rough End to 2022. The Stock Is Rising✔️ Coinbase Stock Is Falling. New Downgrade Casts a Shadow Over 2023✔️ Crypto CEOs Fearing Worst Is Yet to Come Are Cutting More Jobs✔️ SEC Faces Calls to Boost Crypto-Exchange Enforcement After FTX Collapse✔️ Coinbase to Waive Fees for Converting Tether Stablecoins to USDC✔️ More Crypto Exchanges Verify Reserves, But Questions About Assets Remain

MercadoLibre Files Complaint Against Apple, Partners with Watsapp

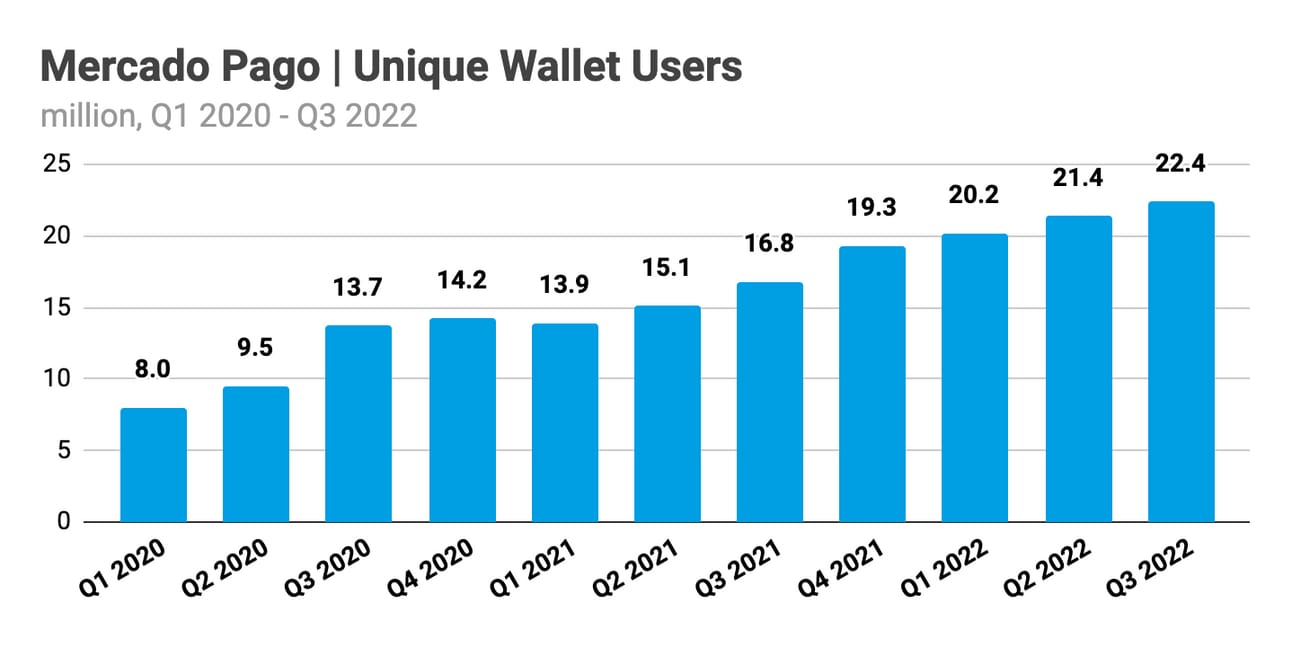

MercadoLibre, the LatAm e-commerce and Fintech giant, filed a complaint against Apple, accusing the U.S. tech company of breaking the antitrust regulation. The nature of the complaint is nothing new: Apple is limiting the use of alternative payment methods and taking a 30% cut from the sales in iOS applications. The complaint is logical, as MercadoLibre uses its e-commerce platform to scale its Fintech arm, MercadoPago. Thus, in Q3 2022, MercadoPago reported 22.4 million unique users of its digital wallet and $32.2 billion in Total Payment Volume, of which $9.1 billion were processed on MercadoLibre. Last week Coinbase had to disable NFT transfers in its iOS app, as Apple wanted to take their commission on the gas fees.

At the same time, MercadoLibre is working on a partnership with another U.S. tech giant META. Thus, the company is running a pilot of introducing business payments in WhatsApp in Brazil, one of the largest markets for the messaging app. The solution would allow consumers to find businesses in the WhatsApp directory and make in-app payments with their debit or credit card. The partnership is part of the Meta Pay Program (previously called Facebook Pay Program). The Central Bank of Brazil had to introduce changes to the regulation governing Mastercard operations in the country to permit this partnership. Central Bank of Brazil truly deserves credit for promoting digital payments in the country (first, PIX, now Meta Pay).

✔️ MercadoLibre Files Complaint Against Apple in Brazil, Mexico✔️ MercadoLibre files complaints against Apple for 'anti-competitive practices'✔️ MercadoLibre in talks with WhatsApp on business messaging payments✔️ MercadoLibre considers business payments on WhatsApp✔️ Meta's WhatsApp makes Brazil a key test market for business messaging✔️ Brazil permits changes to Mastercard's payment arrangement

In Other News

✔️ The $42 Billion Question: Why Aren’t Americans Ditching Big Banks?✔️ Retail traders think stocks will bottom in 2023✔️ SEC to Float Proposals to Get Small Investors Better Prices on Stock Trades✔️ Goldman Sachs on hunt for bargain crypto firms after FTX fiasco✔️ Stablecoin Issuer Circle Ditches $9 Billion SPAC Deal in Latest Blow to Crypto✔️ Jack Dorsey’s Block Invests in Renewable Bitcoin Miner Gridless in Africa✔️ Walmart-backed fintech startup plans to launch its own buy now, pay later loans✔️ Travel and E-Commerce Face a Slowdown in 2023, Analyst Warns✔️ 3 Reasons an Analyst Says to Sell Shopify Stock. One Hint: Amazon✔️ Black Friday Status Dims as Sales in Stores Fall Short✔️ Brazil's Nubank announces $330 million equity capitalization in Mexico✔️ Brazil Maintains Key Rate at 13.75% as Lula’s Spending Plan Adds to Inflation Risk✔️ Under fire for weak regulation, dLocal CEO says seeking UK license✔️ Morgan Stanley Buys Technology, Hires Entire Staff of Robo-Advisor Blooom✔️ Galileo Launches Customizable Buy Now, Pay Later (BNPL) Solution✔️ Paysafe Announces Reverse Stock Split✔️ Morgan Stanley cut about 2% of global staff✔️ Plaid lays off 20% of staff

Disclosure & Disclaimer: I own shares in several companies that I write about in this newsletter, as I am bullish on the transformation in the financial services industry. However, the information contained in this newsletter is intended for informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions.