This Week in the Markets

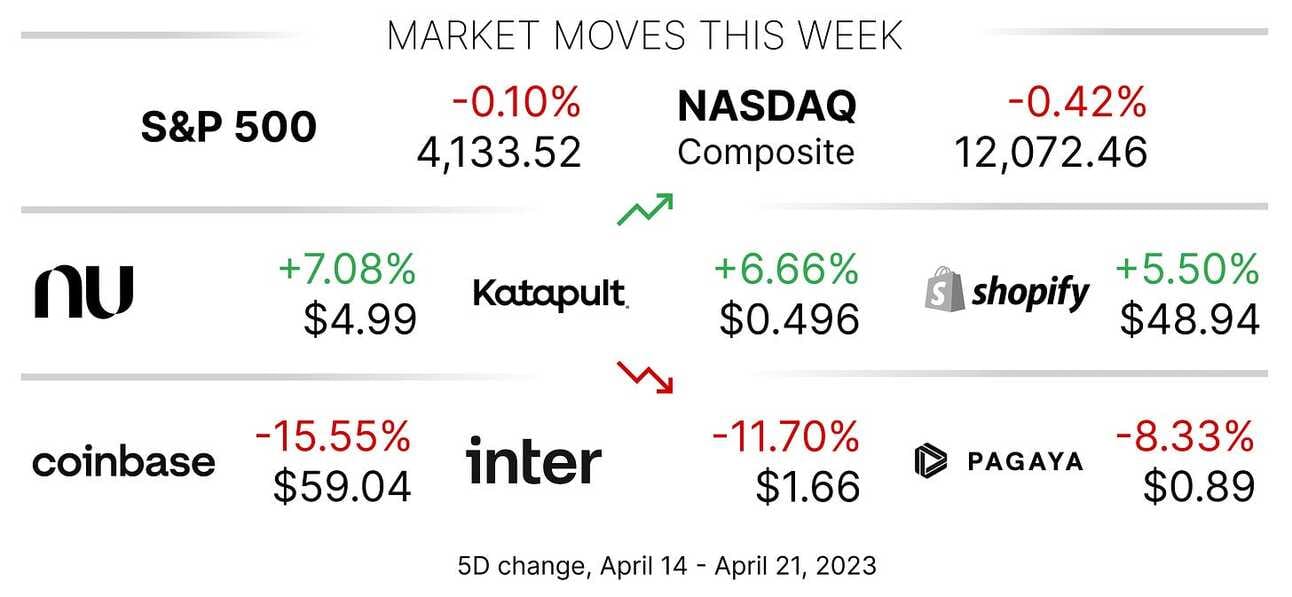

This was a quiet week in the markets with major indices finishing the week little changed. Big banks finished their earnings season, showing resilience in the U.S. banking system and suggesting that the deposit crisis was contained to a few financial institutions. Shares of Coinbase (NASDAQ: ) and mining companies like Marathon Digital (NASDAQ: ) and Riot Platforms (NASDAQ: ) declined as Bitcoin price well below the $28,000 mark.

Next week, Fintech companies will start reporting their Q1 2023 results. We will hear from Visa (NYSE: ) and Fiserv (NASDAQ: ) on Tuesday (April 25), LendingClub (NYSE: ) on Wednesday (April 26), and Mastercard (NYSE: ) and FIS (NYSE: ) on Thursday (April 27).

✔️ Better-Than-Feared Earnings Has Analysts Rethinking Projections✔️ Wall Street Banks Sailed Through a Quarter of Collapsed Lenders✔️ Stocks end Friday’s session little changed✔️ Bitcoin Stumbles This Week After $30,000 Threshold Fails to Hold

Apple Launches High-Yield Savings Accounts

Apple (NASDAQ: ) has launched a new high-yield savings account for Apple Card customers, according to a recent press release from the tech giant. The savings account is FDIC-insured and offers a 4.15% annual percentage yield (APY), “a rate that’s more than 10 times the national average”. The introduction of Apple's savings account is a continuation of the company's push into financial services, which began with the launch of Apple Pay in 2014. With its competitive interest rate and no minimum balance requirements, the new savings account is expected to attract attention from Apple Card users looking to grow their savings. Apple is launching the service in cooperation with Goldman Sachs (NYSE: ).

Image source: Apple

✔️ Apple launches its savings account with 4.15% interest rate✔️ Apple, Goldman Sachs Debut Savings Account With 4.15% Annual Yield✔️ Apple’s new savings account lets Card users grow their Daily Cash✔️ Apple Pay’s Long Road to Paying Off Is Getting Shorter

Coinbase Gets Bermuda License, CEO Floats the Idea of Relocating the Company

Coinbase (NASDAQ: ) CEO Brian Armstrong has said that he would not rule out relocating the company away from the United States if the regulatory environment for cryptocurrencies does not improve. Speaking at a Fintech conference in London, Armstrong said that he was concerned about the lack of regulatory clarity in the US and the impact it was having on the company's ability to operate. He added that the company was considering all options, including moving its headquarters to a jurisdiction with a more favorable regulatory framework. Armstrong's comments come as Coinbase continues to face regulatory scrutiny from the SEC. Last month, Coinbase received a formal notice from the agency regarding the regulator's intention to take enforcement action against the company.

Image source: Hubert Lamela on Flickr

✔️ Coinbase CEO Won’t Rule Out Relocating Company Away From US✔️ Coinbase CEO says the crypto exchange is preparing to go to court with the SEC✔️ Coinbase gets Bermuda license, plans to launch offshore exchange in weeks✔️ An update to Coinbase’s global scale to go broad and deep✔️ Coinbase Explores Overseas Venue as US Ramps Up Crypto Scrutiny

UK’s Wise Reports Strong Fiscal Q4 2023 Results, Stock Plummets Anyways

Wise (LON: WISE) the UK-based money transfer service, released a trading update for Fiscal Q4 2023 (the company’s fiscal year ends on March 31) showing strong growth. The company reported a 43% YoY increase in revenue and an 83% YoY increase in total income, driven by growth across all its segments, including personal and business customers. Wise’s 6.2 million active users moved £26.7 billion in cross-border volume during the quarter, which represents a 25% YoY increase, and held £10.7 billion of their money with the company. However, the company’s earnings fell short of market expectations due to a drop in cross-border transfers. The shares price was down 7.76% for the day but recovered later in the week.

✔️ Money transfer firm Wise shares drop as volumes disappoint✔️ Wise misses estimates as currency volatility slows cash transfers overseas✔️ Wise’s tougher times raise risk of mission drift

Shift4 Payments Becomes the Latest Target of Short-Sellers

In a report released on Monday, short-seller Blue Orca Capital accused payment processing company Shift4 Payments (NYSE: ) of inflating its gross profit, EBITDA, and cash flow numbers. Blue Orca believes that Shift4 Payments is “substantially less profitable, generates far less cash, and is materially more levered than investors.” The company becomes the latest target of short sellers. Thus, in November last year, Muddy Waters published a report on dLocal (NASDAQ: ) accusing the payments processor of manipulating its accounting records and inflating its take rates. This year Hindenburg Research accused Block (NYSE: ) of inflating its Cash App user metrics, and Spruce Point Capital Management accused Canadian Nuvei (NASDAQ: ) of “covered up a pattern of business failures, lack of organic growth, and a web of relationships with individuals connected to major Ponzi Schemes.”

✔️ Blue Orca is Short Shift4 Payments, Inc.✔️ CEO Jared Isaacman Issues Response to Short Seller Report✔️ Nuvei Faces Short-Seller Report After Ryan Reynolds Stake✔️ Block: How Inflated User Metrics and “Frictionless” Fraud Facilitation Enabled Insiders To Cash Out Over $1 Billion✔️ Muddy Waters is Short DLocal Ltd.

In Other News

✔️ Biggest US Banks Wrote Off $3.4 Billion in Bad Consumer LoansDespite a significant increase in credit card write-offs, bank executives do not see any major concerns or issues in the banking industry. They remain confident that the overall credit quality of their customers is still strong, the current surge in credit card write-offs is temporary, and that the current economic conditions are favorable.

✔️ Goldman Sachs misses revenue estimates after taking $470 million hit on Marcus loansGoldman Sachs posted its first-quarter results on Tuesday that fell short of analysts’ expectations due to weaker trading results and a $470 million hit linked to the sale of consumer loans. Thus, the bank sold a $4 billion portion of its Marcus loan book and transferred the remainder to held-for-sale status.

✔️ First EU-Wide Crypto Regulations Clear Final Parliament VoteThe European Union has taken a major step towards regulating the crypto industry as the Markets in Crypto-Assets regulation was passed in the European Parliament. The regulation aims to provide a comprehensive framework for the crypto industry, including rules around stablecoins, crypto exchanges, and wallets.

✔️ Credit Card Debt, Defaults Pose a Major Challenge to Brazil’s FintechsBrazilian Fintech companies are facing a challenge as defaults on credit card debt rise in the country. Despite the rapid growth of Fintech companies, their lack of historical data and traditional banking infrastructure is making it difficult to manage the rising defaults and forcing companies to rely on alternative data sources.

✔️ MercadoLibre Bucks Big Tech Layoffs By Adding 13,000 JobsMercadoLibre, the Latin American e-commerce giant, is planning to hire thousands of new employees in Mexico and Brazil as part of its expansion strategy in the region. The new hires will be focused on customer service and logistics, as the company seeks to improve its delivery times and overall customer experience.

Cover image: Microsoft Bing Image Creator, Powered by DALL·E, prompt “people stand in line to a bank that looks like a giant apple, pop art style”

Disclaimer: Information contained in this newsletter is intended for educational and informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions.