Hey!

I have written a lot about embedded payments, which refers to the integration of payments into software platforms. Companies like Shopify, Toast, and Bill generate billions in revenue from payment processing.

Adyen, in collaboration with Boston Consulting Group, estimated the embedded lending opportunity (as in potential revenue) to be $48 billion. Embedded lending is believed to be an even larger opportunity than embedded payments, and remains largely untapped.

My research suggests that individual lending programs have struggled to capture this opportunity. Despite years of effort, major embedded lending programs like Square Loans and Shopify Capital have captured a small fraction of this opportunity. Perhaps, this opportunity is not that large after all?

Or, perhaps this opportunity won't be captured by individual lending programs, but rather by embedded lending providers that power multiple small programs? Think Stripe Capital for Platforms, Adyen Capital, Parafin, and YouLend.

This is an exciting area! Shall we dive in?

Jevgenijs

p.s. I would like to thank Rhea for helping me with this research. This topic has been on my to-do list for a long time, and would probably stay there if not for her help🙏🏻

p.s.s. if you have feedback just reply to this email or ping me on X/Twitter

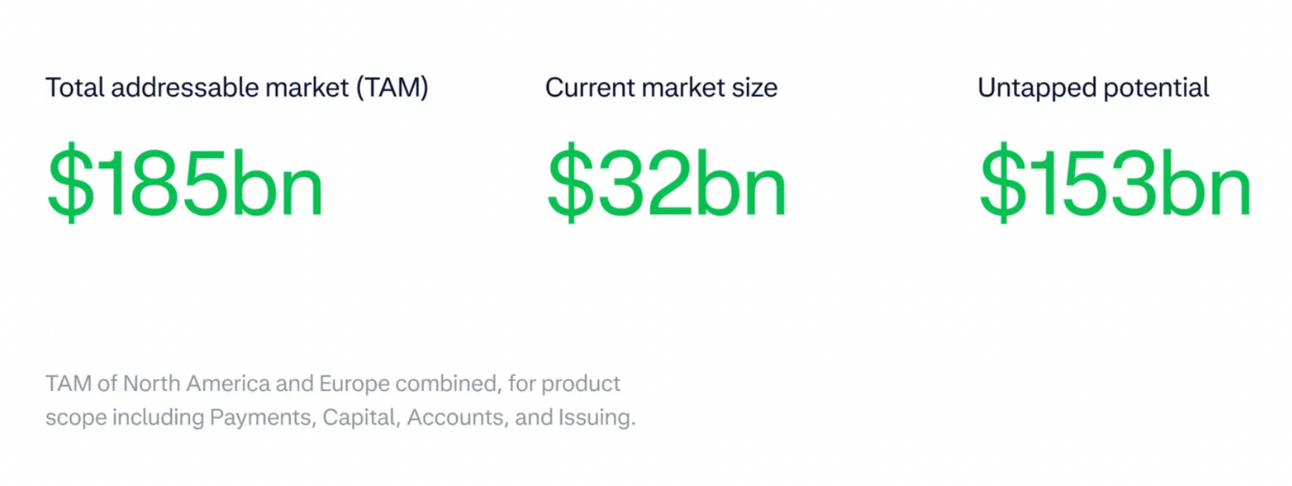

Adyen, in collaboration with Boston Consulting Group, estimated the addressable market for embedded finance to be $185 billion. Embedded finance refers to the integration of financial services, such as payments, lending, or banking, directly into a non-financial company's platform (in this particular context, a platform serving SMBs). The TAM for embedded finance represents the total revenue potential that embedded finance providers can generate.

“Four embedded financial products drive significant revenue potential for SaaS platforms in the SMB space: Payments, Capital, Accounts, and Issuing. [ Today ] their combined total addressable market (TAM) stands at $185bn. So far, only $32bn out of $185bn has been captured, leaving 80% of the market up for grabs.

According to the research, as adoption increases, the market is projected to double by 2030, growing at a 10-15% compound annual growth rate. Meanwhile, products like capital, accounts, and issuing are expected to grow even faster, at a 20% annual rate.

Payments has a $47 billion TAM, with $25 billion, or 54%, already captured. However, other segments remain largely untapped: capital ($48 billion TAM) has captured just $3 billion (93% still open), while accounts ($75 billion TAM) and issuing ($15 billion TAM) have each captured only a fraction.

With the highest adoption, payments is now the cornerstone for embedding broader financial products. Although payments still hold considerable untapped potential, an equally large opportunity lies in other financial product categories, where adoption is rapidly accelerating — albeit from a small base. Capital holds major growth potential given persistent unmet funding needs from SMBs.

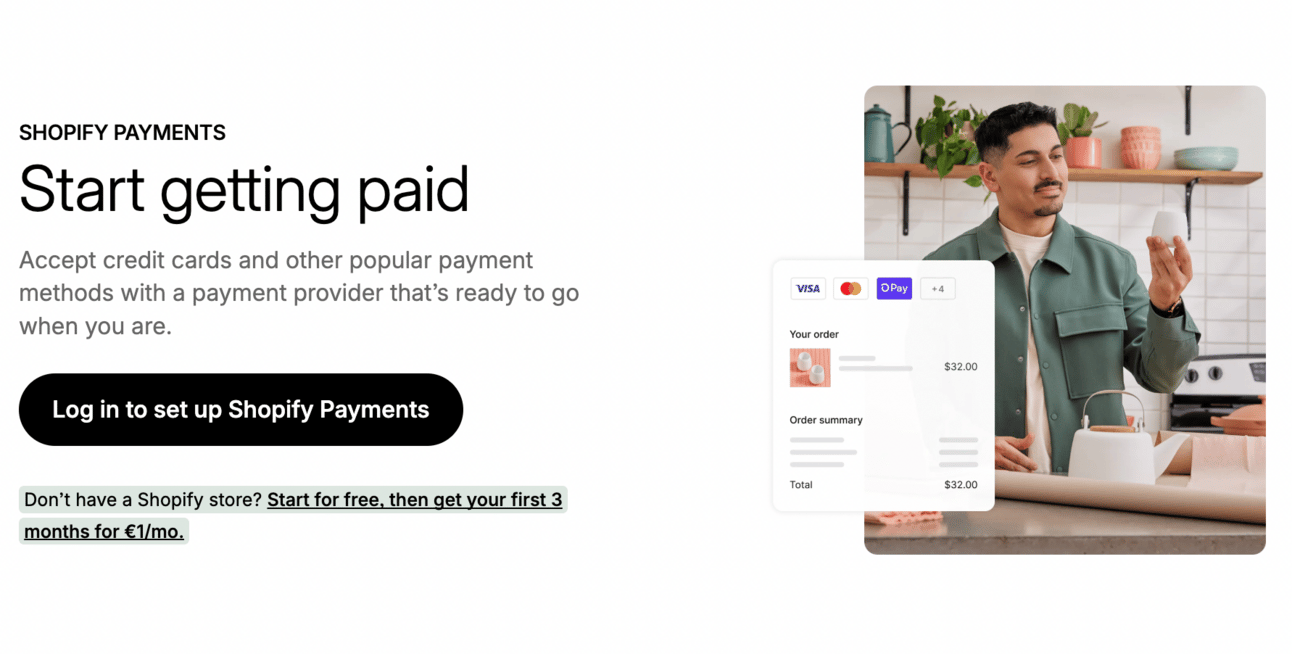

Shopify $SHOP ( ▲ 0.73% ) is an excellent example of a company that has been masterfully monetizing embedded payments. Thus, in 2024, 74% of the company’s revenue came from the “Merchant Solutions” segment, which primarily generates generates revenue from payment processing.

Image source: Shopify Payments

Shopify’s revenue in 2024 was $8.9 billion, so 74% is $6.6 billion. Even if 80% of “merchant solutions” revenue comes from embedded payments (as per disclosures during Shopify Investor Day) that is $5.3 billion.

“During the year ended December 31, 2024, merchant solutions revenues accounted for 74% of total revenues. We principally generate merchant solutions revenues from payment processing fees and currency conversion fees from Shopify Payments.”

Toast $TOST ( ▲ 2.51% ) is another great example. In 2024, $4.1 billion, or 82% of the company’s total revenue came from the “Financial Technology” segment, which also primarily consists of payment processing fees.

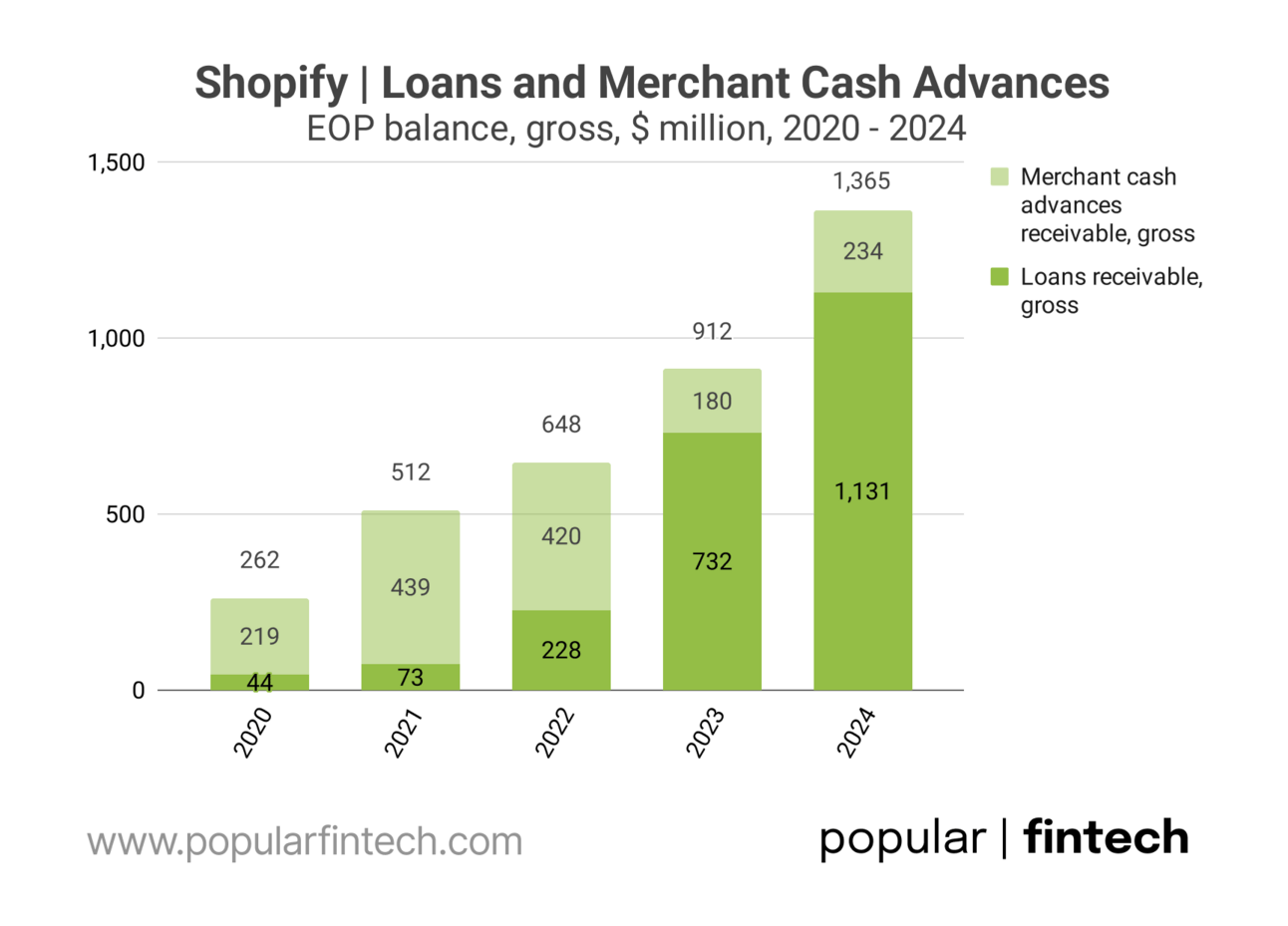

There is also, Bill, Square, Mindbody…I think Adyen’s estimate of the revenue from embedded payments makes sense. But what about lending? This seems to be a large, and largely untapped opportunity. Let’s start with Shopify, which offers sales-based repayment loans and merchant cash advances ("MCAs") through “Shopify Capital”.

Image source: Shopify Capital

Shopify does not disclose lending origination volumes, but…from the website disclosure (“All loans through Shopify Capital are issued by WebBank in the United States”) and the note in the company’s annual report (see below), we can conclude that in 2024, the company originated $3 billion in small business loans in the U.S.

The company finished the year with $1.2 billion of merchant loans and MCAs on its balance sheet (net of provisions).

“Certain loans and merchant cash advances are facilitated by the Company and originated by a bank partner, from whom the Company then purchases the loans and merchant cash advances obtaining all rights, title and interest or discount. In the year ended December 31, 2024, the Company purchased $3.0 billion of merchant cash advances and loans to Shopify merchants (December 31, 2023 - $2.0 billion).”

However, in 2024, Shopify earned just $205 million from "the Company’s lending services.” Not that much compared to revenue from payment processing.

“In the year ended December 31, 2024, the Company recognized revenue of $205 million related to interest and fees earned on the Company's lending services.”

What about Toast? Toast offers “working capital loans to qualified customers based on the customer’s current payment processing and point of sale data.” Toast Capital loans are also originated by WebBank. However, Toast does not purchase those loans from the bank like Shopify does. Instead, it earns the origination and servicing fees.

Image source: Toast Capital

“Toast Capital’s bank partner originates all loans, and Toast Capital then services the loans using Toast’s payments infrastructure to remit a fixed percentage of daily sales to our bank partner until the loan is repaid. Toast Capital earns fees for the underwriting and marketing of loans, which are recognized upon origination of the loan, and loan servicing fees, which are recognized as the servicing is delivered.”

In 2024, Toast Capital originations “exceed $1 billion”. Toast does not disclose revenue for Toast Capital; however, in Q4 2024, Toast Capital contributed “$43 million in gross profit” (<12% of the company’s total gross profit). Similarly to Shopify, the merchant lending business still has a marginal contribution compared to payments.

“Toast Capital contributed $43 million in gross profit in Q4 [ 2024 ]. For the year, Toast Capital originations exceeded $1 billion, reflecting steady healthy demand from our customers.”

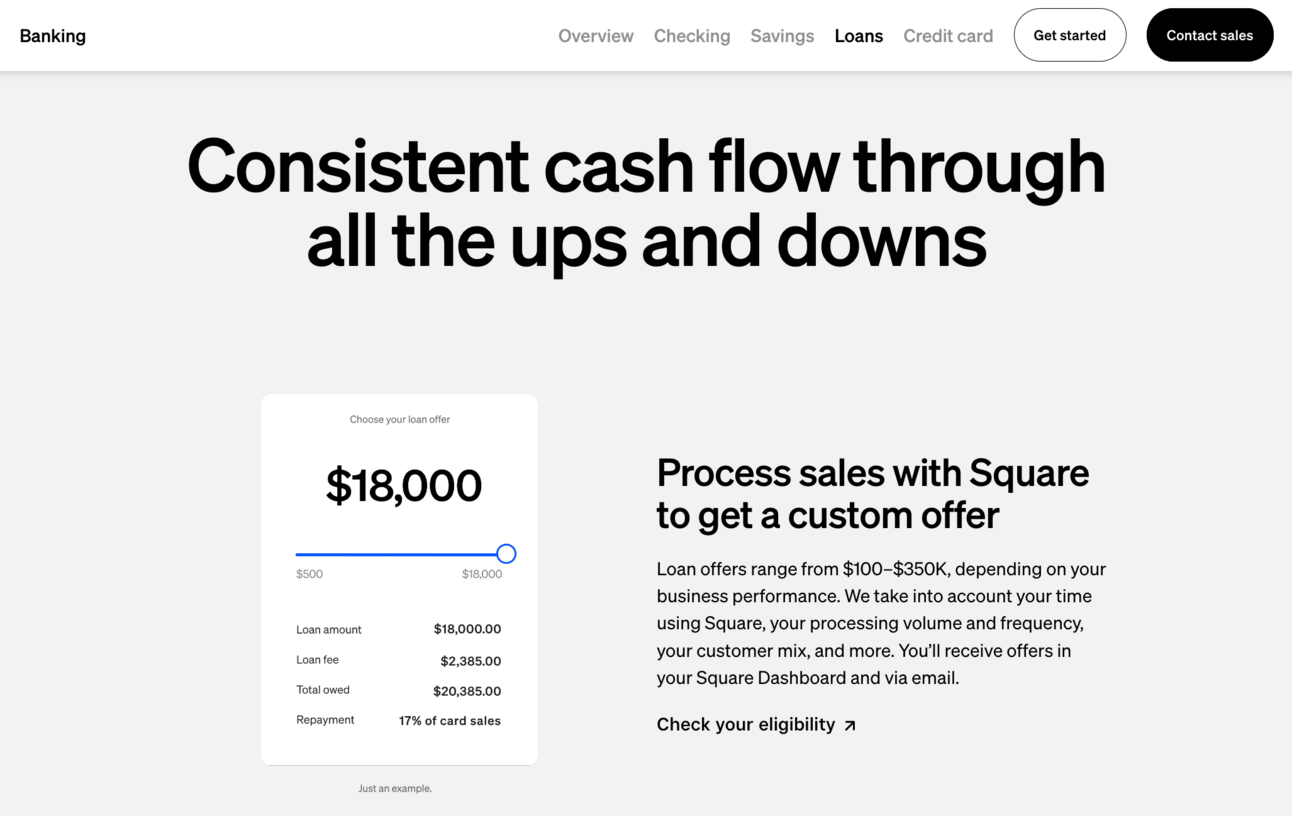

Let’s talk about Square Loans from Block $XYZ ( ▲ 4.85% ) , previously known as Square Capital. "Square Loans originates “loans that are generally repaid through withholding a percentage of the seller's receivables processed by the company.” Square owns an industrial bank, Square Financial Services, so does not need a banking partner.

Image Source: Square Loans

A fun fact is that Square lends more money to small businesses than Chase. In 2024, Square originated $5.7 billion in small business loans, while Chase originated $4.5 billion (see the chart below). Since its launch in 2014, Square Loans originated more than $25 billion in small business loans and advances.

“Since its public launch in May 2014, Square Loans has facilitated more than 3.1 million loans and advances, representing more than $25.8 billion in principal amount loaned or advanced. We launched Square Credit Card in 2023 to provide another lending option to qualified Square sellers.”

Block occasionally discloses the gross profit it generates from Square Banking (which, primarily includes gross profit generated by Square Loans). Thus, Square Banking generated $206 million and $221 million in gross profit in Q3 and Q4 2024 respectively., This translates to a 22% and 23% contribution to Square’s total gross profit.

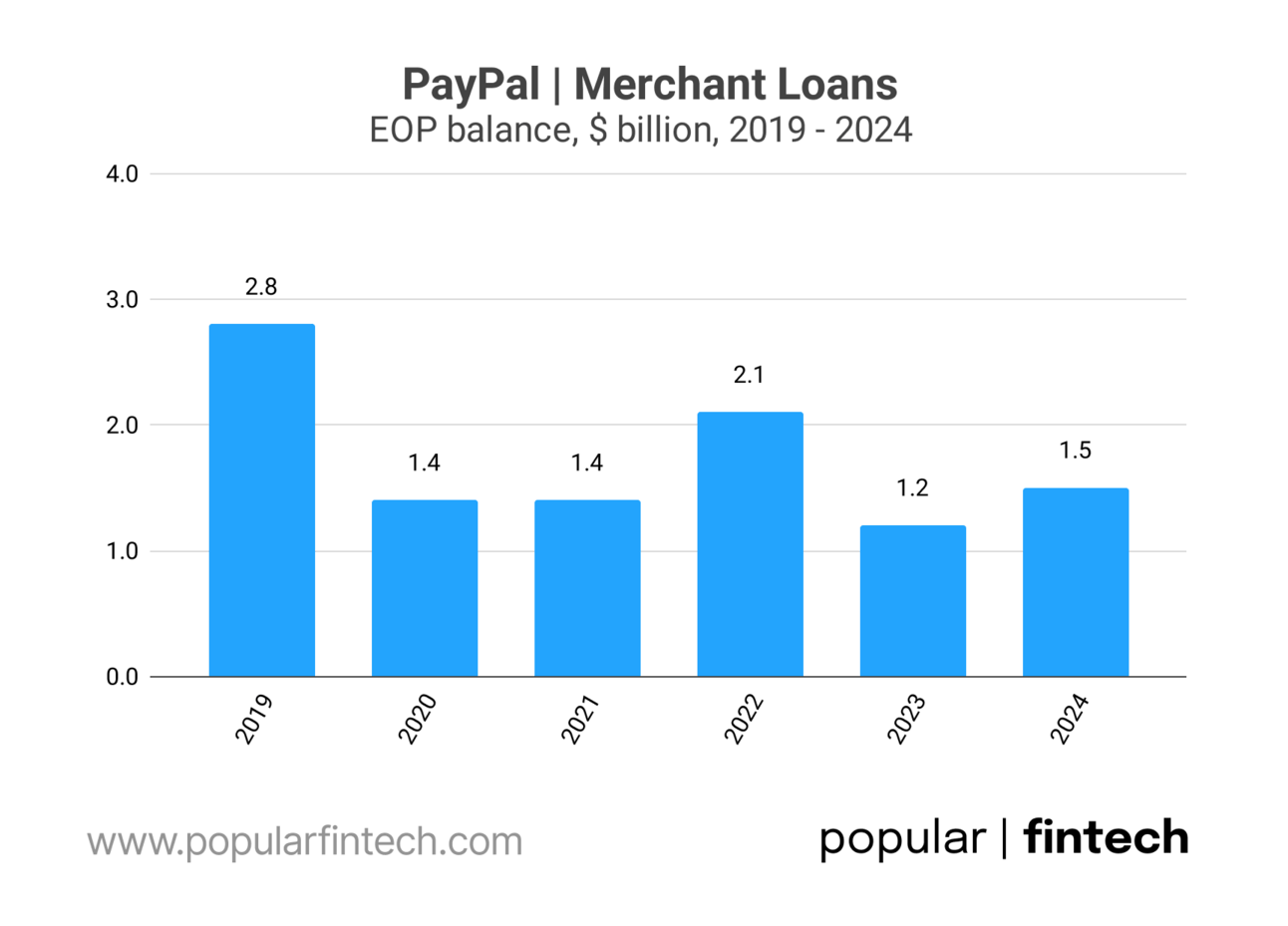

Finally, let’s take a look at the OG of Fintech lending, PayPal. Similarly, to Shopify, the company does not disclose origination volumes, but a similar disclosure (see below) suggests that, in 2024, PayPal originated $1.8 billion in merchant loans in the U.S. (up from $1.7 billion in 2023). So less than Shopify Capital and Square Loans. I couldn’t find the revenue number, but the origination volume and portfolio size suggest that merchant lending is a marginal contributor for PayPal too.

“We purchase receivables related to credit extended to U.S. merchants by a partner institution and are responsible for the servicing functions related to that portfolio. During the years ended December 31, 2024 and 2023, we purchased approximately $1.8 billion and $1.7 billion in merchant receivables, respectively.”

Alright, but who else is there? What I learned is that all major e-commerce marketplaces, such as Amazon, Walmart, and eBay, have their own merchant lending programs…and most of those programs are powered by independent embedded finance companies.

Image source: Amazon Lending

Thus, Amazon partners with Parafin, Uncapper, and SellersFi, Walmart handles some lending themselves, but also partners with Parafin, and eBay relies on Liberis and iBusiness Funding. I also learned that Amazon stopped underwriting loans directly last year.

This naturally begs the question: why do Amazon, Walmart, and eBay partner on lending, while Shopify, Square, and Toast build their own capabilities? I asked around the most reasonable answer I heard was that there were no embedded finance companies to partner with when Shopify, Square, and Toast decided to build their lending arms.

If this is the case, then there is a follow-up question: if the opportunity in embedded lending is so vast (and largely untapped) why did Amazon stop lending directly and decide to outsource this function to specialized players? Could it be that the potential for embedded lending is exaggerated?

After all, Parafin, which seems to be the preferred partner for many players (Amazon, Walmart, DoorDash, Mindbody), is an early-stage company, as the company’s website states “$8 billion in offers extended to businesses”, which is not much. Perhaps, Amazon didn’t see a big enough opportunity to dedicate its own resources?

Image source: Parafin

I am somewhat skeptical about the size of the opportunity, because, as I illustrated above, even the most mature programs, such as Square Loans and Shopify Capital are still relatively small despite years of trying (the Square Loans program was launched in 2014, and Shopify Capital was launched in 2016).

However, what if…the opportunity in embedded lending will not be captured by individual lending programs, but by embedded lending providers, such as Stripe (Stripe Capital for Platforms), Adyen (Adyen Capital), Parafin, YouLend, and others?

Image source: Stripe Capital for Platforms

“The 43% of US GDP that is driven by small businesses contains untapped potential energy. 77% of these businesses say growth capital is hard to come by. Vertical SaaS, with Stripe Capital, can help. Last year, hundreds of thousands of independent businesses using platforms like Jobber or Housecall Pro logged in to their software to find an offer for growth capital waiting for them.”

I believe there's a scenario where these platforms support numerous individual programs that, while each may be small on its own, collectively generate billions in revenue.

What do you think? This certainly won’t be the last article on the topic, so happy to hear your thoughts and feedback!

Cover image source: Shopify

Disclaimer: Information contained in this newsletter is intended for educational and informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions.