Hi!

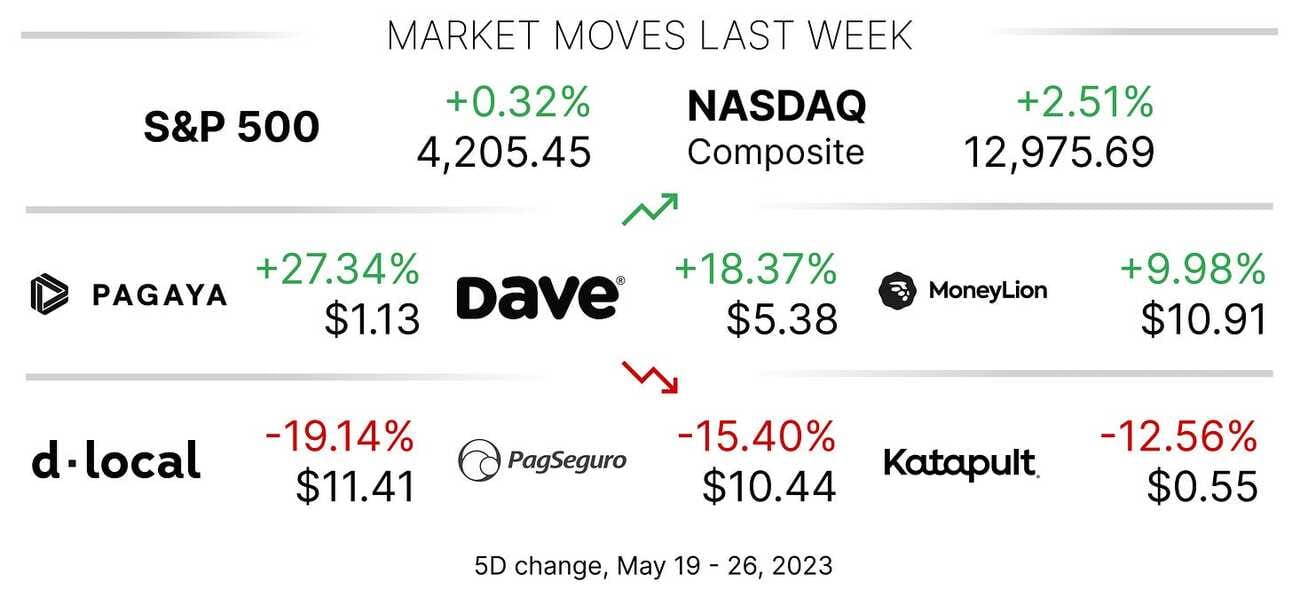

I hope you had a wonderful weekend! The Personal Consumption Expenditures (PCE) price index, the Federal Reserve’s preferred measure of inflation, increased 4.7% in April on a year-over-year basis. So the Fed might not be done with raising rates, as many investors expected.

The CME FedWatch Tool now estimates 63.0% probability of another 25 basis points hike in June, up from a 23.8% probability just a month ago. Higher rates are not good Fintech stocks (an all other unprofitable growth stocks for that matter).

In the meantime,

dLocal stock plummeted on new allegations,

Klarna losses narrowed in the first quarter of 2023, and

J.P.Mogran is working on a ChatGPT-like investment advice service

Thank you for reading and see you tomorrow!

Jevgenijs

Please help me spread the word about the “Popular Fintech” newsletter 👇🏻

dLocal Stock Plummets on New Allegations

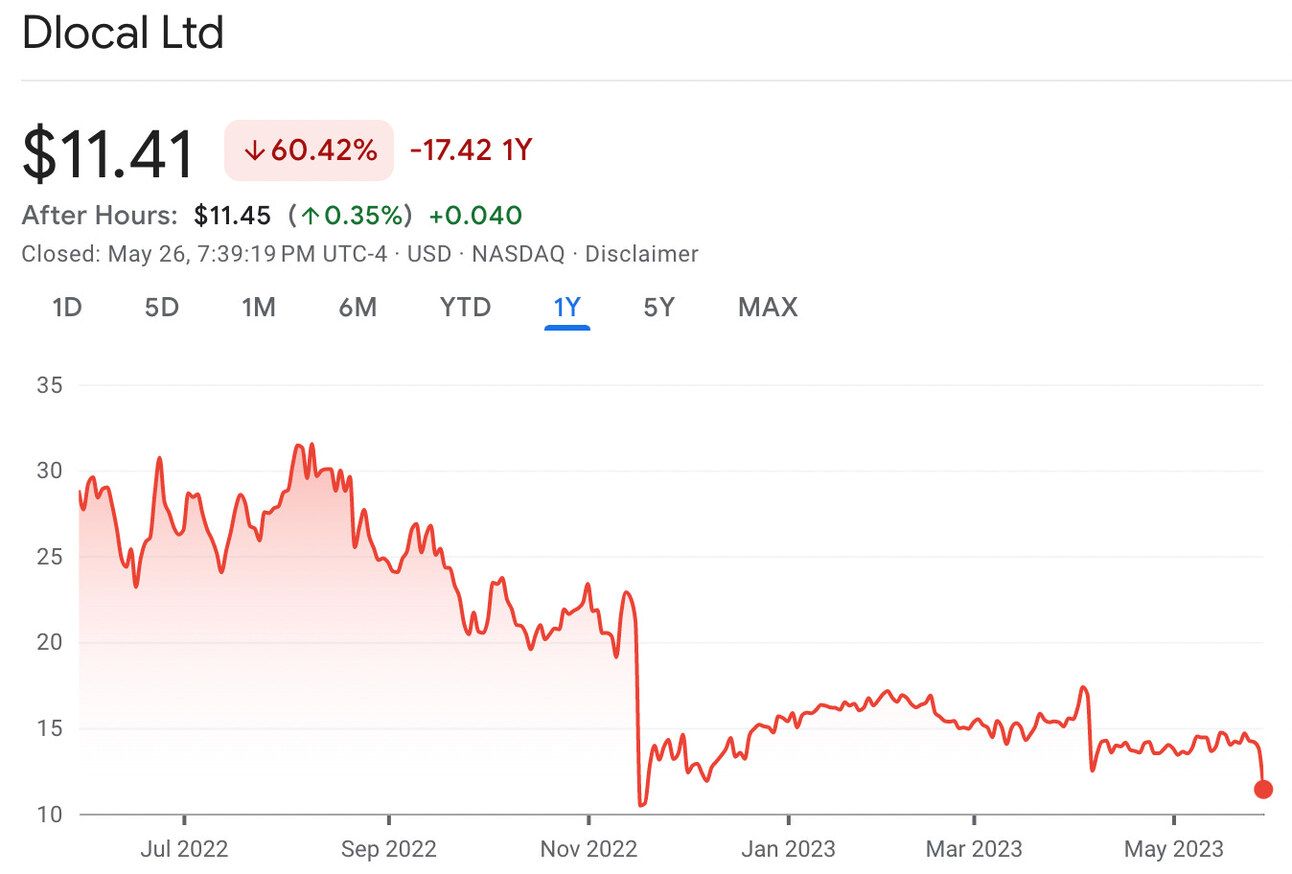

Shares of Uruguayan Fintech company dLocal (NASDAQ: DLO) plummeted more than 17.32% on Friday after Argentine news outlet Infobae reported that the company is being investigated by the country’s government. According to Infobae sources, dLocal, which helps enterprise merchants, such as Amazon, Shopify, and Microsoft, accept payments in emerging markets, was being investigated for an illicit transfer of $400 million outside of the country through a network of subsidiaries. Argentina imposed capital controls in 2019 in a bid to support its currency and prevent further decline of foreign exchange reserves.

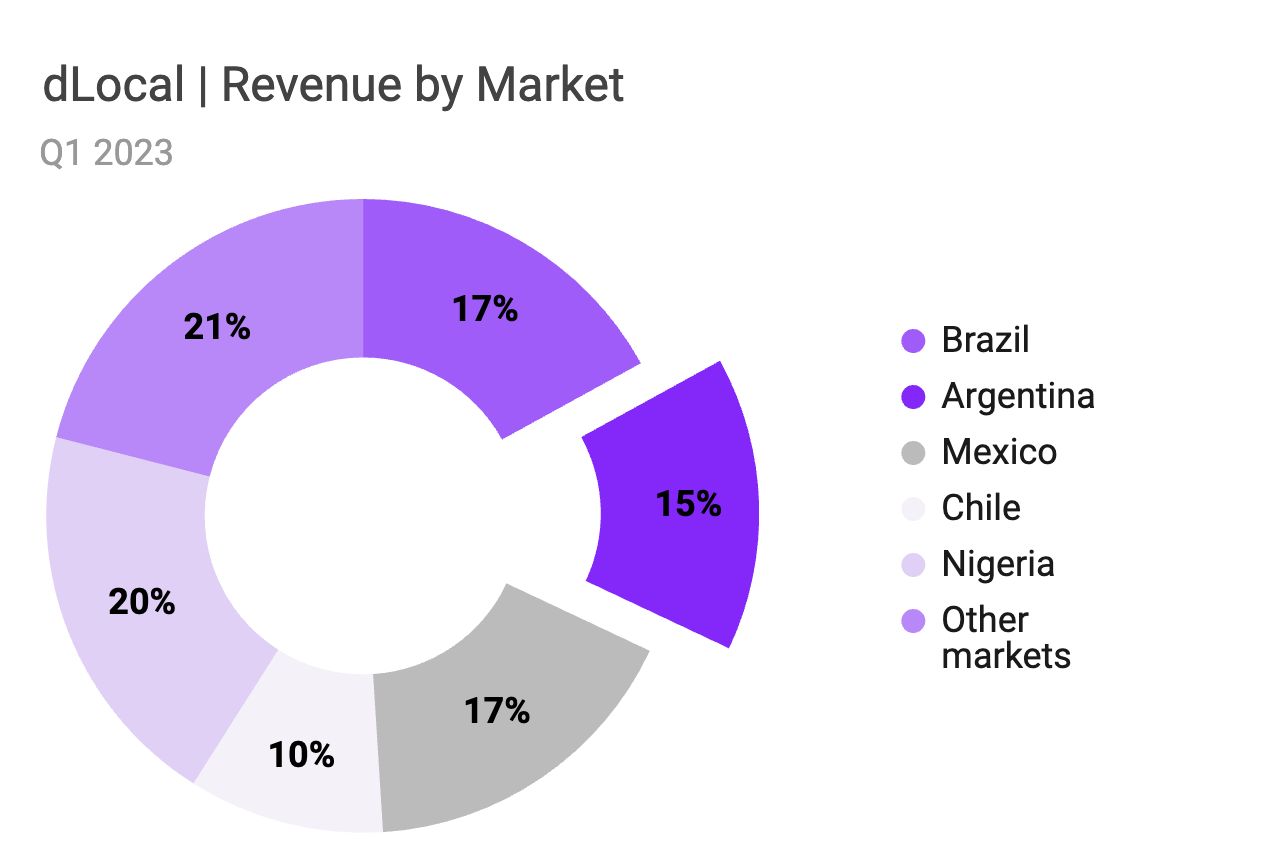

In the first quarter of 2023, the company’s operations in Argentina contributed $20.0 million, or 15% of the total revenue, down from $21.1 million, or 24% of the total revenue in the first quarter of 2022. dLocal addressed its challenges in the Argentine market in its annual report: “…during 2022, the Argentine central bank unexpectedly limited the amount of funds that could be expatriated from Argentina,[...] which created certain operational problems until we were able to reach a resolution with the central bank.” As part of its service, dLocal handles the currency conversion and secure delivery of funds to the merchant's country, such as the US.

dLocal refuted allegations in a press release, claiming that the company has not been “notified by any Argentinian authority regarding a foreign exchange investigation.” This is not the first time, that the company’s business model and practices were challenged. Thus, in November last year, dLocal faced allegations of fraud by the short-seller Muddy Waters Research. The company’s stock was cut in half after Muddy Waters published its report accusing the company of inflating reported payment volume numbers, booking conflicting inter-company transactions, and back-dating accounting entries to reflect stock transactions by the founders.

✔️ Report of Argentina fraud probe sinks shares in dLocal✔️ dLocal issues response to the press article allegations✔️ dLocal Reports 2023 First Quarter Financial Results✔️ LatAm’s dLocal Shares Drop 50% After Muddy Waters Questions Disclosures

Klarna’s Losses Narrow

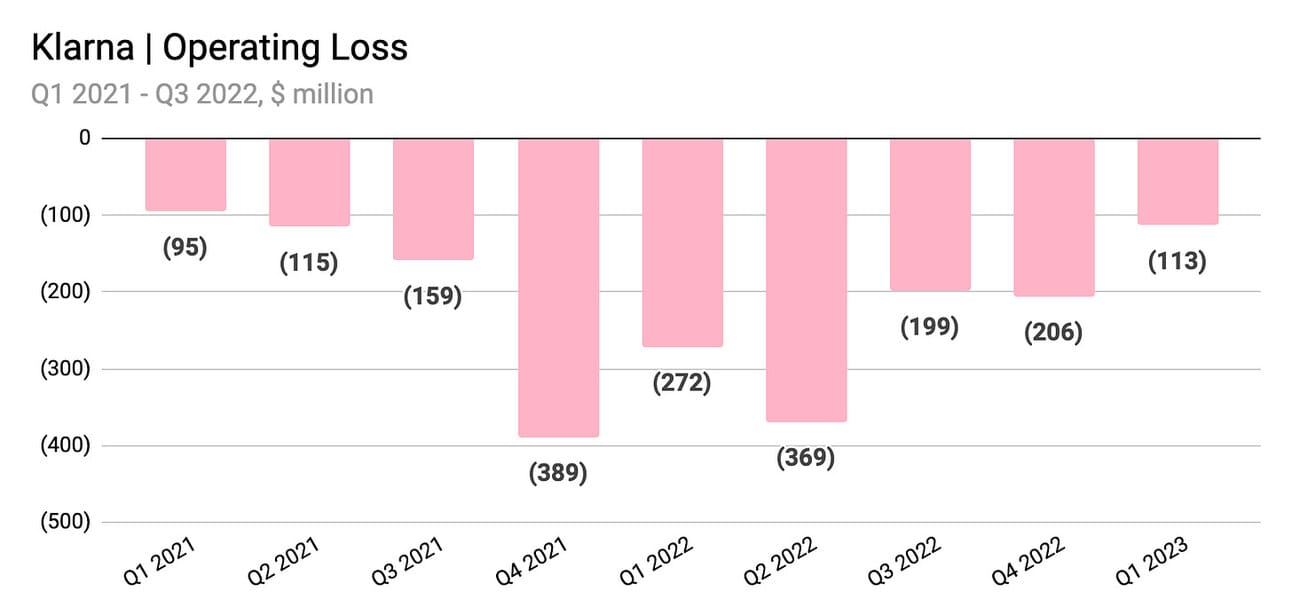

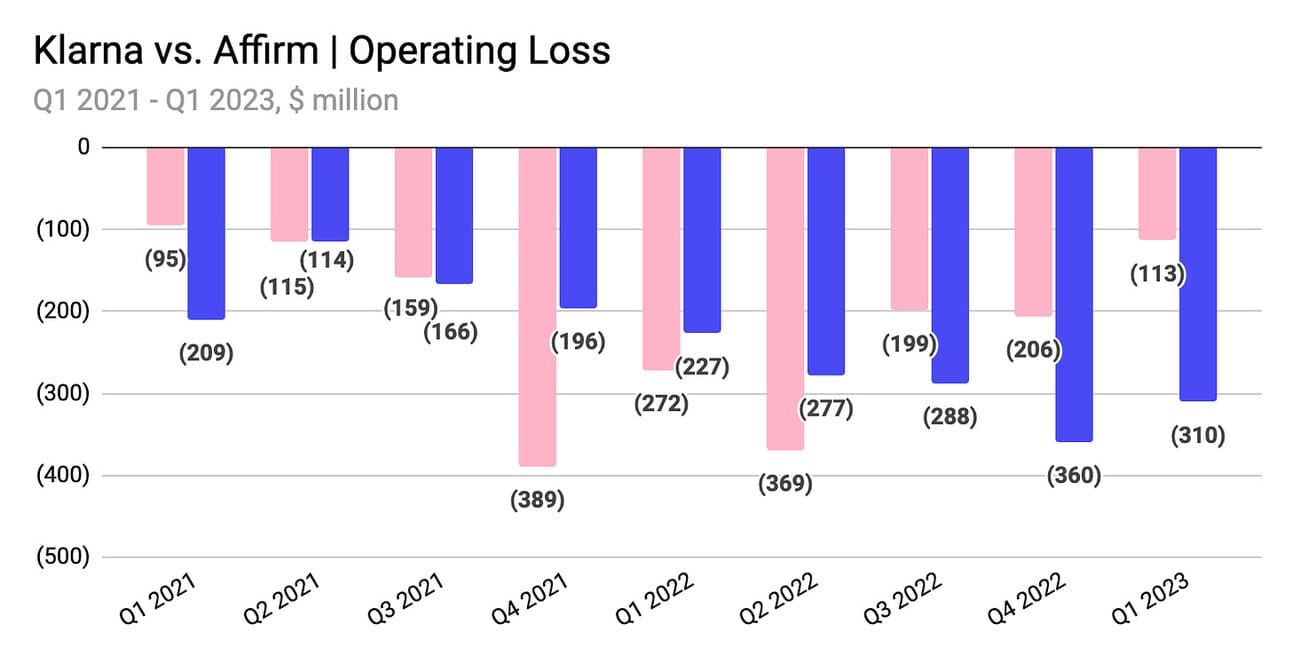

Klarna, the world’s largest Buy Now Pay Later lender, reported its first quarter 2023 results, showing continued revenue growth and improvements in profitability. Gross Merchandise Volume increased by 13% YoY to SEK 210.7 billion (approx. $20.2 billion) while Total operating income increased by 22% YoY to SEK 4.4 billion (approx. $420 million). Klarna reported a Operating loss of SEK 1.27 billion (approx. $113 million), which is a meaningful improvement compared to a Net loss of SEK 2.54 billion (approx. $272 million) in the first quarter of 2022. Credit losses declined to 0.37% of GMV, compared to 0.64% of GMV in the first quarter of 2022.

Klarna executed two rounds of layoffs in 2022, cutting more than 10% of its workforce, which started translating into lower operating expenses in the second half of the year. Nevertheless, the layoffs and cost cuts did not impact the company’s growth trajectory, as the company continued to scale its international operations with the United States becoming its largest market by revenue in December last year. In February 2023, the company’s co-founder and CEO, Sebastian Siemiatkowski, said that the company plans to return to profitability by the summer. He reiterate the goal of reaching profitability in a series of tweets last week.

✔️ Klarna’s losses halve as Swedish fintech predicts return to profit✔️ Fintech firm Klarna halves net loss in first quarter as it races toward profitability✔️ Klarna launches UK’s first credit ‘opt out’ after meeting with MP✔️ Klarna CEO on the Future of AI-Powered Shopping

J.P.Morgan is Building a ChatGPT-like Investment Advice Service

JPMorgan Chase (NYSE: JPM) is reportedly developing a software service similar to ChatGPT that will provide investment advice to its customers. The company has applied to trademark the product, called IndexGPT, which utilizes cloud computing software and AI to analyze and select securities tailored to customer needs. While other banks have tested similar AI technologies for internal use, JPMorgan may be the first financial institution to release a GPT-like product directly to customers. The filing indicates that JPMorgan has plans to launch the product in the near future. Financial advisors have expressed concerns about the potential impact of technology on their roles, but so far, fears of displacement have not materialized.

✔️ JPMorgan is developing a ChatGPT-like A.I. service that gives investment advice✔️ AI to Pick Stocks? JPMorgan’s Move Hints at Banks Following Big Tech’s Lead

Affirm (NASDAQ: AFRM), one Klarna’s competitors in the BNPL space, reported $310 million operating loss for the first quarter of 2023. Affirm’s management reiterated its ambition to reach profitability on an Adjusted basis (excluding stock-based compensation) by the end of its fiscal year 2023, which ends in June. The company announced laying off 19% of its workforce in February, as well as exited the Australian market to focus on the United States and Canada.

Executive Director, Conversational Artificial Intelligence Platform Lead@ J.P. Morgan Wilmington, DE, United States

Vice President - Conversational AI Product@ J.P. MorganBengaluru, Karnataka, India

Vice President - Conversational NLU@ J.P. MorganPlano, TX, United States

Product Director - User Account Group@ KlarnaStockholm, Sweden

Engineering Director@ Klarna Stockholm, Sweden

Cover image source: dLocal

Disclaimer: Information contained in this newsletter is intended for educational and informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions.