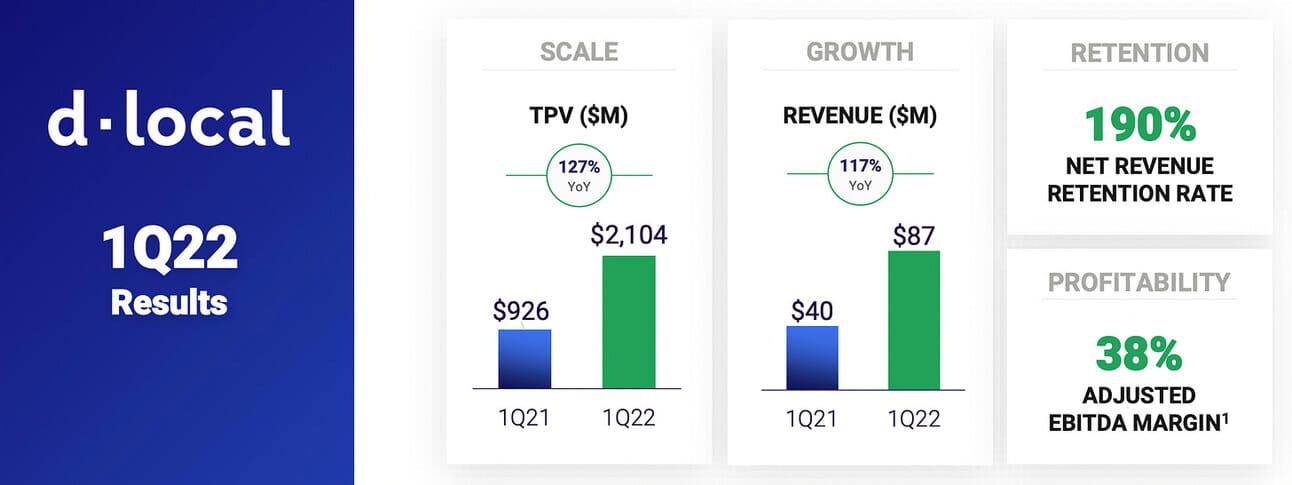

dLocal ( ) reported its Q1 2022 results on May 17, 2022. The company that helps some of the largest global merchants accept (and distribute) payments in emerging markets (again) reported triple-digit revenue growth (117% YoY) and a double-digit net income margin (30%). The company’s services are in demand, as global merchants are looking for growth in emerging markets, and the company continues to operate in a very cost-efficient manner. I wish all Fintech companies would be like dLocal.

Let’s break down the numbers behind the dLocal miracle!

If you are new to dLocal, I suggest reading my review of the company’s Q4 2021 earnings 👉🏻 “dLocal Q4 2021 Earnings: a Fintech with triple-digit revenue and profit growth”

Total Payment Volume

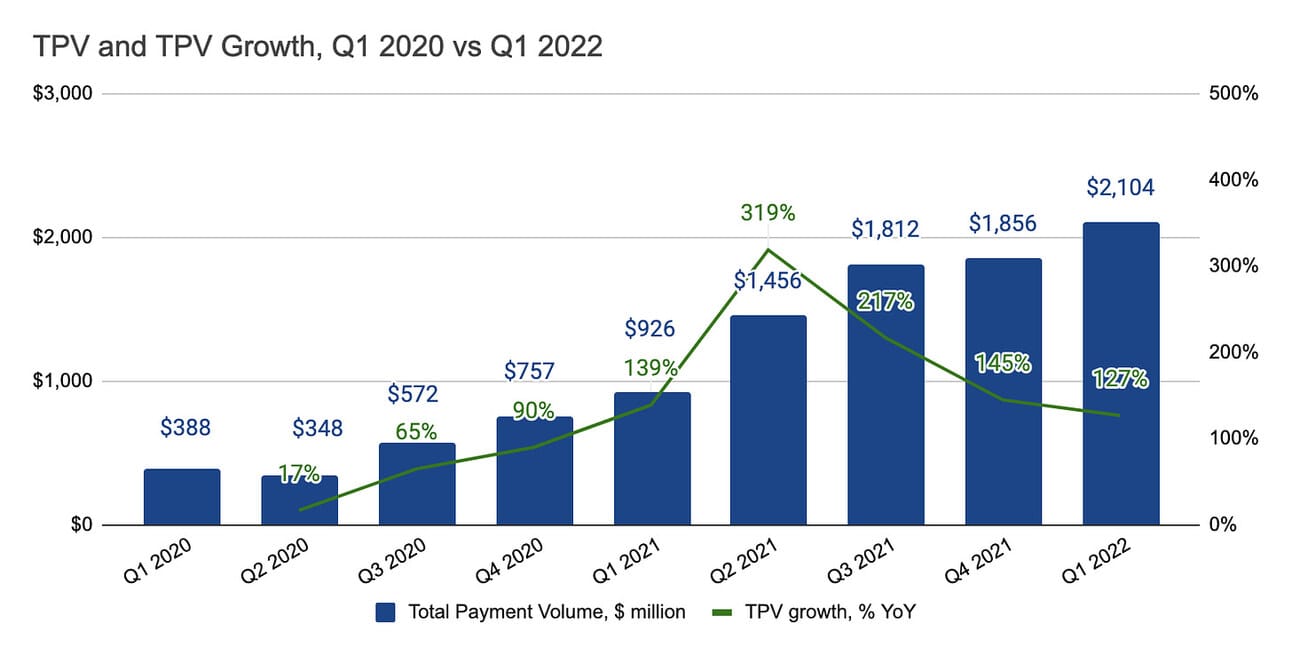

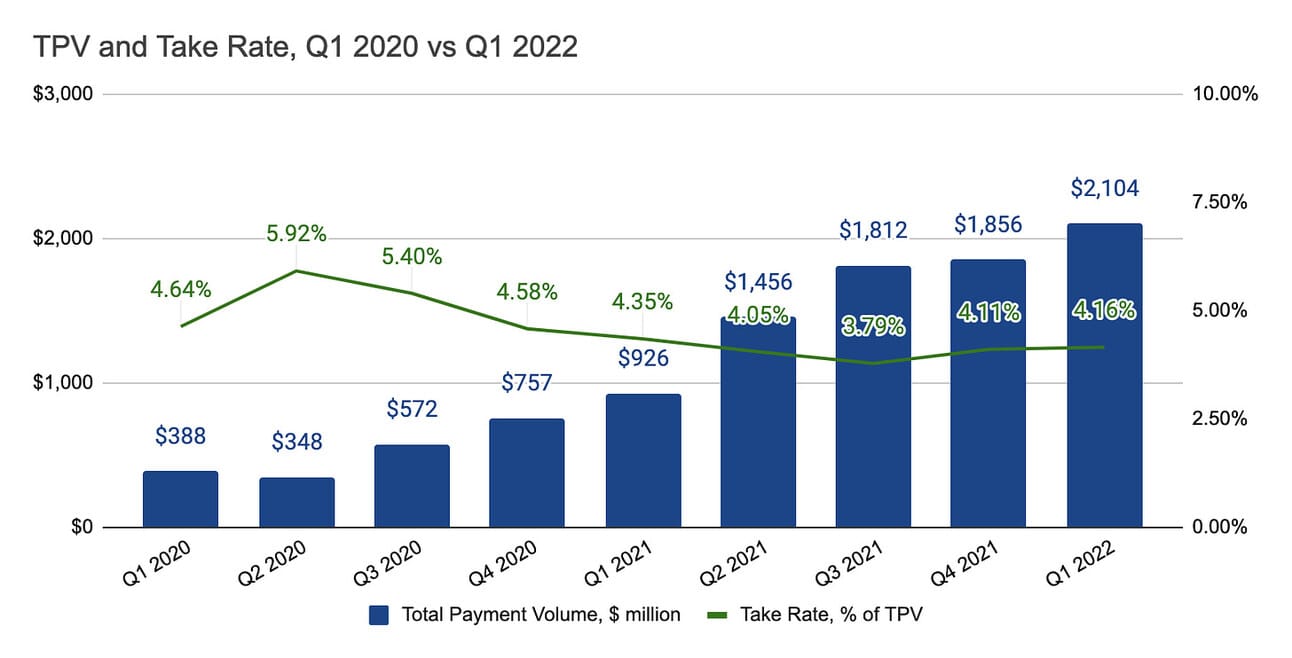

dLocal reported $2.1 billion in Total Payment Volume in Q1 2022, which represents a 127% YoY growth. As illustrated on the chart below, this was the fifth consecutive quarter with triple-digit growth in TPV, although the growth is decelerating. It is also worth noting that the company delivered sequential growth despite first quarters usually being “slow” quarters in terms of consumer spending. There has to be a seasonality effect, but looks like the company has been growing at the pace that “hides” this effect.

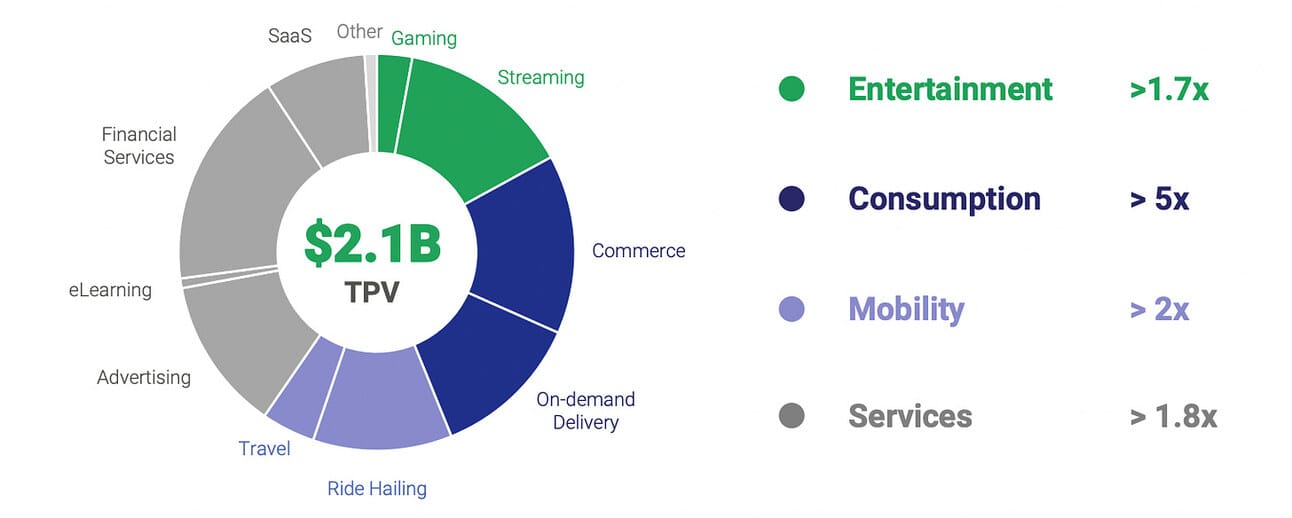

During the earnings call, the management stressed the benefits of its well-diversified customer base. Thus, the chart below provides insights into the composition of Q1 2022 TPV by the merchant category (i.e. on-demand delivery, ride-hailing, financial services, etc.) and YoY growth in the merchant vertical (entertainment, consumption, mobility, and services). In particular, the earnings release mentioned that the growth (Q1 2022 over Q1 2021) was driven by the “on-demand delivery, travel, commerce, advertising and SaaS” categories.

It is important to keep in mind that dLocal clients are primarily large global corporations (Microsoft, Shopify, Amazon, etc), that use the company’s services to collect and distribute payments in emerging markets (primarily in LatAm). Thus, the company’s growth is driven by a) state of emerging market economies (demand), and (more importantly) b) the growth ambitions of dLocal customers in those emerging markets (supply). As per the management’s comments, at the moment the appetite for expanding in emerging markets (LatAm, Africa, and APAC) is strong, as the company’s customers are struggling to find growth in the US, Europe, and China.

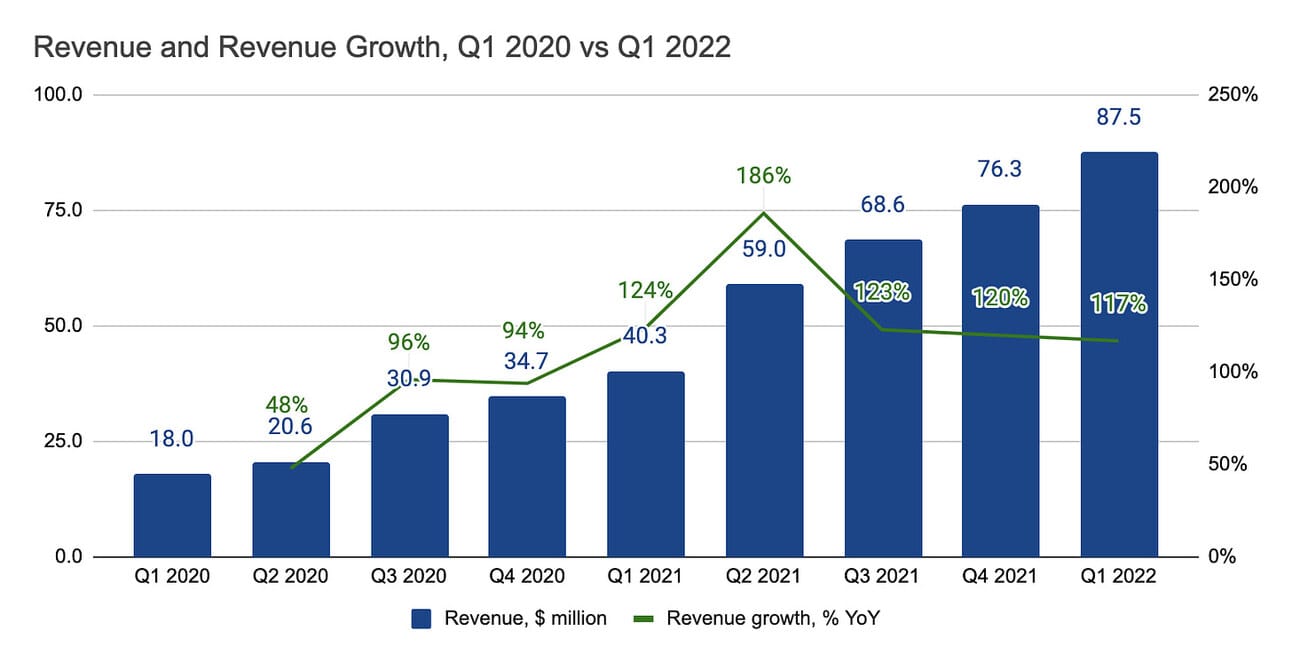

Revenue and Take Rate

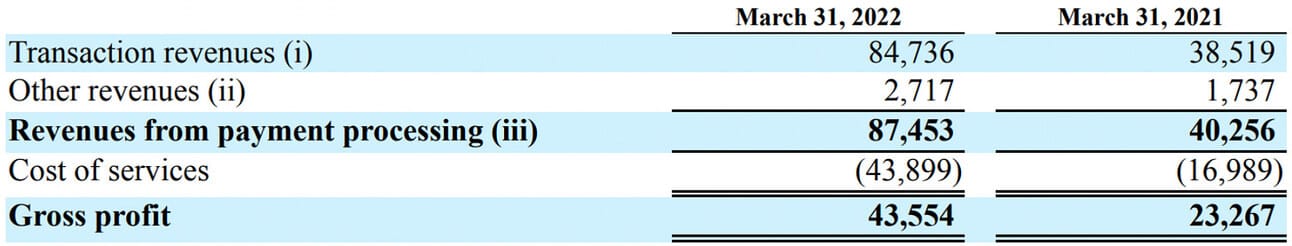

The company reported $87.5 in revenue for the quarter, which represented a 117% YoY growth. As the table below illustrates, LatAm remains the company’s core market and represents 88.7% of the company’s revenues (almost unchanged from 89.2% in Q1 2021). During the earnings call, the company’s management reiterated that growth outside of LatAm is a top priority for the company (to the point that top managers relocated to South Africa and Singapore), but so far the progress in this direction has been quite slow.

As the company’s revenues are simply a function of the Total Payment Volume and the Take Rate, TPV growth translated into revenue growth (the same five consecutive triple-digit growth quarters, and a similar deceleration from the peak in Q2 2021). Q2 2021 was a very strong quarter for the company, so we should expect a further deceleration of growth in Q2 2022 purely because of the harder comps (perhaps, the first quarter without a triple-digit growth?).

Another impressive part about dLocal business is the Take Rate. As the chart below illustrates, they can sustain a gross Take Rate (Revenue / TPV) of 4%+. There was a clear margin compression trend in 2020, but looks like it stabilized in 2021 (and the minor fluctuations are the result of the payment mix).

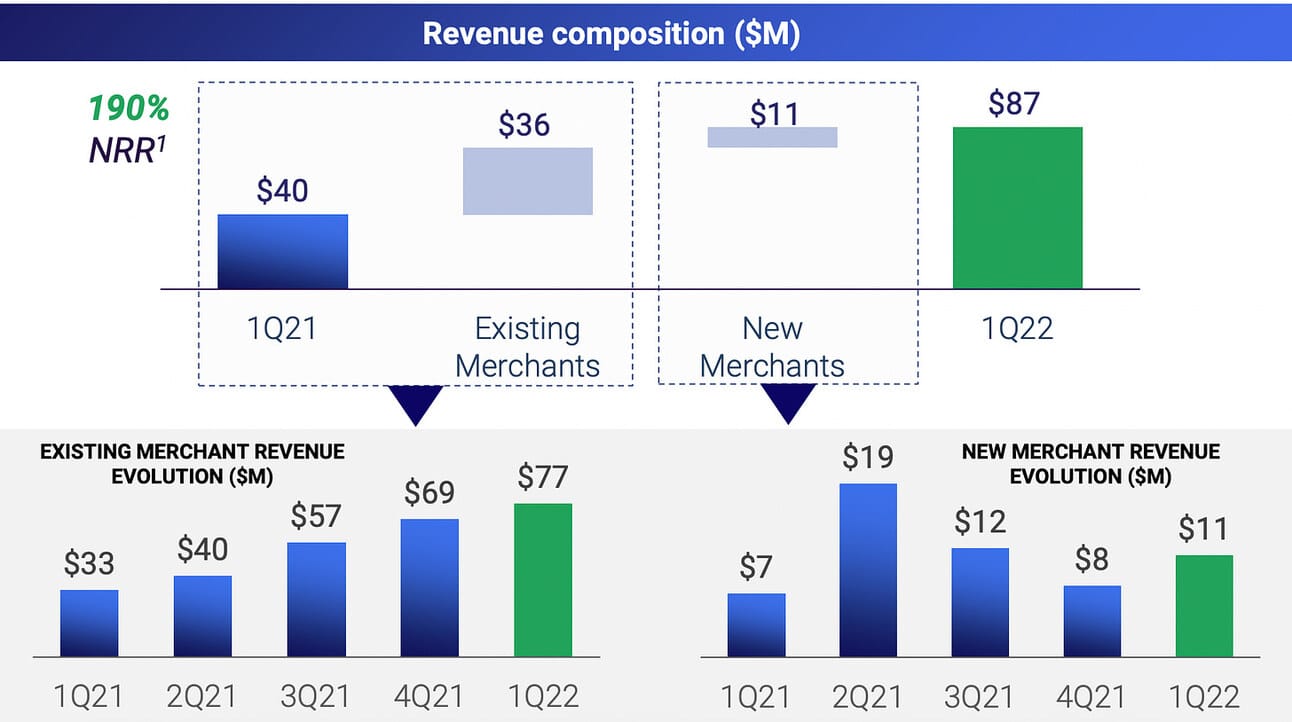

On the final note, I would like to mention the revenue composition slide from the company’s presentation. dLocal does not guide TPV or Revenue, but they guide for 150%+ Net Retention Rate (NRR). In Q1 2022, NRR stood at 190%, which, as illustrated below, means that the merchants, that the company served in Q1 2021, generate 190% larger revenue in Q1 2022 ($40 million in Q1 2021 vs. $76 million in Q1 2022). Thus, the 150% NRR guidance means that existing merchants will bring at least $88.5 million in Q2 2022, $103.5 million in Q3 2022, and $115.5 million in Q4 2022.

Gross Profit

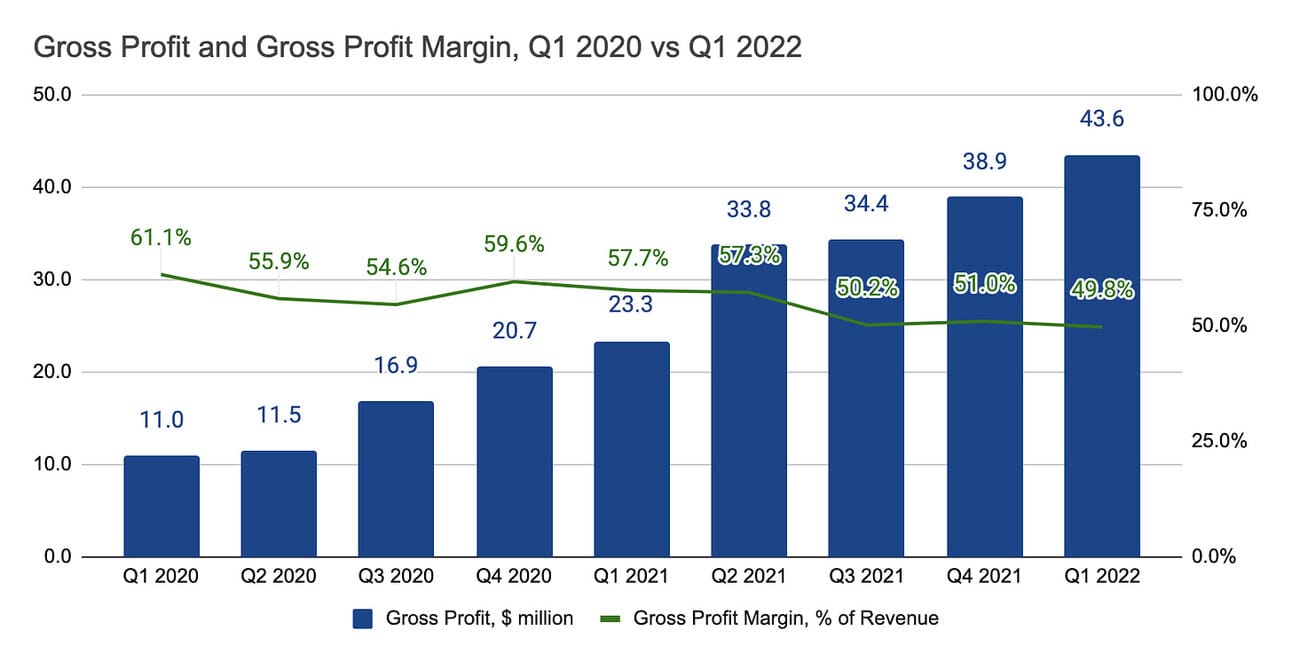

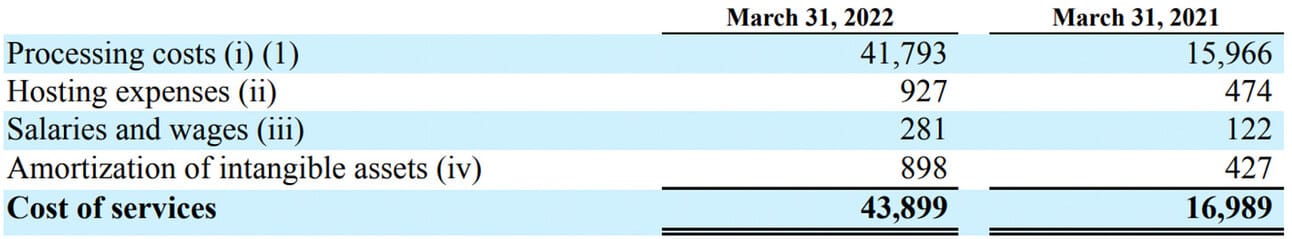

dLocal reported $43.6 million in Gross profit, which represented an 87% YoY growth. Although still impressive, the growth of Gross profit was lower than the growth of Revenue (87% vs. 117% YoY) due to a lower gross profit margin (49.8% in Q1 2022 vs. 57.7% in Q1 2021).

As the chart below illustrates, the gross profit margin compressed compared to 2021, but seems to have stabilized in the last three quarters at around 50%. The company’s management reiterated that they don’t optimize (and don’t incentivize their sales teams) for the percentage margin, and instead evaluate prospective clients in terms of absolute contribution to gross profit. The company’s founder and CEO, Sebastian Kanovich, regularly stresses that each customer of dLocal is “gross profitable”, and the company does not “subsidize” any agreements for the sake of growth.

The “Cost of service” in the case of dLocal is primarily the processing costs, which are the variable “fees that financial institutions (banks, local acquirers, or payment methods) charge” the company. Therefore, the gross profit, that a particular customer contributes, is essentially a function of the Take Rate, expected GPV, and the estimated processing costs (given the volumes and payment types used by that customer). dLocal works with large corporates and relies on direct sales to acquire customers; thus, the company is in full control of its gross profit margins, as the margin is essentially “fixed” during the sales process on a case-by-case basis.

Operating Expenses

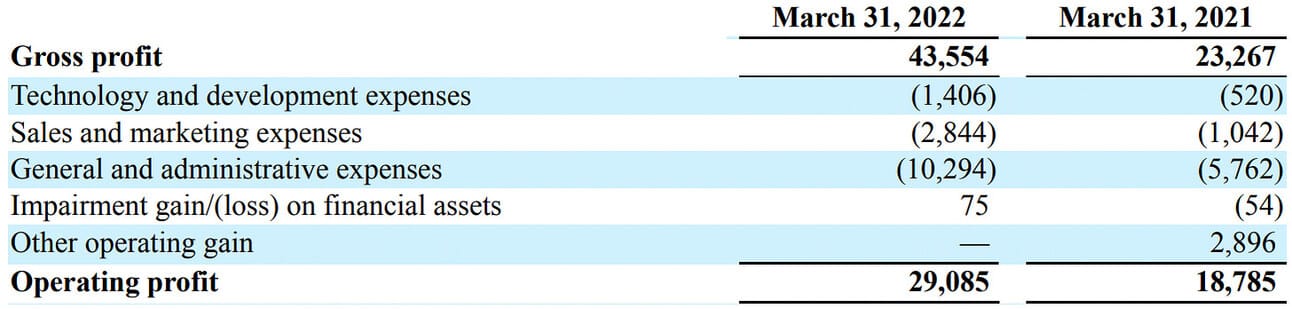

The company’s operating expenses in Q1 2022 stood at $14.5 million, which represented a 223% growth YoY (or 96% YoY excluding the “Other operating gain” position). As the result, the company earned $29.1 million in operating profit for the quarter, representing a 55% YoY growth.

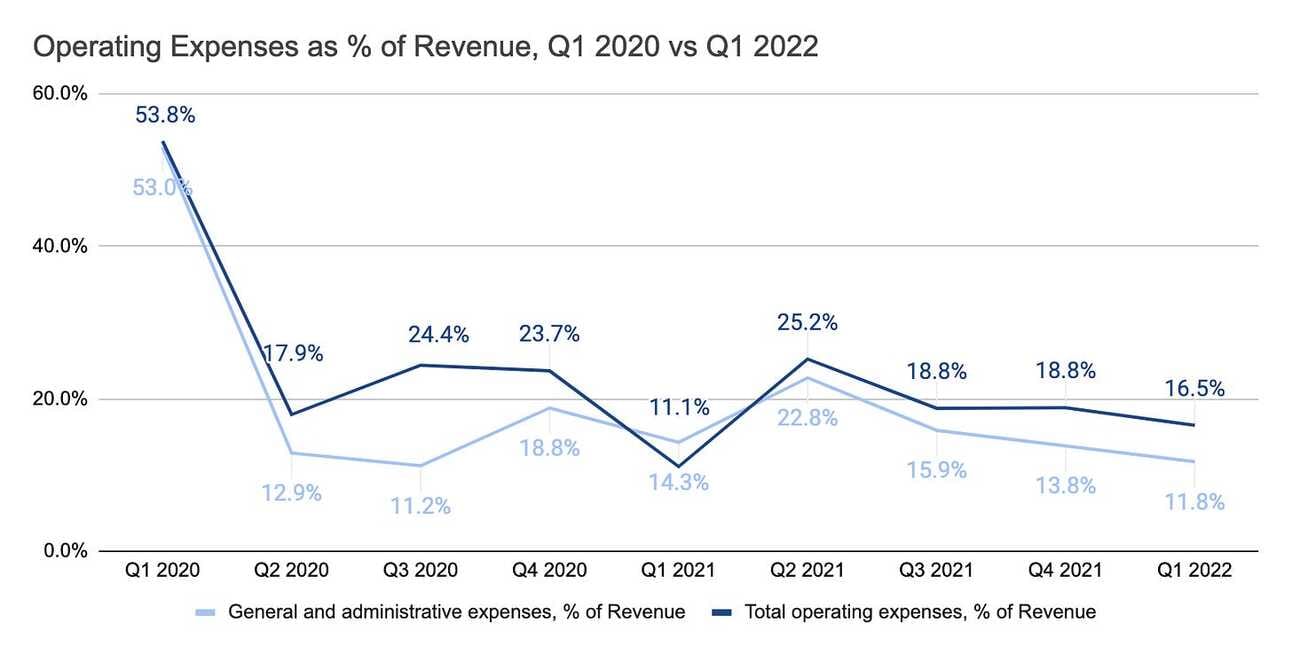

dLocal is very efficient in terms of operating expenses (I guess this is a benefit of operating in emerging markets). Thus, as you can see from the chart below, the total operating expenses represent less than 20% of the revenue. The company capitalizes part of the technology and development expenses, but those are still ridiculously low (consistently below 2% of the revenue). The sales and marketing expenses are also low (as the company does only direct sales), and thus, “General and administrative expenses” are the key driver of operating costs.

Let’s see how the operating costs evolve over time, but so far you can give a credit to the company’s management for operating in a very cost-efficient maner.

Profit and Adjusted EBITDA

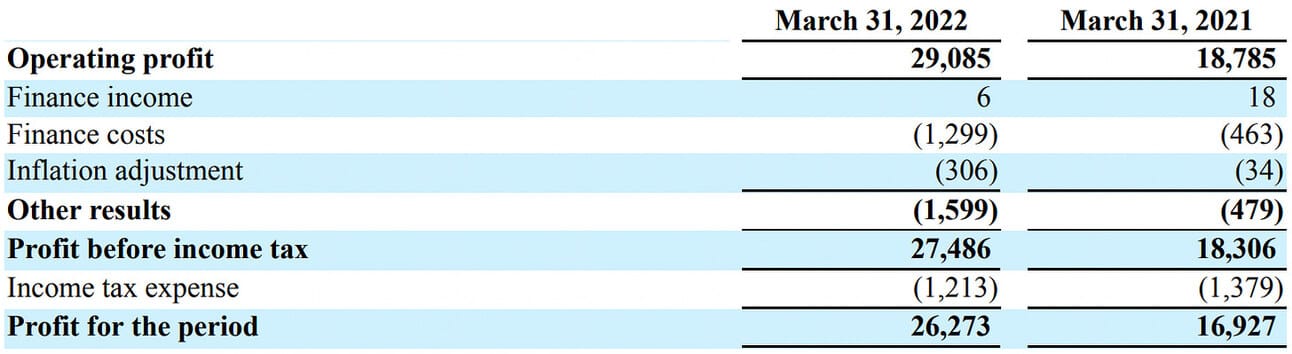

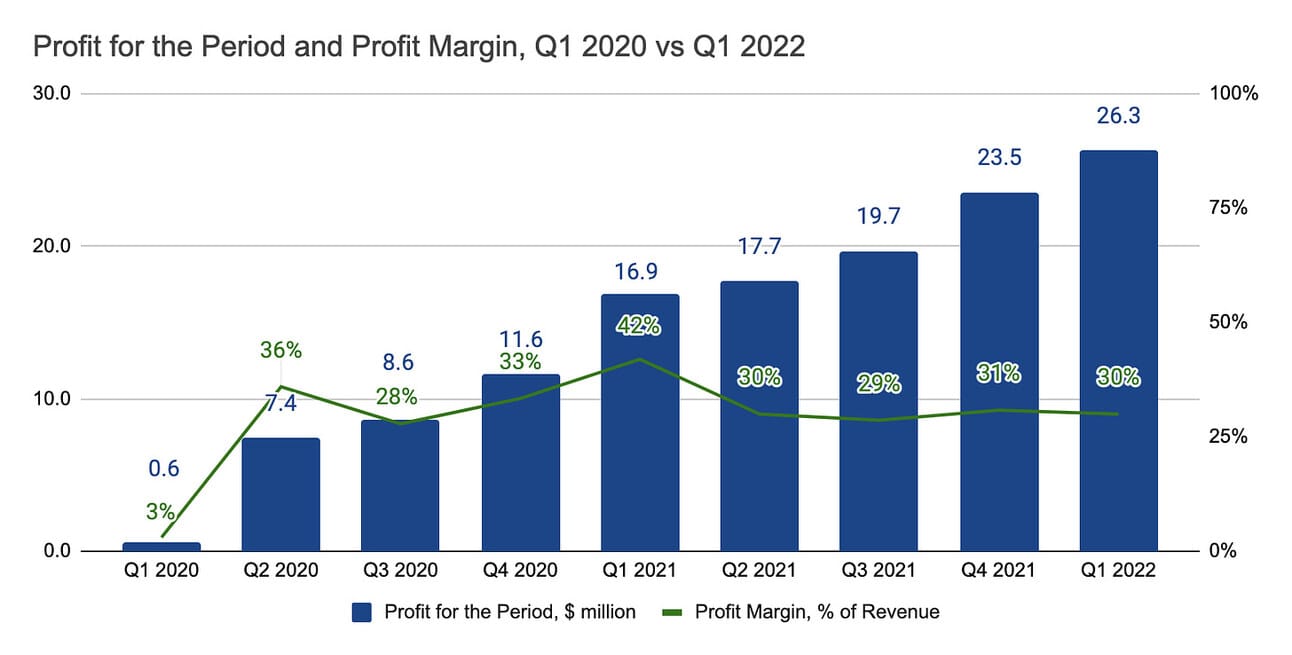

dLocal reported $26.3 million in profit for the period, which represented 55% YoY growth. I believe this is the most fascinating metric of the company: they are delivering triple-digit growth in TPV and revenue, and yet they already are profitable (and have been profitable for more than two years). You don’t find such a combination often, at least in the Fintech world.

dLocal has also been quite consistent in terms of the profit margin. Thus, as the chart below illustrates, they have managed to deliver a 30% profit margin (Profit for the period / Revenue) for the last four quarters. This period would probably be 6 quarters if not for the exceptionally great first quarter of 2021, when the company generated a profit margin of 42%.

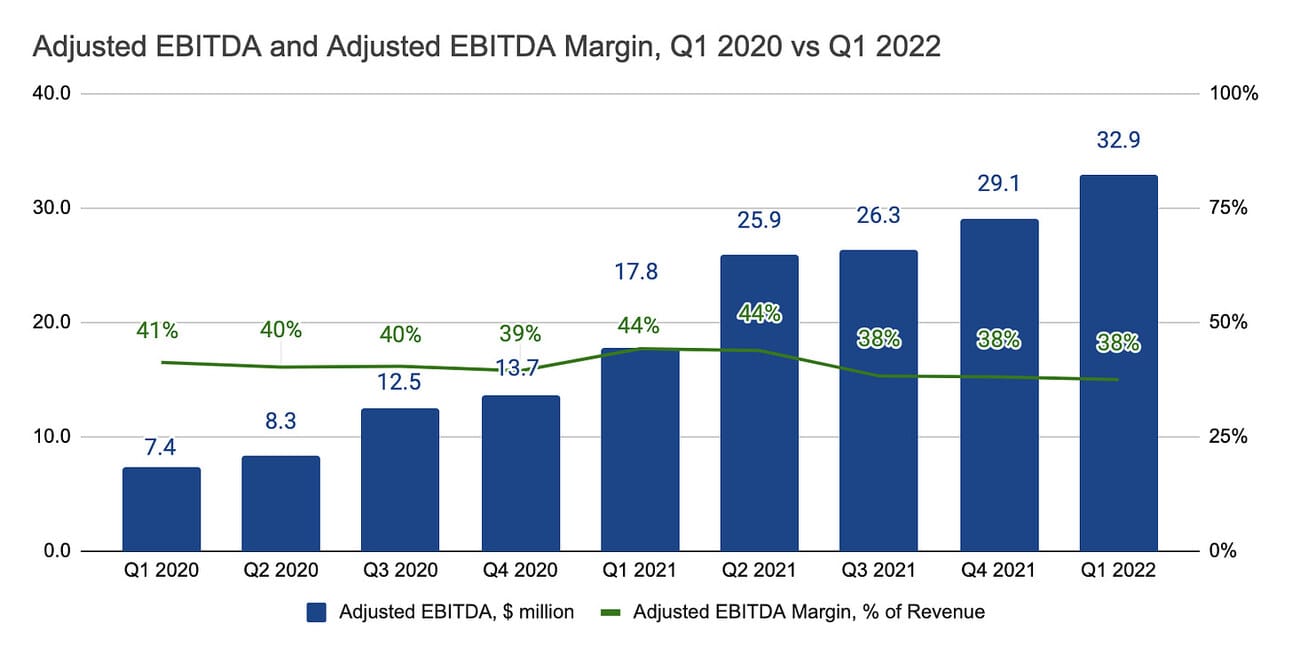

The company does not guide for the profit, but aims to maintain Adjusted EBITDA “north of 35%”. Over the last three quarters, the company consistently delivered an Adjusted EBITDA margin of 38% (please see the chart below). In calculating the Adjusted EBITDA, the company adjusts the profit for the period by interest, tax, depreciation, and amortization, as well as share-based compensation.

In short, the company’s management does not guide for TPV, revenue, or gross profit, to have some flexibility, but they essentially say that they will be growing revenue at (at least) a 50% YoY rate (based on the 150% NRR guidance), and will be earning 35% in EBITDA (or roughly 30% in Net Income) on this revenue. I guess the only question that remains is for how long they can sustain such growth.

Things to Watch in 2022

Not much changed since my last review of the company, so I am watching the same developments going forward:

Growth rates going forward. It will be difficult for dLocal to deliver triple-digit growth in TPV and Revenue in Q2 2022 given the difficult comps (Q2 2021 was a very strong quarter for the company). Yet, the management reiterated their confidence in delivering 150% NRR. Apparently, dLocal customers are looking for growth in the emerging markets, and that fuels the demand for the company’s services.

Margin compression. So far the company has been consistent with keeping its Take Rate above 4% and Gross profit margin above 50%. Moreover, the company’s management reiterated that they optimize for absolute gross profit rather than margins. However, the margins still seem to be too rich for the competition to ignore, and I still expect those to compress over time.

Geographical expansion. The management again reiterated the focus on the geographical expansion beyond LatAm. The company expanded to two new markets, Ivory Coast and Rwanda, during the quarter and now operates in 37 markets. However, there was little progress in terms of revenue share from outside of LatAm. Perhaps, the company might use its cash to stimulate growth through acquisitions.

Product range expansion. The company launched “dLocal Go” a product targeted at SMBs and this launch looked like an attempt to diversify the client base away from large international corporations. However, during the earnings call, the company’s management clarified that “dLocal Go” is targeted at marketplace merchants, and the company is just aiming to help its large marketplace customers with onboarding more small merchants.

In summary, it was another fantastic quarter by dLocal. The revenue growth is strong, the customer base is well-diversified, the appetite for doing business in emerging markets is still there, and the company is delivering consistent profitability margins. Let’s see for how long they can maintain such growth rates, but so far they have been doing an amazing job!

Source of the data used above: Investor Relations

Disclosure & Disclaimer: despite rocky performance in 2021 and early 2022, I have open positions in most of the companies covered in this newsletter, as I am extremely bullish on the transformation in the financial services industry. However, none of the above is financial advice, and you should do your research.