Hi!

Not sure what is happening, but Affirm is all over the news without any particular reason for that. Max Levchin, the company’s founder and CEO, gave an interview to Barron’s, Michael Linford, the company’s CFO, spoke with Yahoo Finance, and no recent story about the state of the Fintech industry goes without mentioning Affirm. The company scheduled a fireside chat with its CFO on Thursday, September 28. Let’s see, perhaps, there is something behind this spike in attention.

In the meantime,

Coinbase pursued FTX Europe acquisition,

Meta plans to expand WhatsApp payments to India, and

Charles Schwab lowers its fixed-income ETF fees

Thank you for reading and have a great day!

Jevgenijs

p.s. have feedback? DM me on Twitter

Coinbase Pursued FTX Europe Acquisition

Coinbase (NASDAQ: COIN) considered acquiring FTX's European entity as part of its strategy to expand its global crypto derivatives business, according to Fortune. FTX Europe had been the primary provider of perpetual futures in Europe, thanks to its regulatory licenses. A perpetual futures contract is a type of cryptocurrency derivative product that allows traders to speculate on the future price of a particular cryptocurrency asset. Various parties, including Coinbase, showed interest in acquiring FTX Europe following FTX's bankruptcy in November 2022. Coinbase eventually decided not to pursue the deal, according to Fortune sources.

Image source: Progressive Hub

In the meantime, Coinbase announced the launch of its Coinbase International Exchange, which allows institutional users “in eligible jurisdictions outside of the US” to trade Bitcoin and Ethereum perpetual futures. The exchange was launched under a license from the Bermuda Monetary Authority, as the company had not received regulatory approval to offer futures in the U.S. at the time of the launch. However, in August, Coinbase received approval from the National Futures Association (NFA), a CFTC-designated self-regulatory organization, “to operate a Futures Commission Merchant (FCM) and offer eligible US customers access to crypto futures.”

✔️ Coinbase pursued FTX Europe acquisition as it looked to expand overseas derivatives business

✔️ Coinbase secures approval to bring federally regulated crypto futures trading

Meta to Expand WhatsApp Payments to India

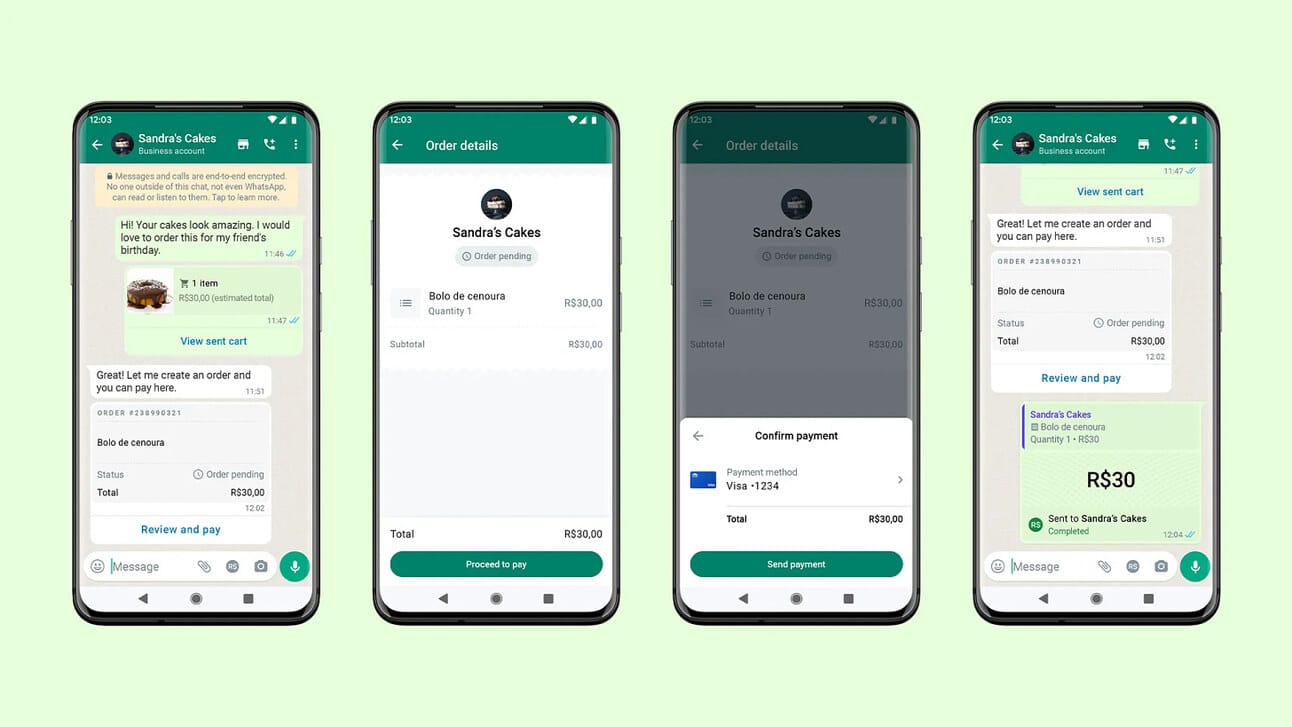

Meta Platforms (NASDAQ: META) plans to expand WhatsApp payments to India, allowing users to buy goods and services from local businesses through chat, according to Bloomberg. This expansion follows successful launches in Brazil and Singapore and targets one of the largest markets for WhatsApp with over 400 million users. The move aims to boost Meta's revenue by charging businesses for premium features, including credit and debit card support and integration with Indian payment apps. While the service will be free for consumers, businesses will pay a processing fee similar to credit card transactions.

Image source: WhatsApp

Earlier this year, WhatsApp introduced the service in Brazil, marking an important milestone for its payment offering, which, prior to the launch supported only peer-to-peer transactions due to regulatory restrictions. The launch enabled end-to-end shopping experiences within the app, eliminating the need for users to visit external websites or use third-party payment services. Consumers in Brazil can make payments using their Mastercard and Visa cards, while businesses can link WhatsApp Payments to their payment acquirers like Cielo, Mercado Pago, or Rede. Brazil has seen rapid adoption of digital payments, with over 124 million people using the Pix instant payment platform.

Charles Schwab Lowers Fixed-Income ETF Fees

Charles Schwab (NYSE: SCHW) is reducing fees on its fixed-income Exchange-Traded Funds (ETFs) in an attempt to offer some of the cheapest options in the market. The company has lowered fees on two of its ETFs, bringing fees on all nine of its fixed-income funds to just three basis points. This move aims to compete in the crowded $7.2 trillion ETF industry where small fee cuts can lead to significant inflows of assets. The move follows similar fee-cutting efforts by other major ETF issuers like BlackRock, Vanguard, and State Street Global Advisors. The company is particularly focused on expanding its fixed-income ETF offerings as the Fed's rate hikes made fixed-income instruments more attractive to investors.

Image source: Charles Schwab

Over the Labor Day weekend, Charles Schwab (NYSE: SCHW) completed the final step in acquiring TD Ameritrade. They moved over 7,000 advisors, nearly 4 million client accounts, and $1.3 trillion in assets from TD Ameritrade to Schwab's platform. Despite a smooth transition, some advisors and investors chose to leave. Thus, in August, Charles Schwab experienced a significant decrease in core net new assets (or net fund inflows), which dropped to $4.9 billion compared to $43.3 billion the previous year and $13.7 billion in July. The company’s management attributed this decline to the temporary loss of TD Ameritrade clients and advisors as part of the integration process. Excluding TD Ameritrade clients, Schwab reported core net new assets of $28.1 billion.

✔️ Schwab Asset Management Reduces Fees on Two Fixed Income ETFs

✔️ All of Schwab’s Bond ETFs Now Cost Just Three Basis Points

In July 2015 you had a choice: a) to bet on PayPal (NASDAQ: PYPL), the financial disruptor, which IPO'ed for the second time, or b) to bet on JPMorgan (NYSE: JPM). In retrospect, betting on the legacy player made more sense, as JPMorgan’s stock went on to outperform PayPal, as well as the S&P 500 and Nasdaq Composite indices.

Fintech Partnerships, Vice President

@ JPMorgan Chase & Co

🇺🇸 San Francisco, CA, United StatesFintech Partnerships, Executive Director

@ JPMorgan Chase & Co

🇺🇸 San Francisco, CA or New York, NY, United StatesDirector, Product Management

@ Meta

🇺🇸 Menlo Park, CA or Fremont, CA, United StatesProduct Manager, Financial Integrity Risk

@ Meta

🇮🇱 Tel Aviv, IsraelProduct Manager - Financial Integrity Ops Scaling

@ Meta

🇮🇱 Tel Aviv, Israel

Cover image source: Coinbase

Disclaimer: Information contained in this newsletter is intended for educational and informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions.