Hi!

Welcome to the “Popular Fintech” newsletter! It’s been a quiet day in the markets with indices hardly moving. Banks continue reporting their Q4 2022 results, but so far it looks like the deposit crisis was contained and didn’t spread beyond a few institutions. Today we are going to look into:

Coinbase getting a Bermuda license

Shift4 Payments becoming the latest target of short sellers

Square rolling out Tap to Pay solution for Android devices

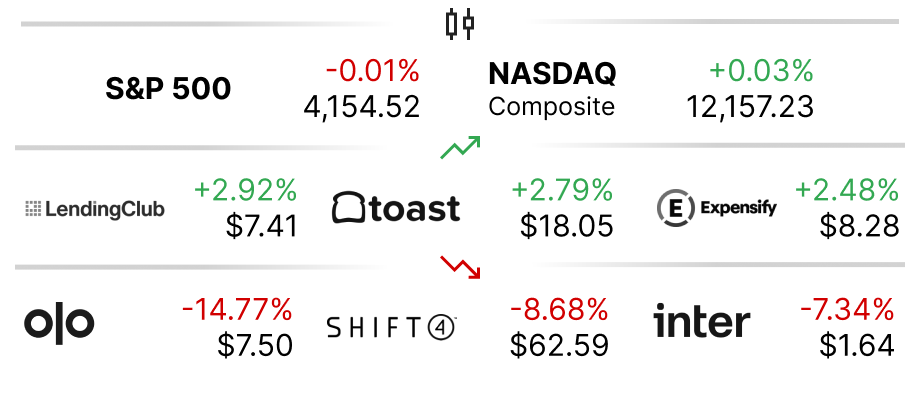

as of April 19, 2023 close, 1D change

Coinbase Gets Bermuda License, Plans to Launch Offshore Exchange in Weeks

Coinbase (NASDAQ: COIN), one of the world's leading cryptocurrency exchanges, has been granted a license to operate in Bermuda, according to a recent article from Fortune and the company’s blog. This license will allow Coinbase to launch an offshore exchange in the coming weeks, which will serve as an additional trading platform for its users. Last month, Bloomberg reported that Coinbase was exploring setting up an offshore venue for its institutional clients. The island nation is known for its favorable regulatory environment for cryptocurrency businesses, with a number of other crypto companies having already established a presence there. By launching an offshore exchange in Bermuda, Coinbase will be able to offer its users more flexibility and access to a wider range of cryptocurrencies and derivatives, while also benefiting from the country's regulatory framework.

Image source: Hubert Lamela on Flickr

✔️ Coinbase gets Bermuda license, plans to launch offshore exchange in coming weeks

✔️ An update to Coinbase’s global scale to go broad and deep

✔️ Coinbase Explores Overseas Venue as US Ramps Up Crypto Scrutiny

✔️ Kraken secures license in Ireland as U.S. crypto companies look abroad for ‘clarity’

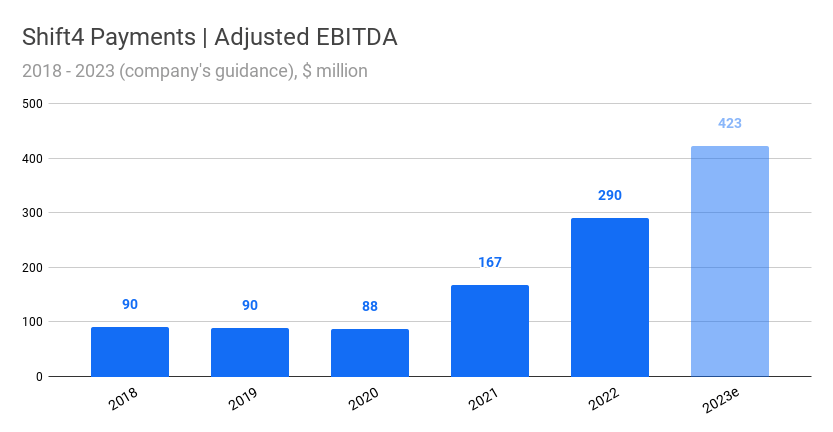

Shift4 Payments Becomes the Latest Target of Short Sellers

In a report released on Monday, short seller Blue Orca accused payment processing company Shift4 Payments (NYSE: FOUR) of inflating its gross profit, EBITDA, and cash flow numbers. Blue Orca believes that Shift4 Payments is “substantially less profitable, generates far less cash, and is materially more levered than investors.” Shift4 Payments stock tumbled 8.7% to close at $62.59. The company becomes the latest target of short sellers. Thus, in November last year, Muddy Waters published a report on dLocal (NASDAQ: DLO) accusing the payments processor of manipulating its accounting records and inflating its take rates. This year Hindenburg Research accused Block (NYSE: SQ) of inflating its Cash App user metrics, and Spruce Point Capital Management accused Canadian Nuvei (NASDAQ: NVEI) of “covered up a pattern of business failures, lack of organic growth, and a web of relationships with individuals connected to major Ponzi Schemes.”

Data source: Shift4 Payments, Investor Relations

✔️ Blue Orca is Short Shift4 Payments, Inc.

✔️ Nuvei Faces Short-Seller Report After Ryan Reynolds Stake

✔️ Block: How Inflated User Metrics and “Frictionless” Fraud Facilitation Enabled Insiders To Cash Out Over $1 Billion

✔️ Muddy Waters is Short DLocal Ltd.

Square Rolls Out Tap to Pay Solution for Android Devices

Square, the payment processing company, has launched Tap to Pay on Android for sellers across the U.S., Australia, Ireland, France, Spain, and the United Kingdom. The software enables Android devices to be used as powerful payment technology and is specifically designed to help smaller retailers streamline their checkout processes and better manage their businesses. With Tap to Pay on Android, businesses can now accept payments, manage inventory, and generate detailed reports, all from their Android devices. The company launches a similar offering for iOS devices, Tap to Pay on iPhone, in September last year. Square’s first product, when the company launched in 2009, was a small card reader that could be attached to a smartphone and enabled merchants to accept payments on the go. Tap to Pay technology essentially eliminates the need for such readers.

Image source: Square

✔️ Square Software Turns Android Devices Into Powerful Payment Technology

✔️ Square Debuts Android Tap to Pay for Merchants

✔️ Square launches Tap to Pay on Android

Chart of the Day

dLocal (NASDAQ: DLO) share price was cut in half when Muddy Waters published their report about the company in November 2022. The short seller called dLocal a fraud pointing out inconsistencies in reported TPV numbers, conflicting inter-company transactions, and corrections made to the founders’ transactions with the company shares. dLocal refuted the accusation (a couple of times), but the stock price has not recovered to its previous levels.

Jobs in Fintech

Director, Corporate Communications and Culture

@ Shift4 Payments

🇺🇸 United StatesSenior Director of Product Management, Payments Processing

@ Toast

🇺🇸 Remote, United StatesProduct Art Director

@ Robinhood

🇺🇸 Menlo Park, CA, or New York, NY, or RemoteDirector of Product Design

@ N26

🇩🇪 Berlin, Germany, Barcelona, Spain, or Vienna, AustriaLead User Researcher

@ Monzo

🇬🇧 London, United Kingdom

That’s it for today! Thank you for reading and see you tomorrow!

Jevgenijs

Cover image: Coinbase

Disclaimer: Information contained in this newsletter is intended for educational and informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions.