Hey!

I love Block. It is an iconic company. But being a shareholder hasn’t been easy. The stock finally got some love recently, climbing above $80, but I’d argue that move is mostly about multiple expansion (the company got included in the S&P 500 index!). Analysts still don’t buy into the company’s growth story.

There’s been a wave of good news: Square completed its replatforming and rolled out a bunch of new features (including a sleek new POS device). Cash App finally integrated Afterpay, and Block began using its own bank for lending. Plus, there’s a shiny new Bitcoin play with Proto.

Still, I don’t think Block is out of the woods. The product momentum is real, but it's unclear how much of it will translate into near-term financials. And if growth stalls, the market won’t care about new product launches (just ask PayPal).

Am I being overly pessimistic this time? Will this time be different?

Let’s dive in!

Jevgenijs

p.s. if you have feedback, just reply to this email or ping me on X/Twitter

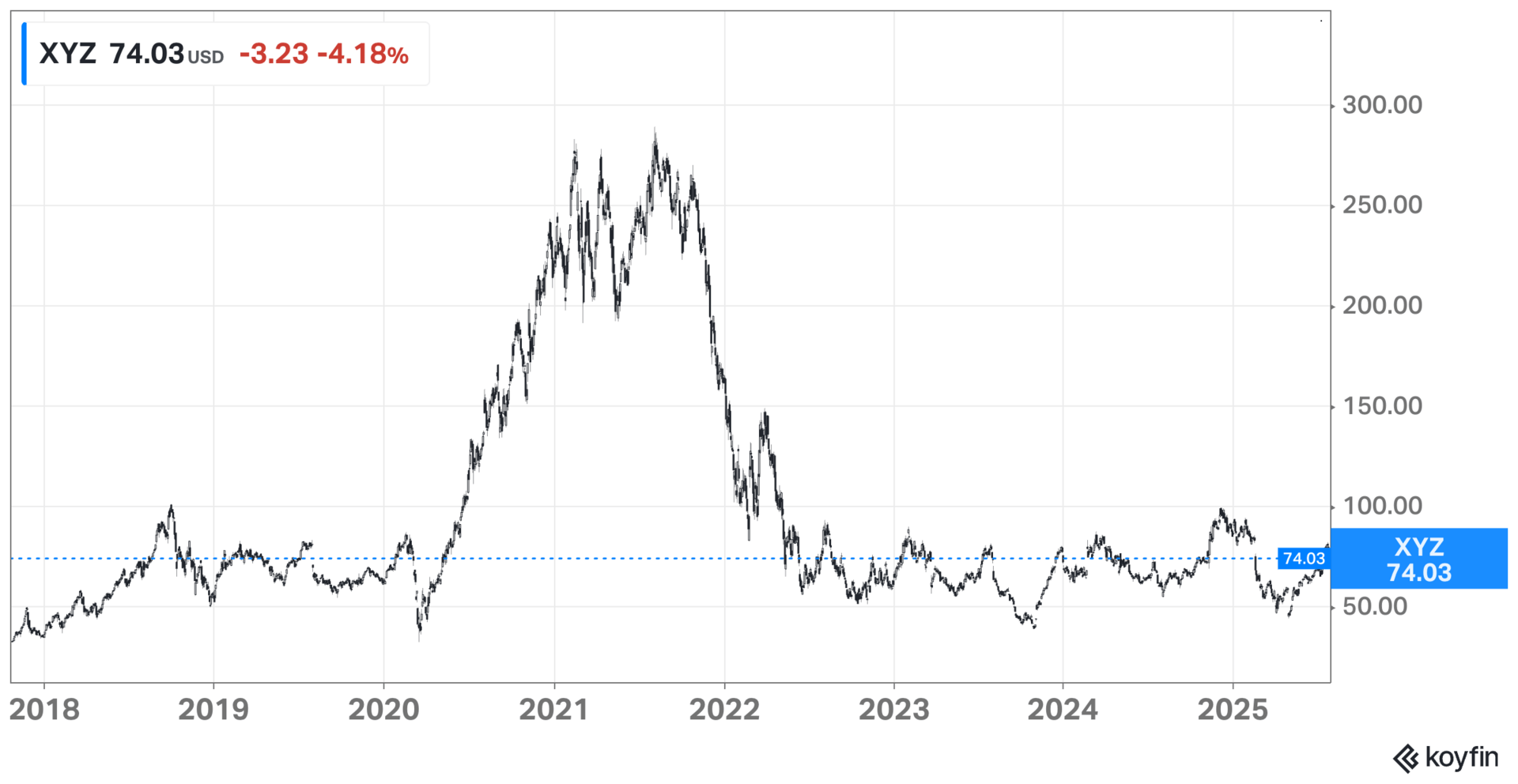

There’s been a lot of excitement around Block $XYZ ( ▼ 2.86% ) lately, mostly because of the stock’s recent move. But if you’ve followed Block for a while, you know we’ve seen this story before: in 2024, 2023, 2022, definitely during the 2020–2021 run, and even back in 2019 and 2018.

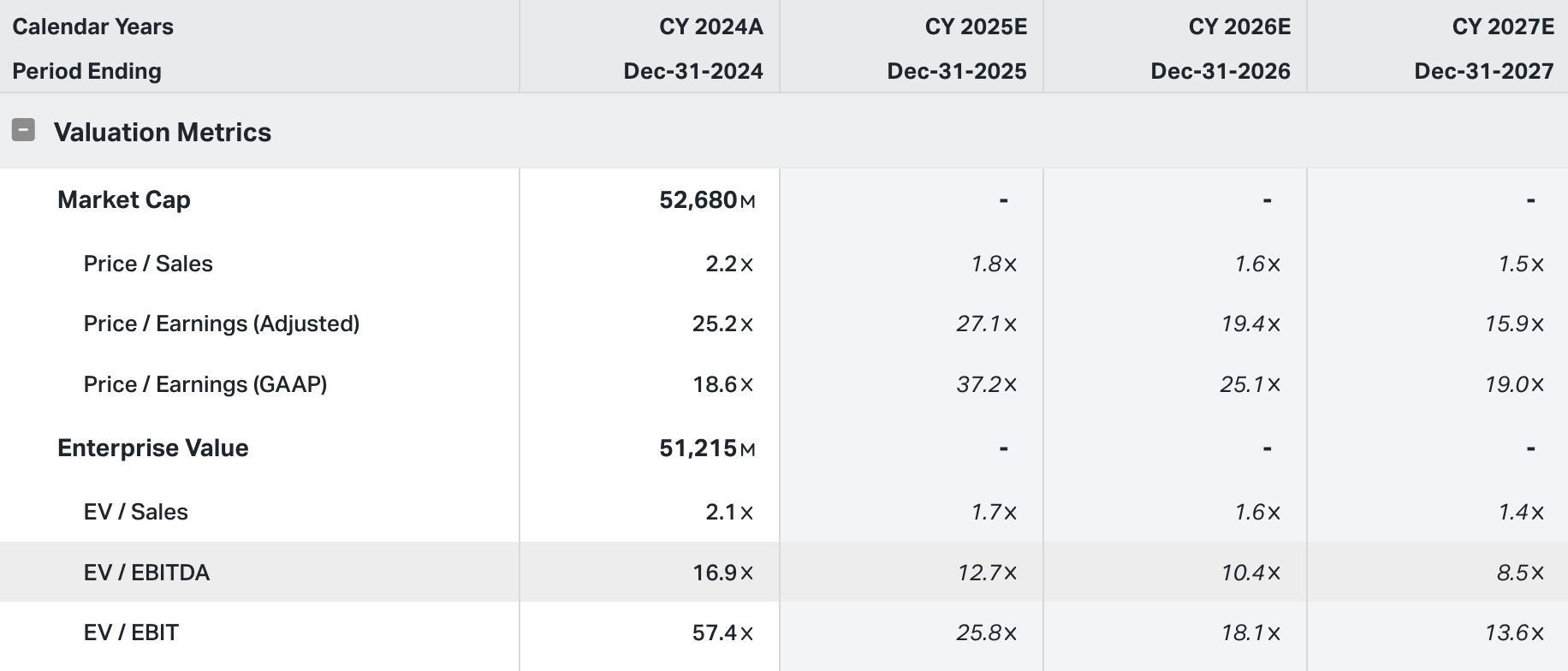

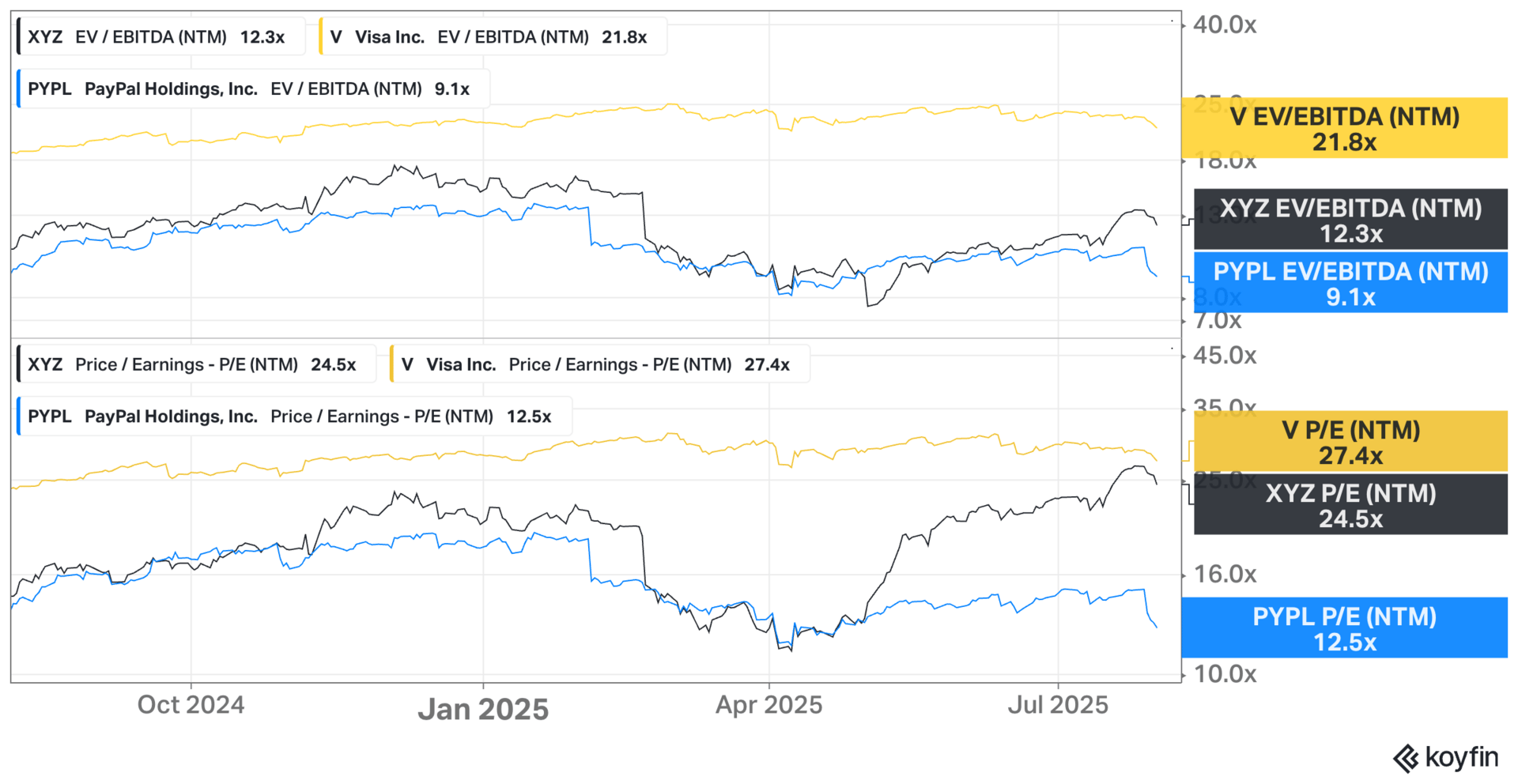

As of August 1, 2025. Source: Koyfin

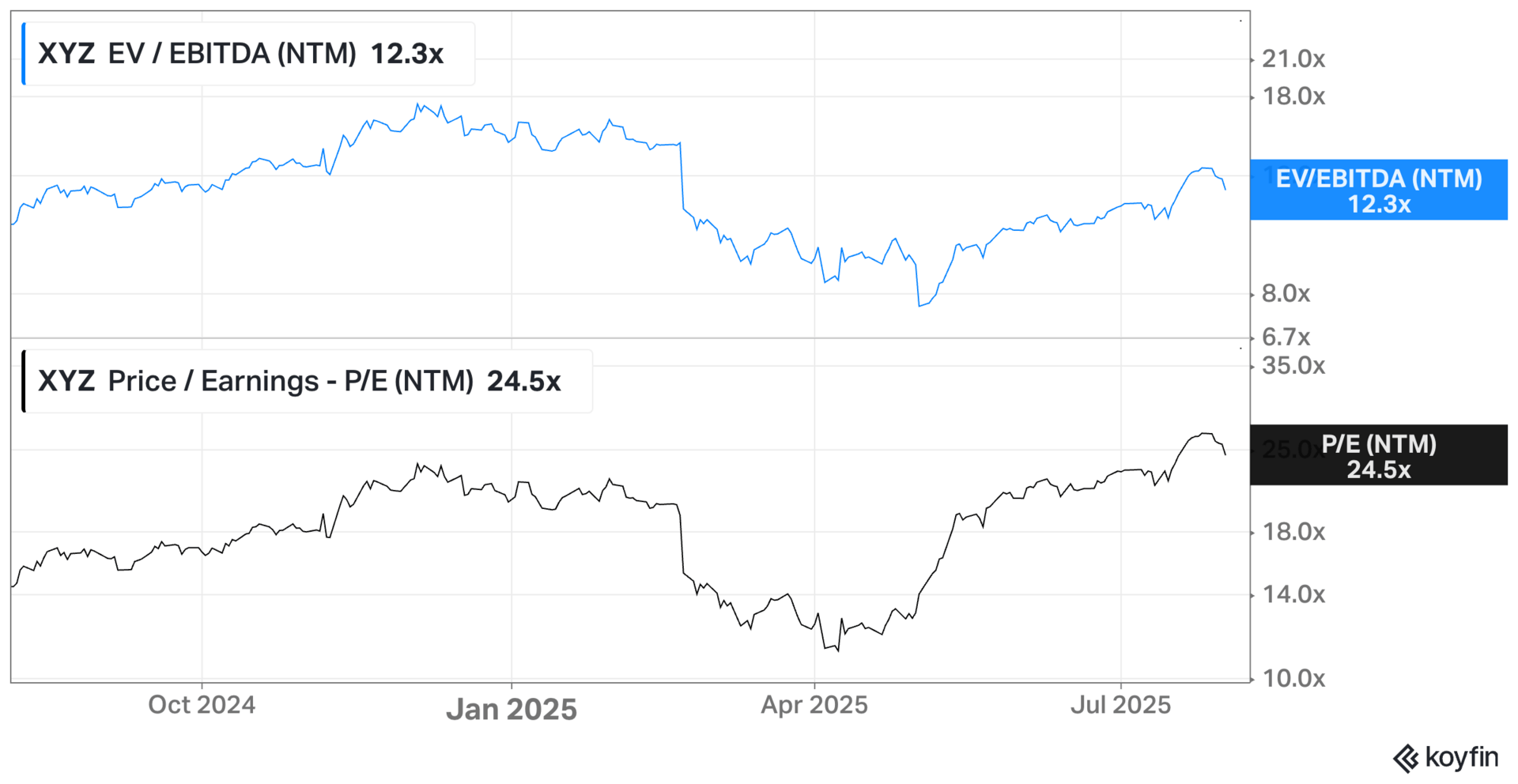

The latest price rally is almost entirely due to multiple expansion and inclusion into the S&P 500. Since April–May, Block’s forward EV/EBITDA jumped from 7.6x to 12.3x, while its adjusted forward P/E doubled from 11.2x to 24.5x.

As of August 1, 2025. Source: Koyfin

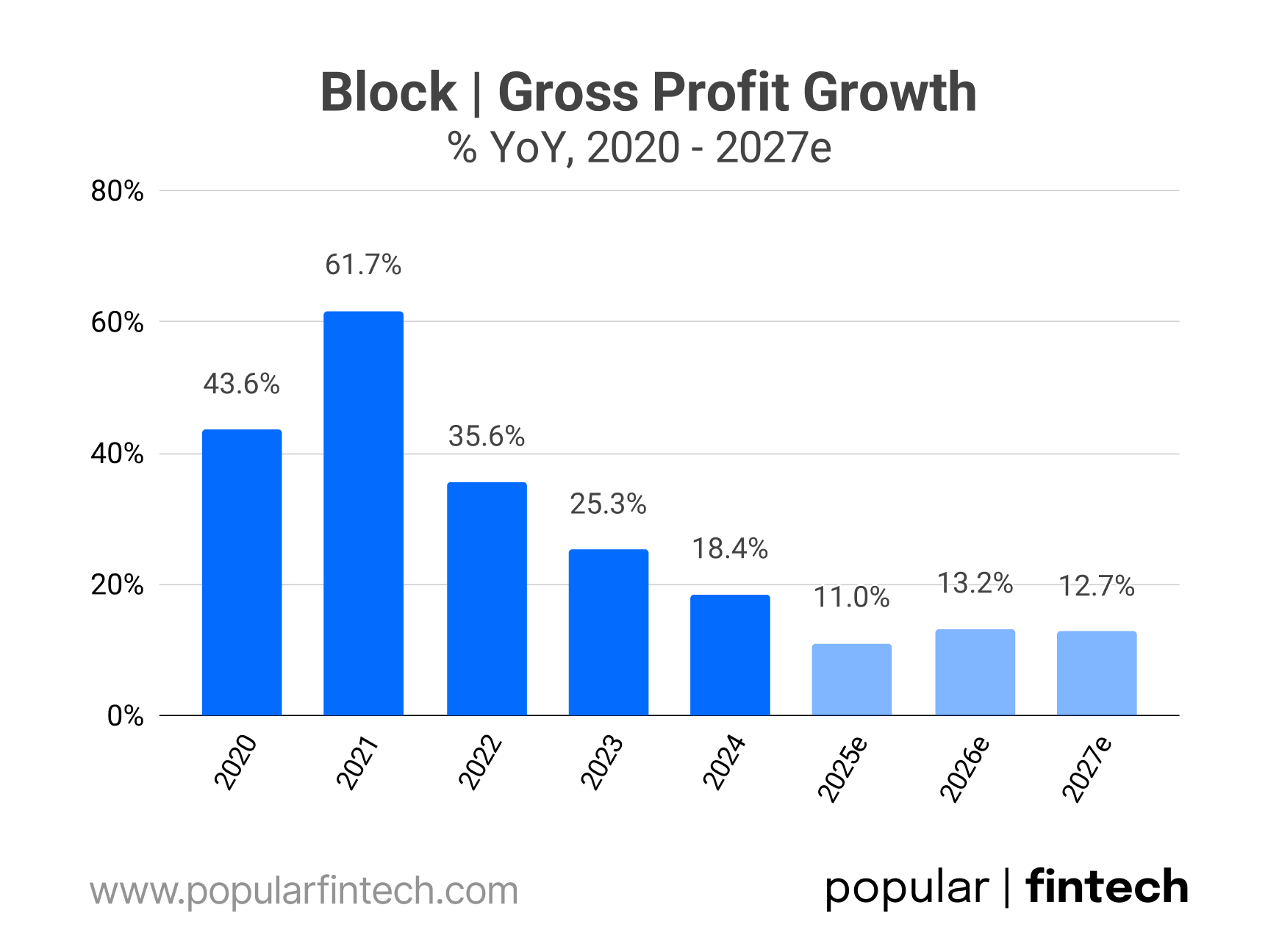

Analysts haven’t raised their earnings estimates and remain skeptical of Block’s repeated claims that it can achieve 15% gross profit growth. Most expect gross profit to grow in the 11–13% range over the next few years.

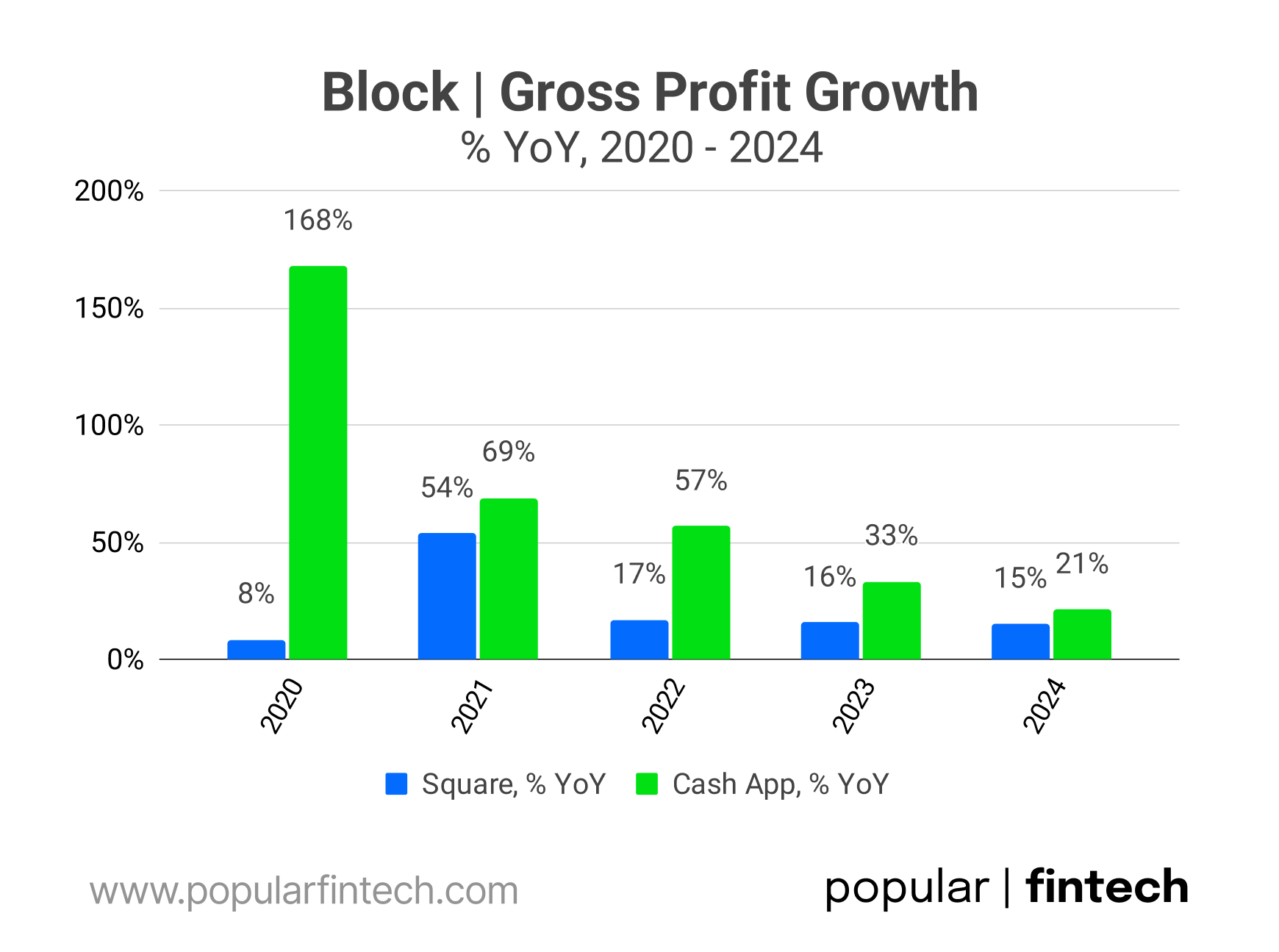

Data source: Block, Koyfin

“We recognize we are operating in a more dynamic macro environment, so we have reflected a more cautious stance on the macro outlook into our guidance for the rest of the year. We now expect $9.96 billion in gross profit for 2025, for growth of 12% YoY.”

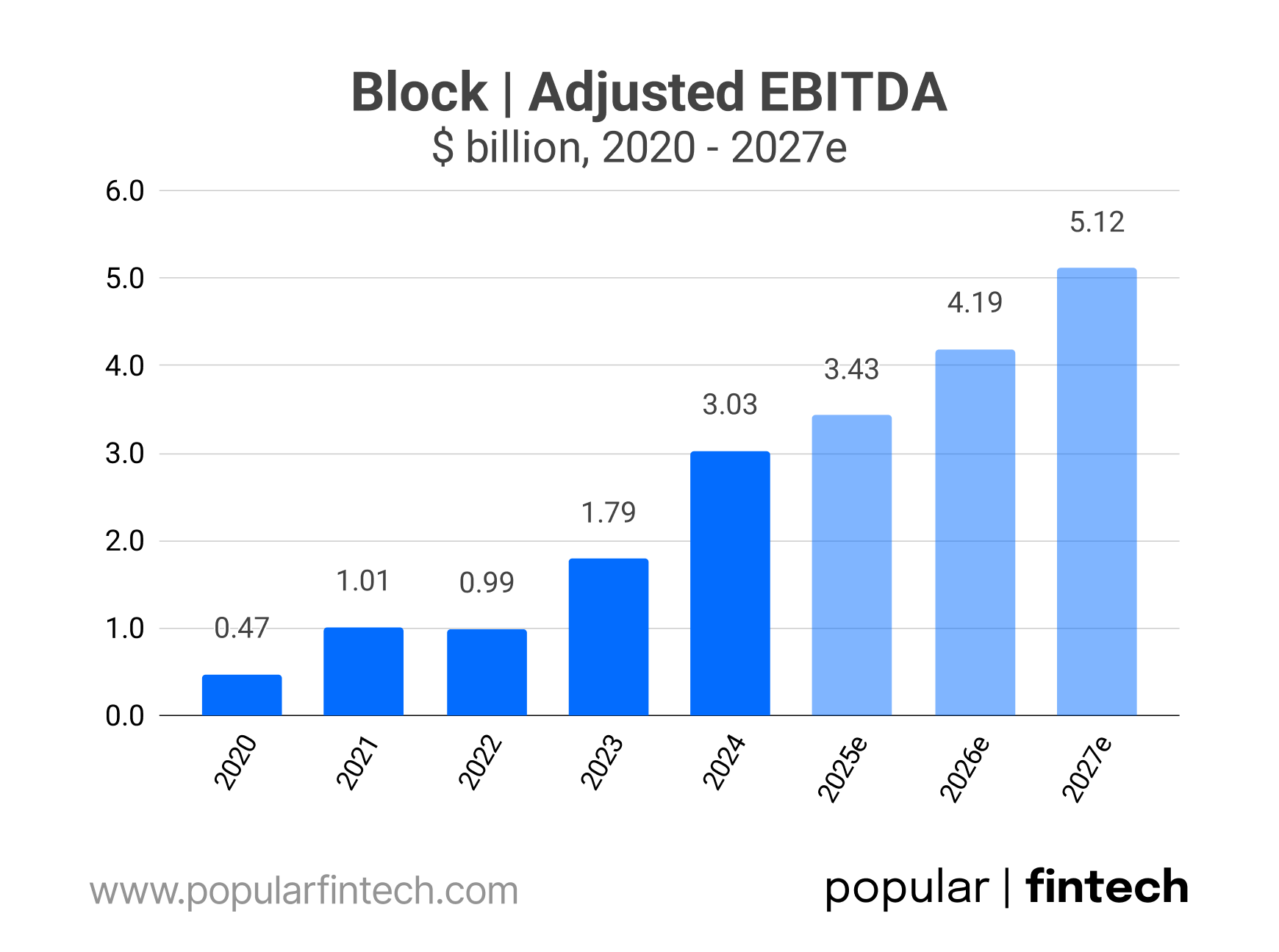

Beyond top-line growth, Block is also benefiting from operating leverage. Adjusted EBITDA is expected to grow at a 19% CAGR over 2025–2027. Management has repeatedly emphasized that they can drive this growth without significantly expanding headcount.

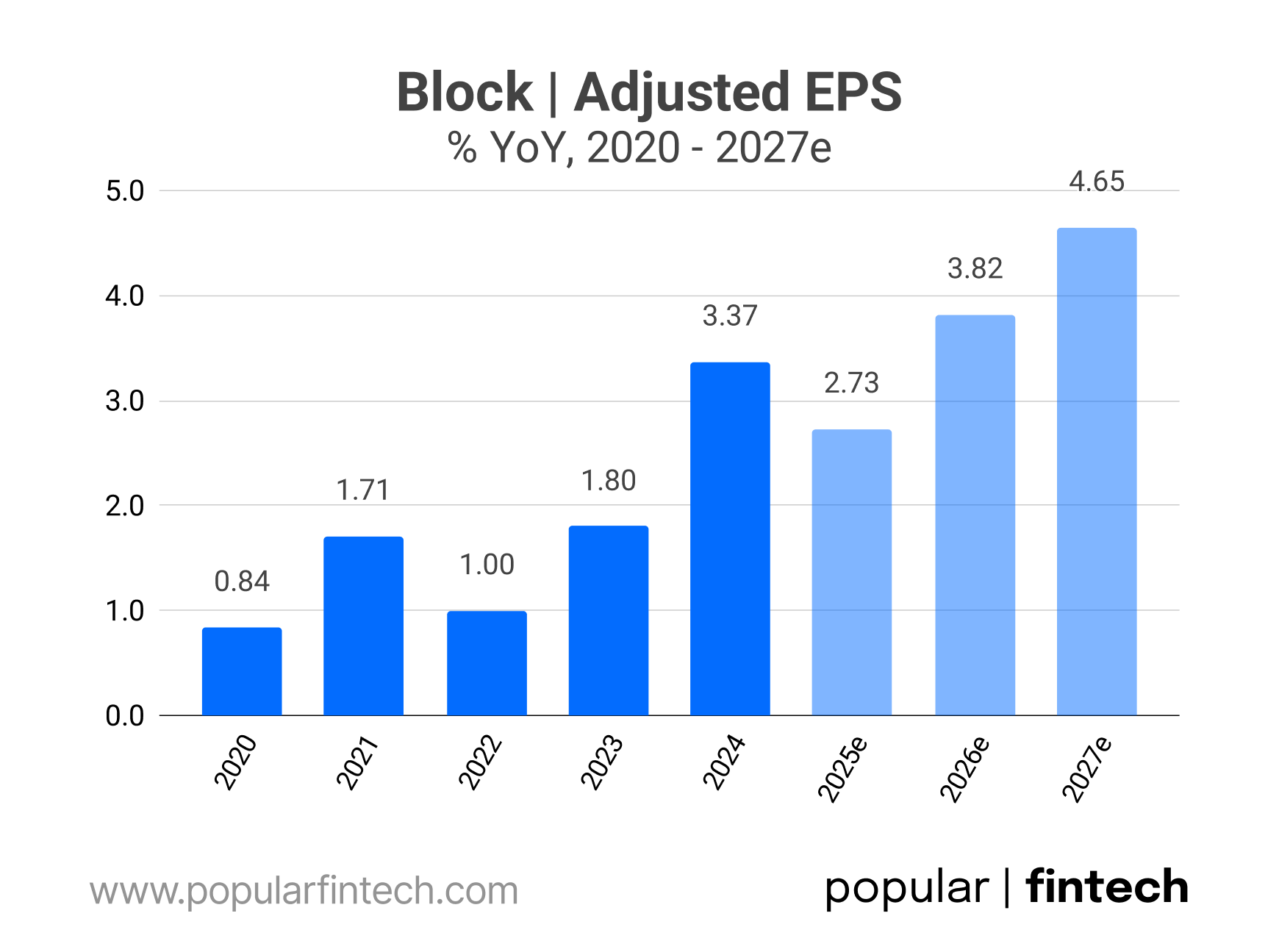

Data source: Block, Koyfin

Adjusted EPS is expected to grow at an 11% CAGR from 2025 to 2027. However, Block benefited from a significant tax break in 2024, so it’s more meaningful to look at the 2023–2027 period, over which adjusted EPS is projected to grow at a 26% CAGR.

Data source: Block, Koyfin

The stock looks expensive on a P/E basis, especially unadjusted. But if you believe Block is prioritizing growth over short-term net income, the EV/EBITDA multiple appears more reasonable.

As of August 1, 2025. Source: Koyfin

I’d compare Block to both Visa and PayPal: Visa serves as a valuation benchmark, while PayPal is a more direct peer, another large player working to reignite growth. As you can see, the forward P/E multiple is out of touch with reality.

So… unless analysts raise their earnings forecasts after Block reports Q2 2025 results, the stock will drop like a rock (not financial advice!). The question is: what might convince analysts to revise their estimates?

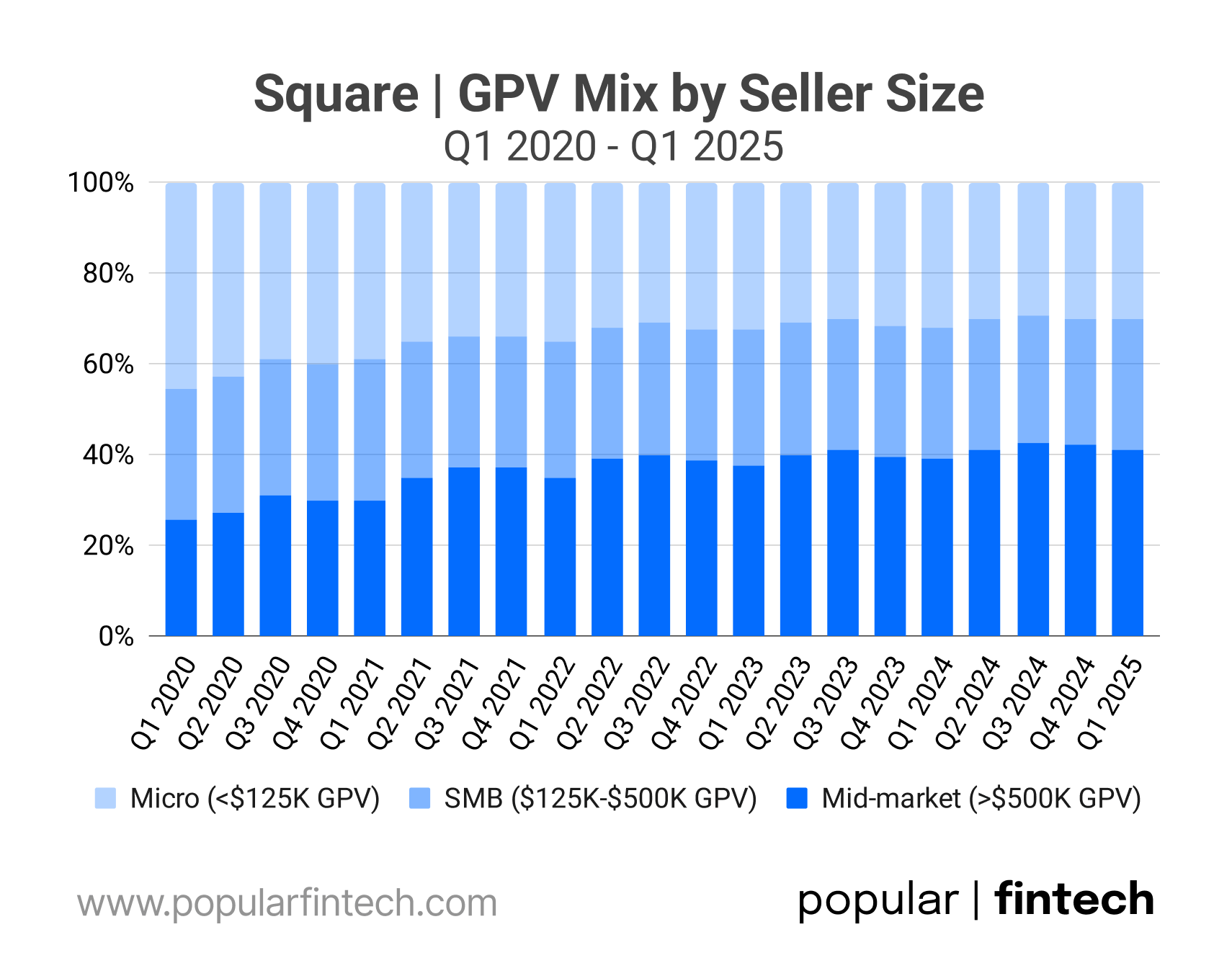

Let’s start with Block’s investment thesis. In Q1 2025, Square grew gross profit by 9.5% YoY, and Cash App by 9.7% YoY. Growth in both segments is clearly slowing, and it is slowing quickly.

The investment thesis is that Block can reignite growth by:

Square: accelerating product development, and expanding field sales to move upmarket

Cash App: scaling its lending products, including Afterpay and Cash App Borrow

Block also has Bitcoin-related initiatives, with its mining hardware business, Proto, emerging as a potential driver of future growth.

“…we continue to have conviction that we can accelerate our growth for Cash App and for the overall company in the back half of the year on four key drivers: Borrow expansion, continuing to ramp Afterpay on Cash App Card, continued share gains in the Square business with improvement in GPV and the launch of an entirely new business for us with Proto, which is our Bitcoin mining chip.”

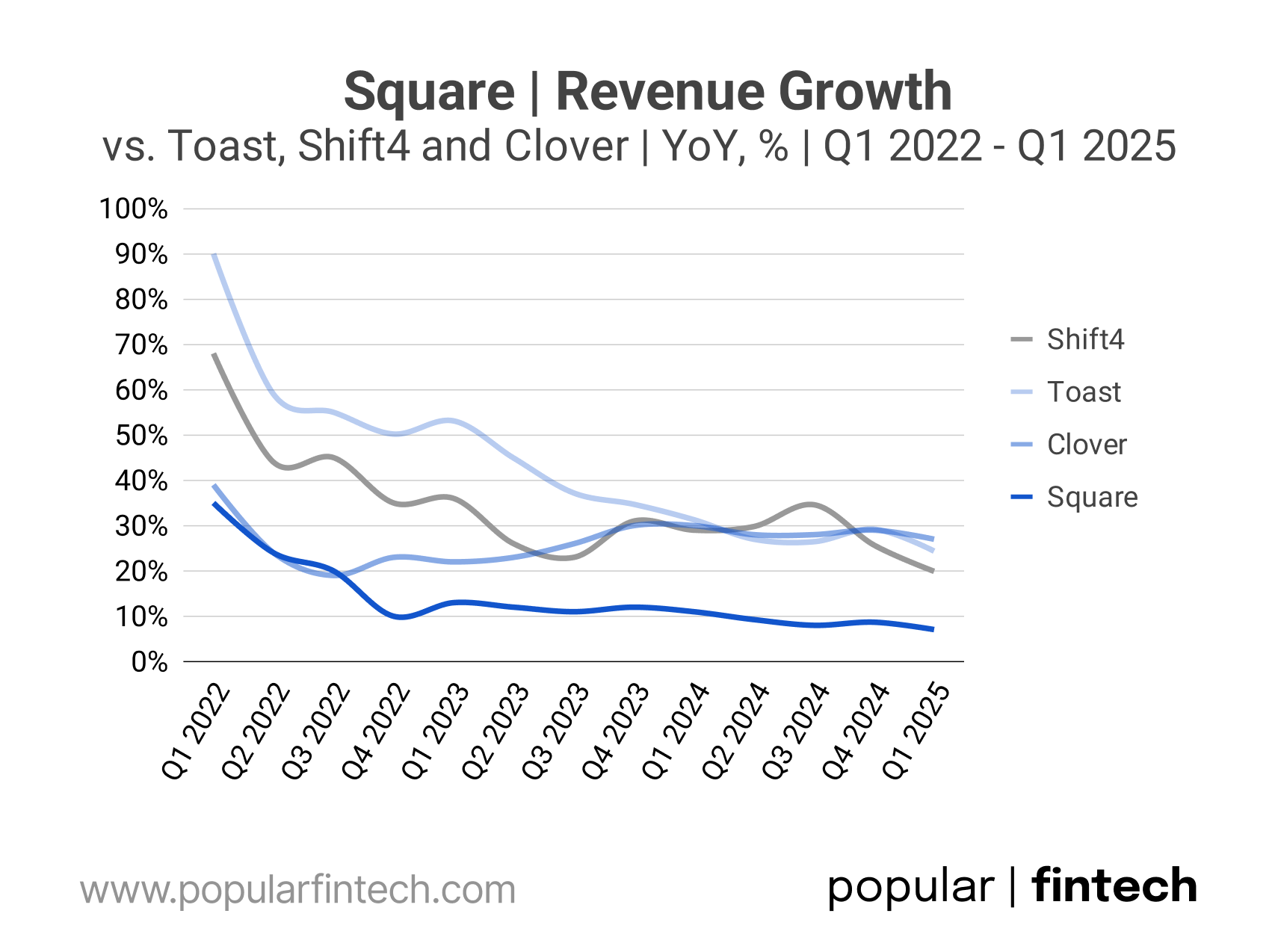

Since Jack Dorsey’s return in the autumn of 2023, Square has been replatforming its solution. This followed a major IT incident and growing concerns that the platform had become overly complex and bloated. Square has also fallen behind its key competitors when it comes to growth.

Data source: Block, Toast, Shift4 and Fiserv

The replatforming appears mostly complete, marked by a major product release in May 2025. The “Spring Release” included over 100 products and features. Block has committed to delivering similar updates twice a year going forward.

Image source: Square Releases

“Today we're announcing probably the largest product announcement and set of releases that we ever had as a company, it's 100 products and features that are all going to be announced today in oe big group. And we're doing this twice a year so that our sellers have more visibility about what is available today and what is to come.”

Block also launched a new handheld POS device, “Square Handheld”, which appears to be the most capable, lightest, durable, and most affordable option on the market. Notably, Square Handheld was launched in several key markets, including the US, Japan, the UK, and Australia.

Image source: Square

“Square handheld is the thinnest device on the market. It's the best priced device on the market. It's the most durable price on the market. …we have the full vertical integration, meaning that we can build really compelling experiences and do them much quicker than a lot of our competitors who work with outside vendors.”

Block’s field sales efforts are beginning to show results, with a few, but notable, customer wins. The company’s recently revived Investor Relations account on X has highlighted new clients like Bambu Dessert Drinks, Live Nation Canada, Toyota Arena Tokyo, and Uncle Sharkii Poke Bar.

Data source: Block

In summary, the thesis that Square can reignite growth by accelerating product development and ramping up field sales remains intact. While the impact may not be visible in Q2 results, management could signal progress through updated guidance. However, Square is not a small ship to turn around.

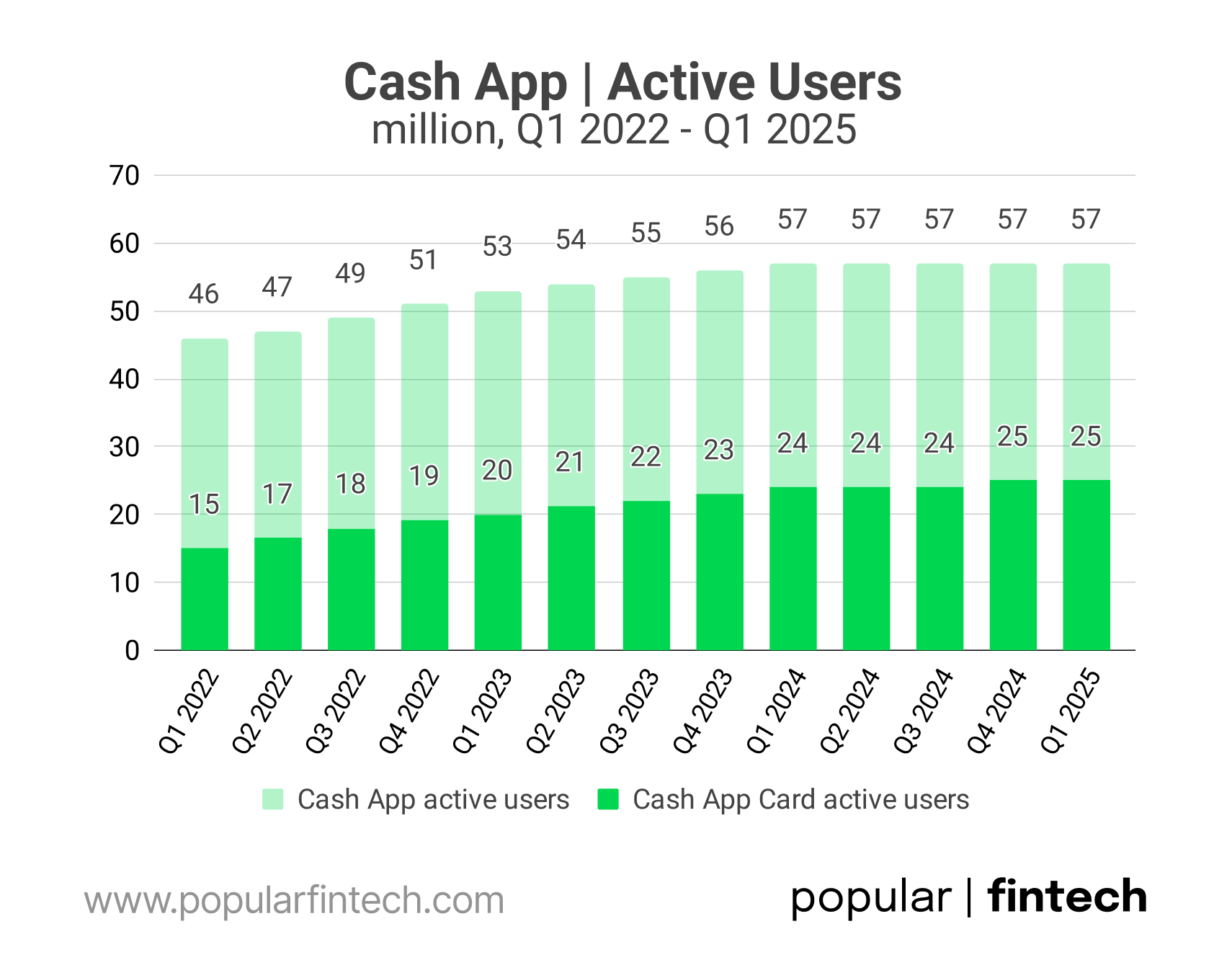

Now let’s turn to Cash App. It appears Cash App has likely maxed out its total addressable market, as both active users and Cash App cardholders have plateaued. Block has yet to show how it plans to expand that TAM.

Data source: Block

“Overall gross profit growth, as you know, for Cash App in Q1 was 10% growth. We saw 13% inflows per active growth in January, and that decelerated to 5% to 6% in each of February and March, much of that deceleration coming in the back half of February and then into March.”

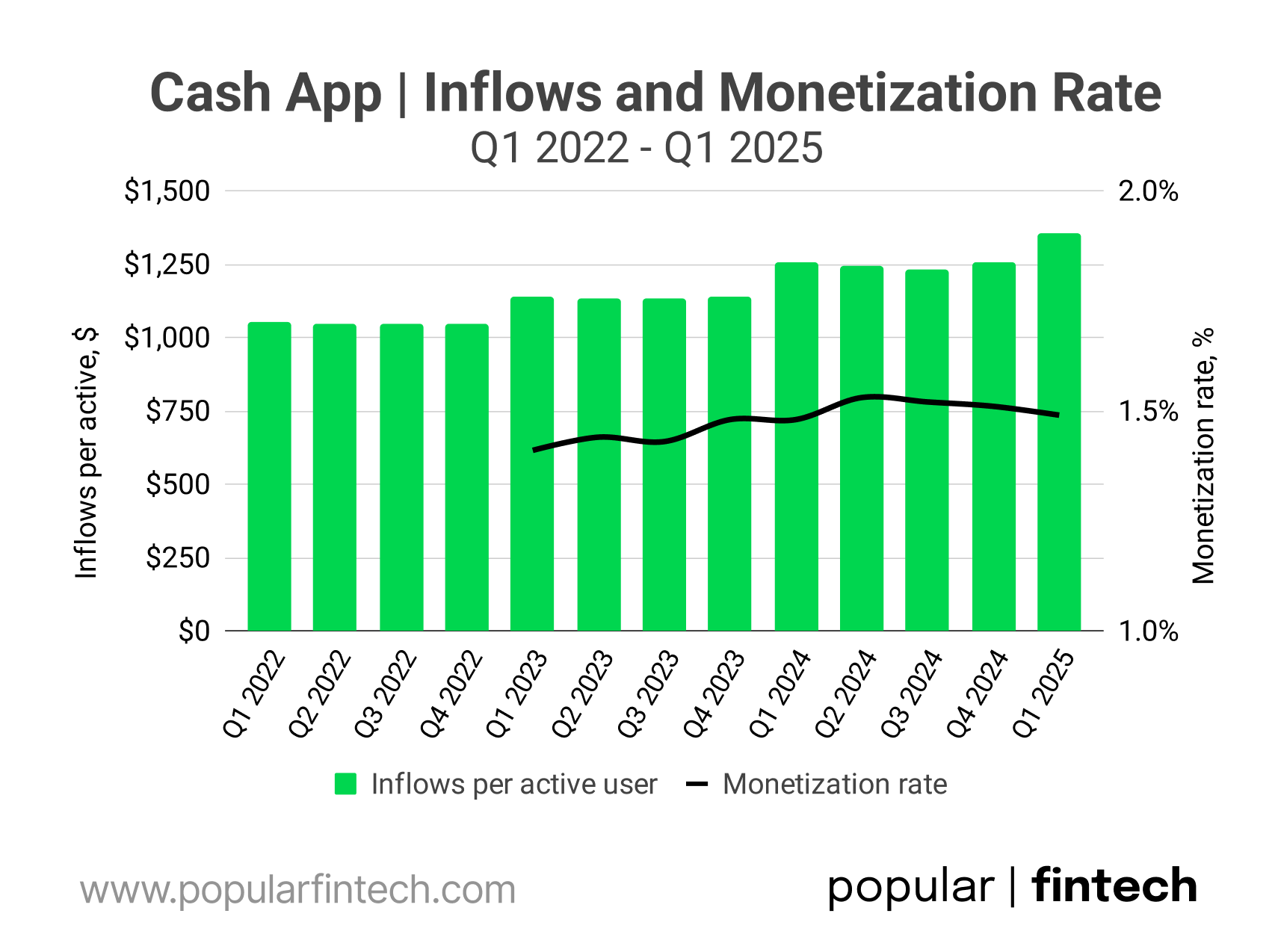

Cash App’s gross profit depends on three things: active users, inflows per user, and the monetization rate. But growth across all three has slowed: active users have stalled, monetization rate has flatlined, and inflows per user dropped to single-digit growth in early 2025.

“So first, gross profit for Cash App in April on a normalized basis, so excluding some onetime benefits, that we saw in the month was 13% YoY. That compares to 7% YoY growth in the month of March.”

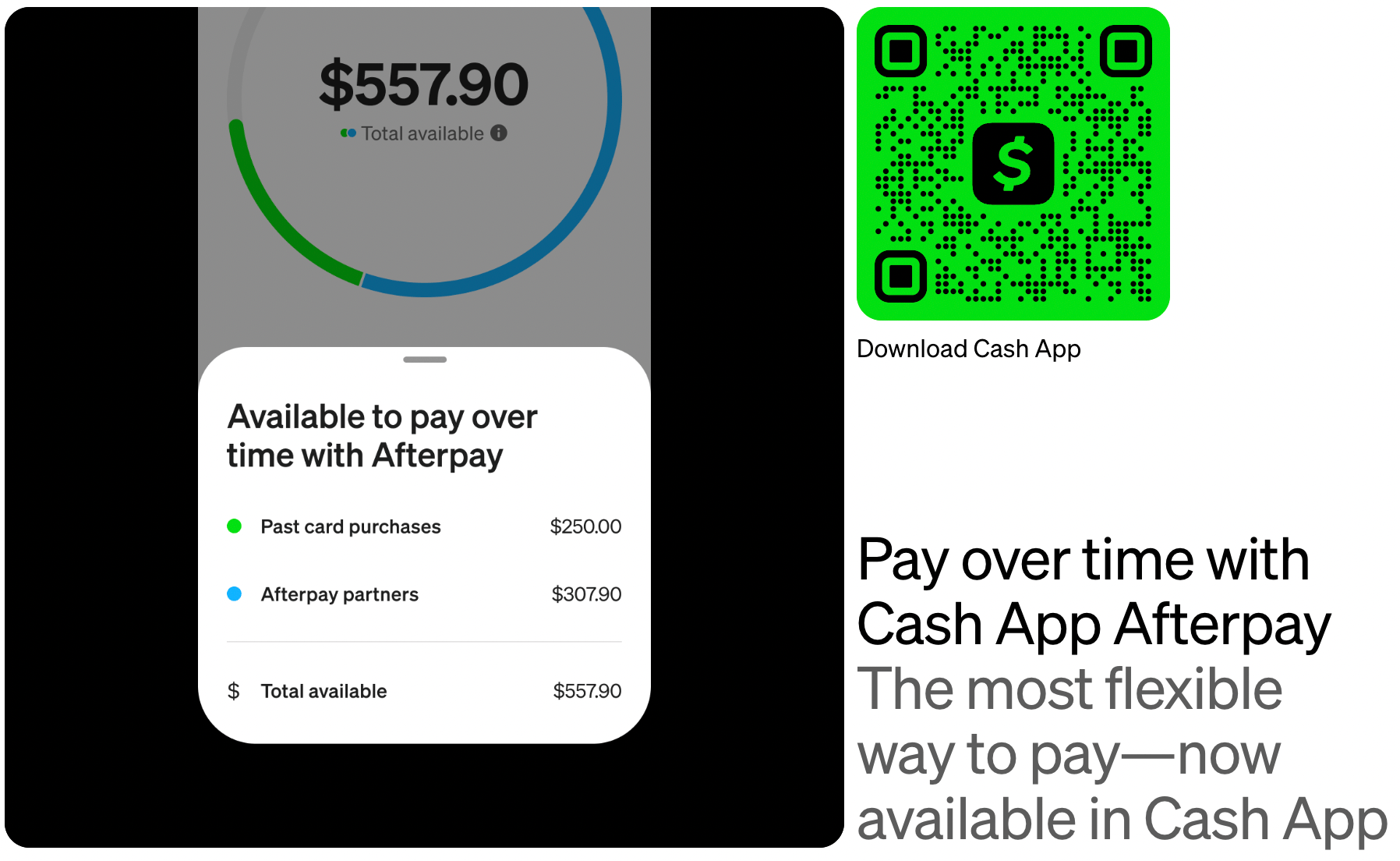

Cash App’s monetization rate is mainly driven by three products: the Cash App Card, instant deposits, and lending (including Afterpay and Cash App Borrow). In March, Block finally integrated Afterpay into Cash App (yes, three years after the acquisition).

Image source: Cash App

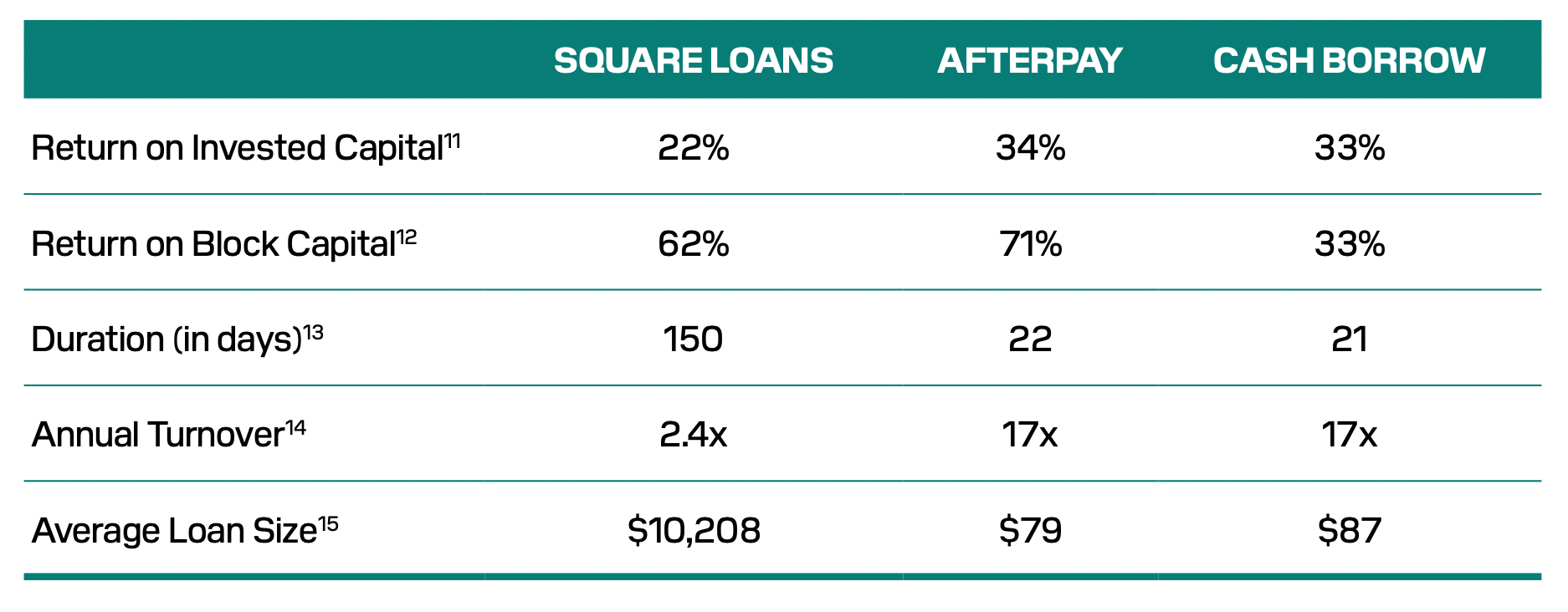

“We're able to double the number of actives in Cash App that we can offer Borrow to because we're now servicing and originating Borrow through our own internal bank, Square Financial Services, which also gives us better unit economics on an already profitable P&L.”

Block also moved Cash App Borrow originations to its own bank, Square Financial Services, which enabled the company to double the number of eligible users it can offer loans to. Block now owns its entire lending stack and no longer relies on external lending partners.

Image source: Block, Q3 2024 Shareholder Letter

Block is making real progress in scaling its consumer lending products, but there are limits. In Q1 2025, Afterpay generated $237 million in gross profit, 17% of Cash App’s total, and grew 14% YoY. So, even with the Cash App integration, the best-case scenario may be a return to peer-level growth (e.g. Affirm and PayPal).

Block originated $9 billion in Cash App Borrow loans in 2024 (up 150% YoY), so it’s still a smaller product than Afterpay. So, expecting a major boost from Cash App Borrow in Q2, or even in 2025, would be unreasonable.

So while the thesis that Block can reignite Cash App’s growth is still intact, and the company is making solid progress, its 2025 results will be driven more by user inflows trends than by lending growth. At best, Block can prove that lending can be the major growth driver in 2026.

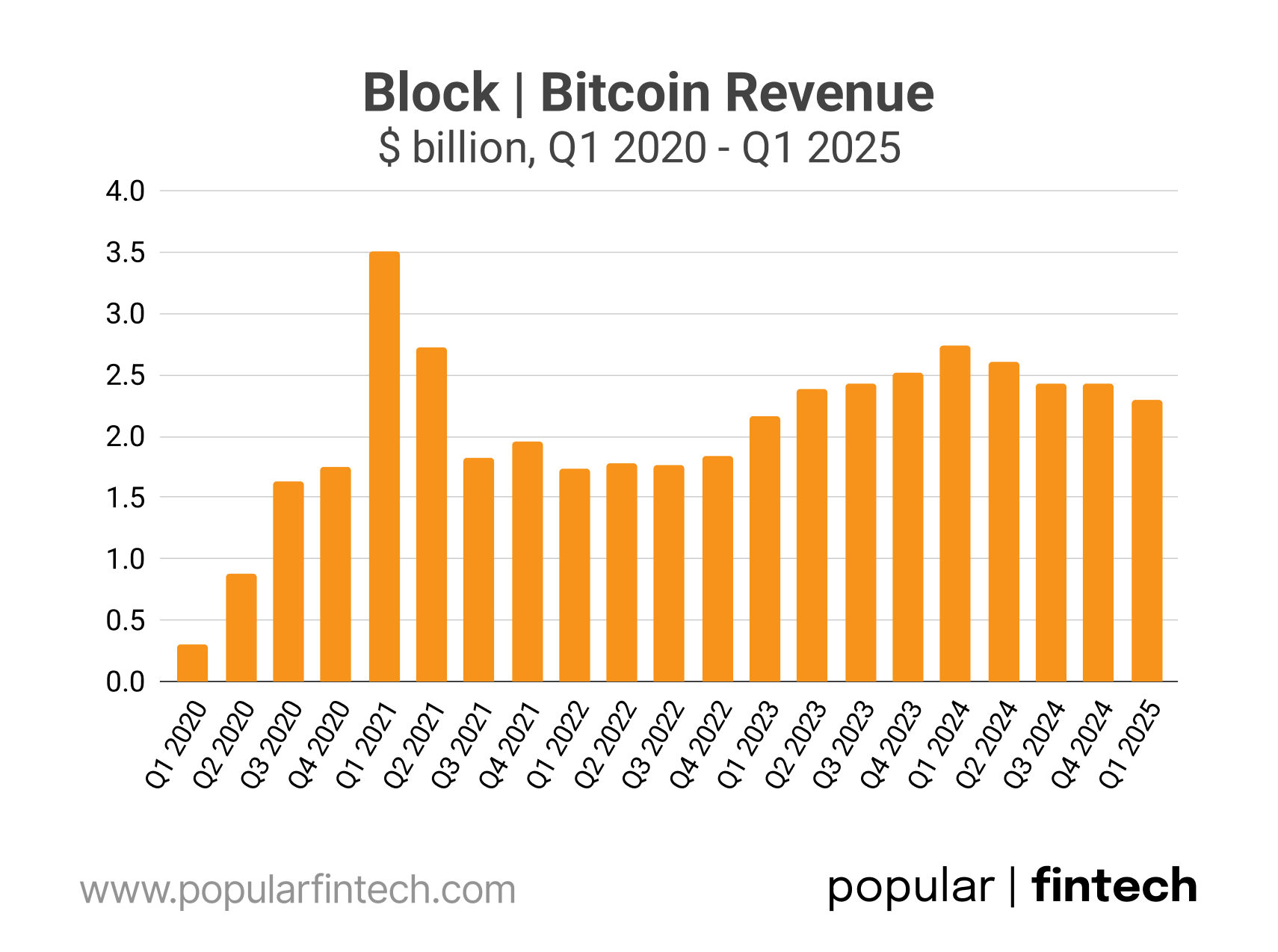

Finally, let’s look at Block’s Bitcoin efforts. The company has explored various Bitcoin-related initiatives, but so far, only one has gained real traction: buying and selling Bitcoin through Cash App. In 2024, this service generated $288 million in gross profit (Block reported “Bitcoin revenue” is essentially trading volume).

“We believe that by building for and on open-source systems and protocols we will increase trust, customer flexibility, and global adoption. This will underlie all of our work, but will show up most obviously in our platform and bitcoin initiatives, our bitkey non-custodial wallet, and Proto, our open bitcoin mining system.”

The latest initiative is Proto, Block’s Bitcoin mining hardware business. The company’s engineers have reportedly developed more efficient mining equipment (including a custom-built chip), aiming to offer a competitive alternative in a market dominated by just a few players.

Not much has been shared about Proto’s potential financial impact or how quickly it can scale. However, according to management, the business is expected to start contributing to gross profit in the second half of 2025. Hopefully, we’ll get more details during the Q2 earnings call.

Image source: Block

“We anticipate…the first gross profit contributions from Proto, as we deliver our first chips and systems in the second half of the year.”

Block is also working to enable Bitcoin payments, and in July, it onboarded the first merchants to its “native Bitcoin acceptance experience.” While I genuinely admire the company’s efforts to make Bitcoin viable for payments (I really do!), I’m highly skeptical that we’ll see any meaningful financial impact from this initiative in 2025, or even next year.

Image source: X

So, where does that leave us? Square has completed its replatforming, the team is shipping new features, and the sales force is starting to bring in new customers. That momentum could translate into more optimistic guidance for the rest of the year.

Cash App is making progress on the lending side. It’s now using its own bank for originations and has finally integrated Afterpay into the app. Still, expecting Afterpay or Cash App Borrow to significantly change the trajectory of the business this year is unrealistic.

As for Bitcoin…well, Jack Dorsey isn’t giving up. Maybe Proto will be the breakthrough, maybe not. Maybe Block will figure out how to make Bitcoin work for payments, maybe they won’t. I’m not ready to bet on any of it (though that might just reflect my limited knowledge about the Bitcoin mining market).

So… is the latest wave of optimism justified? Will analysts finally upgrade their earnings forecasts after Block reports its second quarter results? I like the momentum, but it still feels too early to say Block is out of the woods.

Fingers crossed, I am absolutely wrong and Block crushes it!

Cover image source: Block

Disclaimer: The views expressed here are my own and do not represent the views of my employer. The information contained in this newsletter is intended for educational and informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions. Read the full disclaimer here.