Bill.com ( ) delivered a very strong fiscal year (calendar Q3 2021 - Q2 2022). The company’s core business, Bill.com, grew across all metrics (customer base grew 30% YoY, the payment volume grew 56% YoY, and revenue grew 76% YoY). The company also completed acquisitions of Divvy and Invoice2Go, which are growing at an even faster pace and deliver higher gross profit margins.

The company has many levers to continue growing (organic growth, cross-selling solutions, international expansion), and the management guided for further 49-52% revenue growth in fiscal 2023. However, the economic outlook is not promising, and it begs a question if the management is not overly optimistic about the growth prospects ahead. I guess we will see that in the coming quarters. Until then, let’s review the company fiscal Q4 2022 and the full fiscal year results.

If you are new to Bill.com, I suggest reading the company’s profile:

…and if you are new to Popular Fintech, subscribe to receive upcoming updates:

Customers

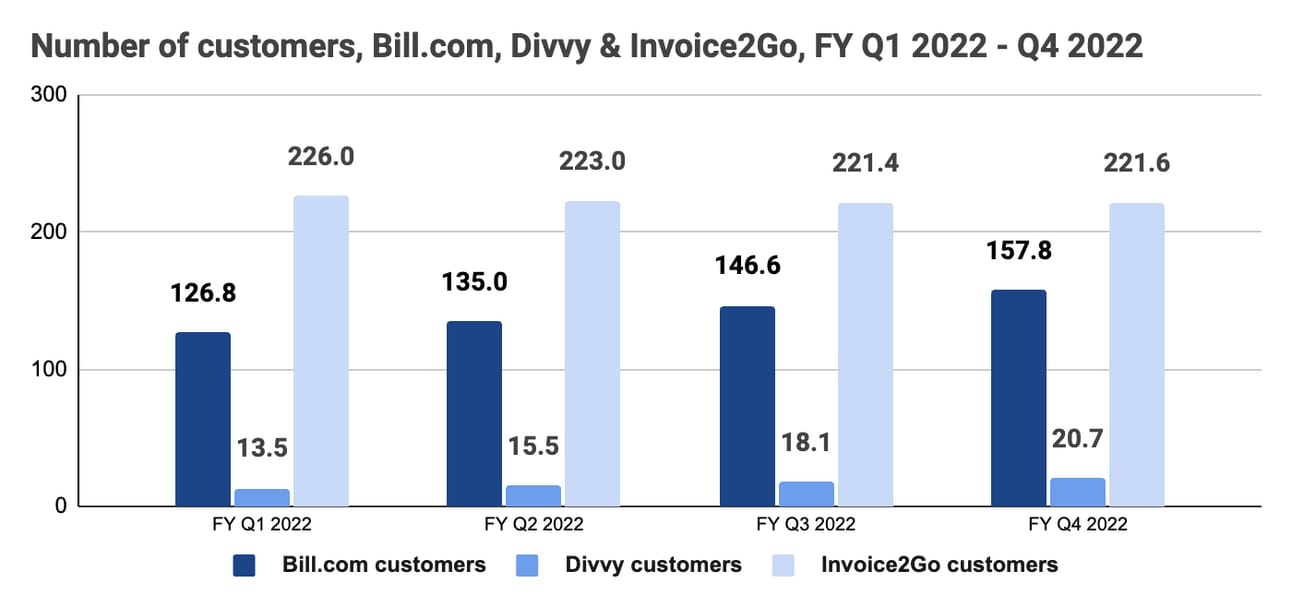

The fiscal year 2022 was a great year for Bill.com. The company grew its customer base from 121.2 thousand customers at the end of Fiscal Q4 2021 to 157.8 thousand customers at the end of Fiscal Q4 2021. As can be seen from the chart below, there was a slowdown in customer onboarding in Fiscal Q1 and Q2 2022, but the company returned to the growth rate of 27%+ by the end of the year.

In addition to the Bill.com customers, the company now services 20.7 thousand Divvy customers and 221.6 Invoice2Go customers. While the Invoice2Go customer base declined slightly since the acquisition, Divvy continued to rapidly expand. At the moment of the acquisition announcement, Divvy reported 7,500 customers, so the business tripled its customer base over the course of the year.

My understanding is that there is little overlap between customers of Bill.com, Divvy, and Invoice2Go; thus, the company sees sizeable upsell opportunities (i.e. selling Divvy solutions to Bill.com customers, or selling Bill.com solutions to the internal Invoice2Go customers).

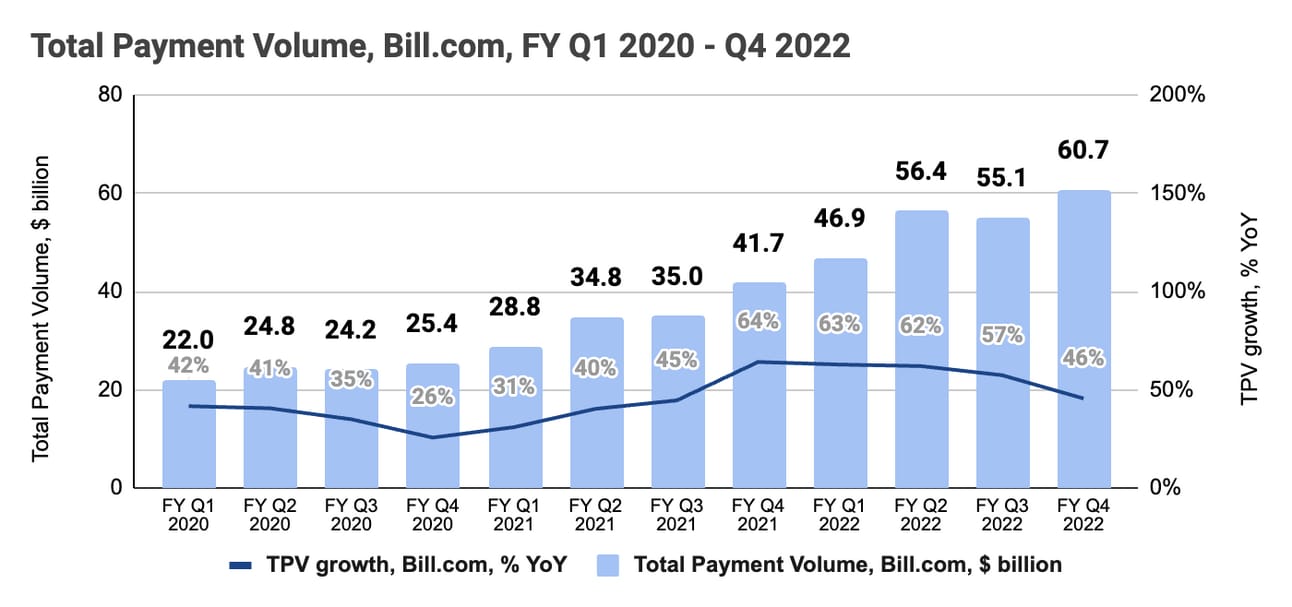

Total Payment Volume

As the company generates a large share of its revenue from the payment processing business, Total Payment Volume is a critical metric to monitor. The company reported $60.7 billion in Total Payment Volume for its core business, Bill.com, during the Fiscal Q4 2022, and $219.1 billion for the full fiscal year 2022. This represents a 46% YoY growth for the quarter (compared to Fiscal Q4 2021) and a 56% YoY growth for the full fiscal year (compared to the fiscal year 2021).

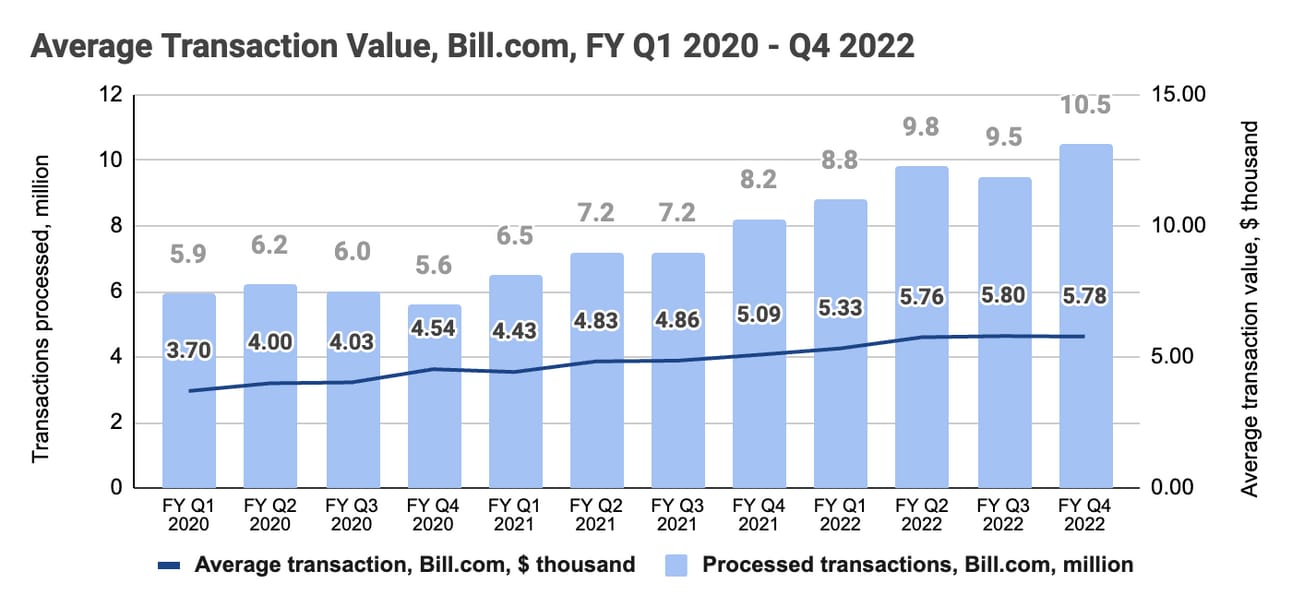

The growth in Total Payment Volume came from both, an increased number of processed transactions and a higher average transaction value. Thus, the company processed 10.5 million transactions in Fiscal Q4 2022, representing a 28% YoY growth. The average transaction value increased 14% from $5.08 thousand in Fiscal Q4 2021 to $5.78 thousand in Fiscal Q4 2022.

In addition to the Bill.com business, the company processed $2.7 billion in Divvy corporate card payments. At the moment of the Divvy acquisition, the company reported $4 billion in annualized TPV. Fiscal Q4 2022 suggests that this number surpassed $10 billion. Divvy generates most of its revenue from interchange fees; thus, the Total Payment Volume is the key metric driving this business income.

At the moment, Invoice2Go derives revenue primarily from subscriptions and uses third-party providers for payment processing. However, Bill.com is planning to migrate the company to its own payment engine over time. Thus, eventually, Payment Volume will also become a critical metric for this business.

Revenue

Bill.com reported revenue of $200.2 million for fiscal Q4 2022 and $641.9 million for the full fiscal year, which represents a 156% YoY growth for the quarter (vs. Fiscal Q4 2021) and 169% YoY for the full fiscal year (vs. Fiscal Year 2021). Excluding Divvy and Invoice2Go, the company’s revenue (“organic revenue”) grew 77% YoY for the quarter and 76% YoY for the full fiscal year.

In Fiscal Q4 2022, Bill.com subscription and transaction fees contributed 57% of the total revenue, Divvy and Invoice2Go subscription and transaction fees contributed 40% of the total revenue, and the rest (3%) came from the float revenue (the company investing cash into marketable securities). Divvy and Invoice2Go revenue grew 26% QoQ, while Bill.com revenue grew 13% QoQ. Therefore, if the acquired businesses keep the growth momentum, their contribution might surpass the core business.

When it comes to the company's core business, Bill.com, the revenue growth comes from a) serving a larger customer base, and b) generating higher revenue per customer. Thus, the company acquired 36.6 thousand customers during the fiscal year, as well as increased the average quarterly revenue per customer from $568 in Fiscal Q4 2021 to $755 in Fiscal Q4 2022.

The average revenue, in turn, was driven by higher a) higher average transaction per customer, and b) higher blended Take Rate (transaction and subscription fees). Thus, the average transaction value increased from $5.09 thousand in Fiscal Q4 2021 to $5.78 thousand in Fiscal Q4 2022, and the Take Rate increased from 0.16% in Fiscal Q4 2021 to 0.19% in Fiscal Q4 2022.

I hope Bill.com starts reporting the revenue from Divvy and Invoice2Go separately, so investors could break down the growth into similar drivers. As a reminder, Divvy generates most of the revenue from the interchange fees (thus, Total Payment Volume, as the function of the number of customers and average spend by a customer, as well as Take Rate, are the core drivers), while Invoice2Go generates most of the revenue from subscription fees (thus, the number of customers and average subscription revenue per customer are the core drivers).

The company’s management guided for $208 - $211 million in revenue in Fiscal Q1 2023, and $955.5 - $973.5 in revenue for the full fiscal year 2023. This guidance implies a 76-78% YoY growth for the quarter and a 49-52% YoY growth for the full fiscal year.

Gross Profit

The company reported a gross profit of $156.8 million for Fiscal Q4 2022, and a gross profit of $496.9 million for the full fiscal year, which represents a 170% YoY growth for the quarter (compared to Fiscal Q4 2021) and 182% YoY growth for the full fiscal year (compared to Fiscal 2021).

Of course, the acquisitions of Divvy and Invoice2Go were the main drivers behind the impressive gross profit growth during Fiscal 2022. However, the acquisitions improved the average Gross Profit Margin. Thus, the Gross Profit Margin increased from 74% in Fiscal Q4 2021 (a quarter, which included only one month of Divvy contribution, and none of Invoice2Go) to 78% in Fiscal Q4 2022.

The company does not provide a breakdown of gross profit by business line (Bill.com, Divvy, and Invoice2Go), a simple calculation suggests that Divvy and Invoice2Go operated at a gross profit margin of 85% in Fiscal Q4 2022 (math check: Bill.com revenue of $120.3 million * 74% gross profit margin + Divvy and Invoice2Go revenue of $79.9 million * 85% gross profit margin = $156.8 million in gross profit).

Therefore, if Divvy and Invoice2Go's share in total revenue continues to increase (due to faster growth than the core business), we can expect the total gross profit margin for the business to improve further (which is already crazy high).

Operating Expenses

The company reported total operating expenses of $240.1 million for Fiscal Q4 2022 and $813.8 million for the full fiscal year 2022, which resulted in an operating loss of $83.4 million for the quarter (up from an operating loss of $70.7 million in Fiscal Q4 2021) and an operating loss of $316.8 million for the full fiscal year (up from an operating loss of $114.0 million in Fiscal 2021).

Operating expenses (and operating loss) escalated with the consolidation of Divvy and Invoice2Go, but as you can see from the chart below, the operating loss has been flat compared to the previous quarter. The growth in the revenue and gross profit compensates for the rump up in the operating expenses.

Looking at the operating expenses as a percentage of the revenue, we can see that the “Research and development” expenses normalized at 33-35% of the revenue, and the “General and administrative” expenses spiked following the acquisitions, but continued to decline since then. The company ramped up the “Sales and marketing” expenses to a 50%+ level during the last four quarters. Total operating expenses stood at 120% of the revenue in Fiscal Q4 2022.

The operating expenses included $57.9 million in stock-based compensation, which represented 29% of the total revenue (meaning that excluding the stock-based compensation, the operating expenses represented 91% of the revenue). Thus, the company’s ambition to reach profitability on an adjusted basis in Fiscal 2023 (more on that below), implies that we should probably continue seeing similar levels of operating expenses (relative to the revenue) going forward.

Net Income (Loss)

The company reported a Net loss of $84.9 million for Fiscal Q4 2022 (up from a Net loss of $41.9 million in Fiscal Q4 2021), and a Net loss of $326.4 million for the full fiscal year 2022 (up from a Net loss of $98.7 million in Fiscal 2021).

On an adjusted basis, the company reported a non-GAAP net loss of $3.3 million for Fiscal Q4 2022 and a non-GAAP net loss of $24.3 million for the full fiscal 2022. In calculating the non-GAAP Net loss, the company adjusts the GAAP Net loss with depreciation and amortization, stock-based compensation, as well one-time expenses such as acquisition-related costs.

The company’s management guided for a non-GAAP Net income of $5.5 - $8.0 million in Fiscal Q1 2023, and a non-GAAP Net income of $27.5 - $45.5 million for the full fiscal year 2023. The company “expects stock-based compensation expenses of approximately $75 million per quarter”, so adding this number to the depreciation and amortization of around $22 million per quarter, should result in a GAAP Net loss of $340-360 million in the fiscal year 2023.

As of June 30, 2022, the company had $2.7 billion in cash, cash equivalents, and marketable securities on its balance sheet.

Things to Watch in Fiscal 2023

Revenue growth. The company’s management guided for another strong year ahead (49-52% YoY revenue growth). Bill.com has multiple levers to support this guidance (growth of the core business, growth of the acquired businesses, solution cross-selling, international expansion, etc.), yet the economic outlook is not promising, which might impact the company’s growth prospects. Numerous companies missed their guidances, as the market conditions changed. I hope Bill.com will not be one of them.

Integration of Divvy. The company’s management indicated that integrating Bill.com and Divvy platforms is one of the key priorities for the year. These two products are a natural fit, so integrating the solutions into one dashboard should allow the company to cross-sell. Divvy’s revenue is growing nicely through acquiring new clients, but I believe there is a lot of cross-selling potential in this acquisition as well.

International expansion. Invoice2Go serves customers across 150 countries (at the moment of the acquisitions, 60% of Invoice2Go customers resided outside of the U.S.). My understanding is that the company will use this customer base as a springboard for Bill.com's international expansion. It will be interesting to see, which markets they will start pursuing first, and how aggressive they will be in this pursuit.

Acquisitions. Bill.com has almost $3 million in cash, cash equivalents, and marketable securities, so I don’t think they have finished their acquisition spree. International acquisitions seem like a logical continuation of the effort, but I wouldn’t exclude additional acquisitions in the spend-management space to inorganically grow Divvy’s business.

In summary, it was a great quarter and a year for the company! The company is growing its core business, Bill.com, it made two promising acquisitions, Divvy and Invoice2Go, and it has a ton of cash to continue growing both organically and through acquisitions. Bill.com is a super exciting company to follow!

Source of the data used above: Investor Relations

Disclosure & Disclaimer: despite rocky performance in 2021 and the first half of 2022, I own shares in most of the companies covered in this newsletter, as I am extremely bullish on the transformation in the financial services industry. However, none of the above is financial advice, and you should do your own research.