Hi!

Hope you had a wonderful weekend! The Federal Open Market Committee will hold a meeting on Tuesday and Wednesday to discuss monetary policy and decide on whether to continue raising rates. The CME FedWatch Tool estimates a 73.6% probability of the fed funds rate remaining at the current level, and a 26.4% probability of another 25 basis points increase.

In the meantime,

Barron’s names best online brokers of 2023,

Visa is rumored to acquire Brazil’s Pismo, and

Shift4 Payments introduces SkyTab Workforce

Thank you for reading and see you tomorrow!

Jevgenijs

Barron’s Names Best Online Brokers of 2023

Barron’s published its 28th annual survey of online brokers last week. In this year’s survey, Interactive Brokers (NASDAQ: IBKR) and Fidelity tied for first place among the 10 brokerages evaluated. Charles Schwab (NYSE: SCHW) took third place, followed by Morgan Stanley's E*Trade. TD Ameritrade, now owned by Schwab, came in fifth, with Merrill Edge, Webull, Ally Invest (NYSE: ALLY), Robinhood (NASDAQ: HOOD), and J.P. Morgan Self-Directed Investing rounding out the list. Barron's decided to exclude SoFi (NASDAQ: SOFI) due to its investment site being perceived as “an afterthought to its core lending banking business.”

Barron’s survey aims to assess and rank online brokers based on their ability to provide a comprehensive range of services, technological advancements, educational resources, and user-friendly platforms to meet the diverse needs of self-directed investors. The methodology involves scoring brokerages based on 101 criteria divided into categories such as trading, mobile, news/information, usability, and international. This year, a greater emphasis was put on mobile capabilities to reflect the increasing reliance on mobile devices for investing activities, as well as availability of fixed-income instruments to reflect their resurgence.

Image source: Interactive Brokers

The brokerage industry has undergone a decade of consolidation, with notable acquisitions such as TD Ameritrade's purchase of Scottrade in 2017 and Morgan Stanley's acquisition of E*Trade in 2020. The consolidation wave reached its peak with Charles Schwab's $22 billion acquisition of TD Ameritrade, which was completed in October 2020. After three years of integration, Schwab is poised to become one of the two major self-directed retail investor giants, alongside Fidelity. At the end of 2022, Schwab and TD Ameritrade had a combined total of 24.7 million retail accounts, which is about 12.4 million fewer accounts than Fidelity.

✔️ 2023’s Best Brokers: The Breakdown

✔️ The Best Online Brokers of 2023: Meeting the Challenge of Diverse Investors

Visa is Rumored to Acquire Brazil’s Pismo

Visa (NYSE: V) is reportedly in advanced negotiations to acquire Pismo, a Brazilian financial technology company that offers cloud-based payment and banking platforms. According to Bloomberg, the deal, which could be valued at around $1 billion, may be announced as early as this month. However, a final agreement has not yet been reached, and the discussions could still fall through. Earlier this year, Bloomberg reported that Mastercard was also among the firms competing to acquire Pismo, with Pismo retaining Goldman Sachs for assistance in the sales process.

Pismo, co-founded by Daniela Binatti and Ricardo Josuá in 2016, enables banks and fintech companies to launch a wide range of products, including cards and payments, digital banking services, digital wallets, and marketplaces. The company competes with the likes of Fiserv’s Finxact, SoFi’s Galileo and Technisys, Marqeta, Mambu, as well as solutions from the established industry vendors such as FIS, Temenos and Oracle. In 2021, Pismo raised $108 million from investors led by SoftBank, Amazon and Accel, bringing its total funding to $118 million.

Image source: Pismo

The deal would mark the biggest acquisition for Visa since late 2021. Thus, in 2021 Visa abandoned its plans for a $5.3 billion acquisition of Plaid due to legal hurdles presented by antitrust regulators. This unexpected setback led Visa to explore alternative opportunities in the financial technology space. Consequently, in the same year, Visa forged ahead and struck a deal to acquire Tink, a Swedish open-banking platform, for approximately $2 billion. Later in the year, Visa acquired a UK’s cross-border payments company Currencycloud for $963 million.

✔️ Visa Nearing Deal for Brazil Payments Provider Pismo, Sources Say

✔️ Visa Competing to Acquire Banking and Payments Platform Pismo

✔️ Mastercard, Visa Are Among Firms in Talks to Buy Fintech Pismo

Shift4 Payments Introduces SkyTab Workforce

Shift4 Payments (NYSE: FOUR) announced launching “SkyTab Workforce”, a mobile employee scheduling app integrated into the SkyTab POS. The solution, which is available for both iOS and Android devices, allows creating and managing employee schedules, tracking payroll, ensuring compliance with labor laws, and facilitating real-time communication among staff members. SkyTab is Shift4’s next-generation restaurant point-of-sale (POS) system that includes integrated hardware, software, management tools, and various mobile solutions.

Image source: SkyTab Workforce on Google Play

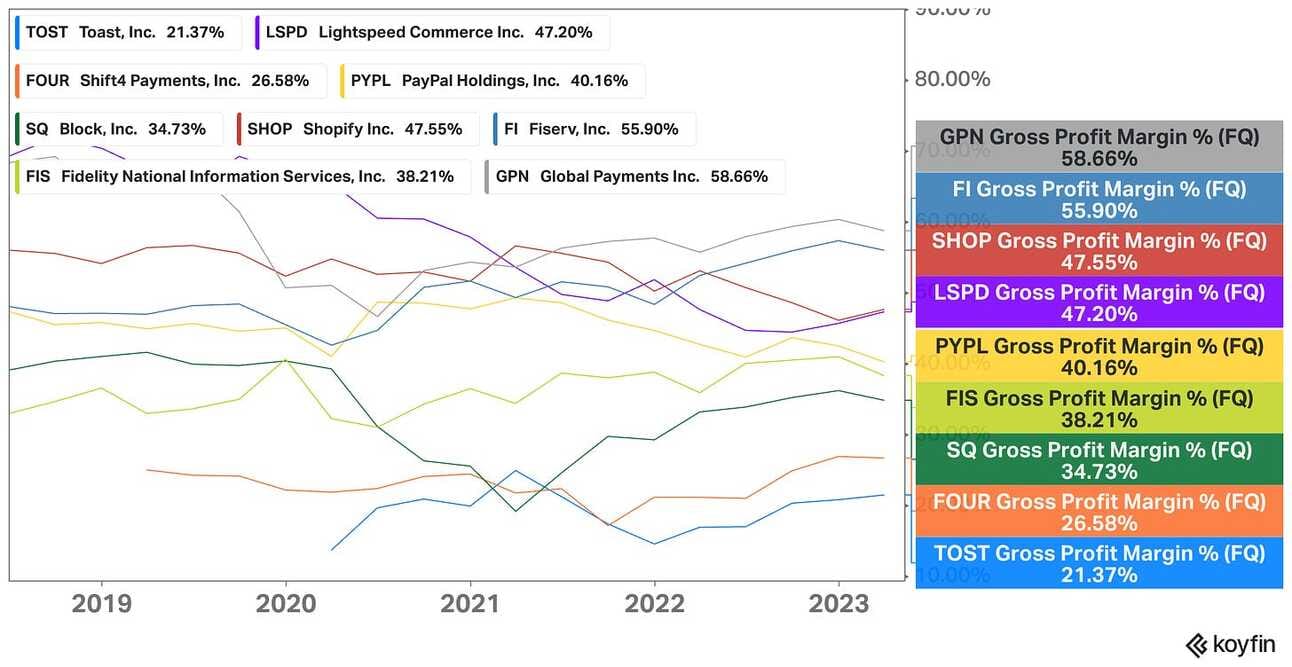

The launch comes on the back of intensifying competition amongst point-of-sale solution providers, as the companies aim to differentiate by broadening their software offering. Thus, this year we saw Toast (NYSE: TOST) launching a reservation and waitlist management solution “Toast Tables”, Square (NYSE: SQ) launching an integration with OpenTable, and Lightspeed Commerce (NYSE: LSPD) launching a new version of its flagship POS platform for restaurants. In addition to strengthening the value proposition, software services command higher gross profit margins compared to payments acceptance and processing.

✔️ Shift4 Payments Unveils SkyTab, an Integrated Pay-at-the-Table Solution

✔️ Square Launches Nearly 100 New Features to Help Sellers Diversify Revenue Streams and Automate Operations

✔️ Lightspeed’s Newest Release of its Flagship Restaurant Platform

✔️ Introducing Toast Tables: Integrated Reservation and Waitlist Management for Restaurants

Speaking of gross profit margins…In the first quarter of 2023, the gross profit margins of payment companies ranged from 21.37% for Toast to 58.66% for Global Payments. Of course, you need to account for the specifics of each company (i.e. Bitcoin revenue generates only 2% gross profit margins for Block), but on a high level the conclusion is simple: higher contribution from software and subscription services results in higher gross profit margins.

Director, Artificial Intelligence and Machine Learning

@ Robinhood

🇺🇸 Menlo Park, CA or New York, NY, United StatesDirector, Product Marketing

@ Robinhood

🇺🇸 Menlo Park, CA or New York, NY, United StatesDirector, Digital and Fintech Partnerships

@ Visa

🇸🇬 SingaporeSenior Product Manager, New Payment Products

@ Shift4 Payments

🇺🇸 Tampa, FL or Atlanta, GA, United StatesProduct Manager, The Giving Block

@ Shift4 Payments

🇺🇸 Remote, United States or Europe

Cover image source: Charles Schwab

Disclaimer: Information contained in this newsletter is intended for educational and informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions.