Hi!

Welcome to the “Popular Fintech” newsletter! I am piloting a daily format of this newsletter, let’s see how it goes. Will continue writing about publicly traded Fintech companies (as well as their competitors and regulators). Today we are going to look into:

Apple launching Savings accounts

Charles Schwab losing 30% of deposits, and

ChartGPT predicting stock market moves

1D change, as of April 17, 2023 close

Apple Launches Savings Accounts

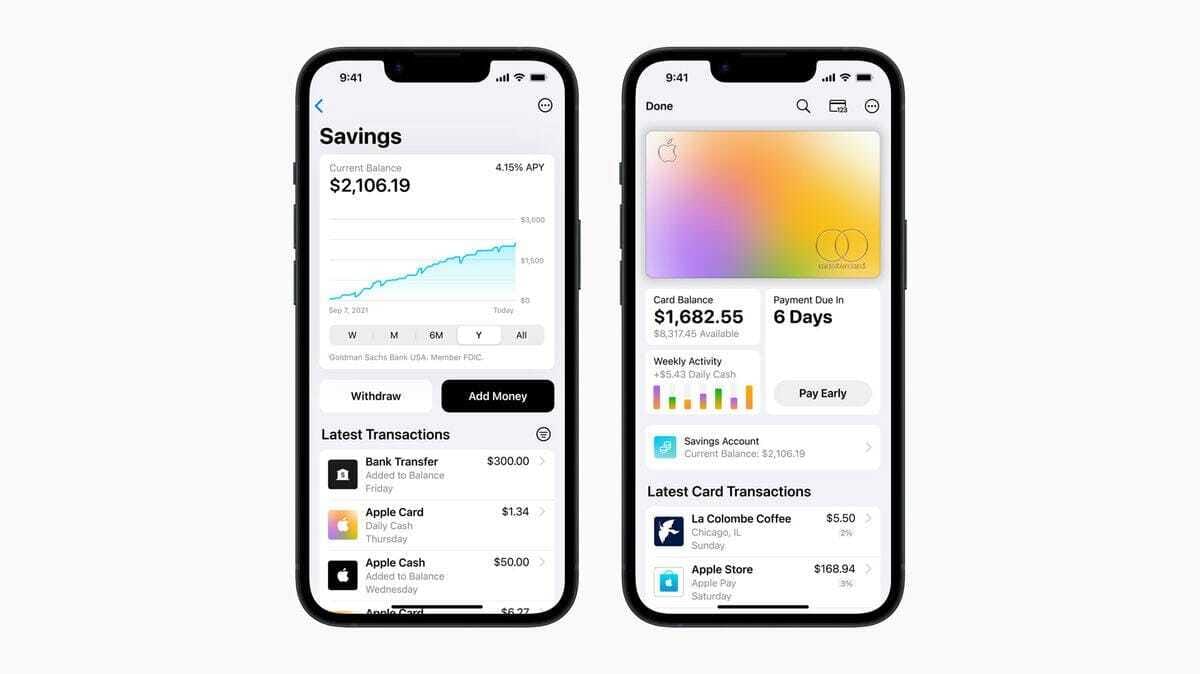

Apple (NASDAQ: AAPL) has launched a new high-yield savings account for Apple Card customers, according to a recent press release from the tech giant. The savings account is FDIC-insured and offers a 4.15% annual percentage yield (APY), “a rate that’s more than 10 times the national average”. The introduction of Apple's savings account is a continuation of the company's push into financial services, which began with the launch of Apple Pay in 2014. With its competitive interest rate and no minimum balance requirements, the new savings account is sure to attract a significant amount of attention from Apple Card users looking to grow their savings. Apple is launching the service in cooperation with its long-standing partner Goldman Sachs (NYSE: GS).

Image source: Apple

✔️ Apple launches its savings account with 4.15% interest rate✔️ Apple Makes the iPhone a Home for Savings Accounts✔️ Apple, Goldman Sachs Debut Savings Account With 4.15% Annual Yield

Charles Schwab Beats Earnings Expectations Despite Losing Deposits

Charles Schwab (NYSE: SCHW) released its first quarter 2023 financial results, reporting a Net Income of $1.6 billion, up 15% from $1.4 billion for the first quarter of 2022. The company has experienced a decline in deposits and announced a decision to temporarily halt its share buyback program. Thus, Schwab's customer deposits decreased to $325.7 billion, which represents a 30% decline compared to the previous year. Investors have been concerned that the brokerage may face a similar fate as Silicon Valley Bank, but Schwab’s management has assured its clients and investors that it remains financially sound and committed to delivering value to its shareholders. The decision to pause share repurchases is seen as a wise move in light of volatile market conditions and is expected to resume once conditions improve.

Data source: Charles Schwab, Investor Relations

✔️ Schwab Leaders Say Firm Can Withstand Storm After Deposit Drain✔️ Schwab Earnings Beat Expectations. Firm Pauses Share Repurchases✔️ Charles Schwab’s Deposits Shrink, but Profits Grow Faster Than Expected

ChatGPT Understands Fedspeak and Can Predict Stock Market Moves

According to the recent studies, ChatGPT, an AI language model developed by OpenAI, is capable of decoding the language used by the US Federal Reserve and predicting stock market movements based on headlines. One of the researches, Can ChatGPT Decipher Fedspeak?, states that ChatGPT has been able to accurately predict market reactions to Fed announcements, as well as understand the language used by Fed officials in their speeches and press releases. The second study, Can ChatGPT Forecast Stock Price Movements?, found that ChatGPT was able to interpret corporate news headlines and showed a statistical link to the stock's subsequent moves, indicating that the AI model could correctly parse the implications of the news.

Image source: Jonathan Kemper on Unsplash

✔️ ChatGPT Can Decode Fed Speak, Predict Stock Moves From Headlines✔️ New task for ChatGPT: Deciphering messages from the Fed

Chart of the Day

Wise (LON: WISE), a UK-based foreign exchange FinTech company, will provide its Q4 Financial Year 2023 Trading Update today (Tuesday, April 18, 2023). In the previous quarter, the company serviced 5.8 million customers (up 33% YoY) and processed £26.4 billion in payments volume (up 28% YoY), generating £268.7 million in total income. The company’s fiscal year ended on March 31, 2023.

Data source: Wise, Investor Relations

Jobs in Fintech

Global Head of Social Media@ Cash AppNew York, NY, United States

Senior Engineering Manager, Machine Learning@ CoinbaseRemote, United States

Product Manager, Web3@ RobinhoodMenlo Park, CA or New York, NY, United States

Senior Product Manager, Technical - Platform teams@ NubankBrazil, San Paolo

Director of UX Research@WiseLondon, United Kingdom

That’s it for today! Thank you for reading and see your tomorrow!

Jevgenijs

Cover image source: Apple

Disclaimer: Information contained in this newsletter is intended for educational and informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions.