Hey!

Adyen represents what a Fintech challenger was meant to be: built on a modern tech stack, growing rapidly, and winning market share from the incumbents. It’s the founders’ second act, and after selling their first company, they knew exactly how to build a next-generation payments processor from scratch.

I believe it is fair to say that Adyen has figured out how to win over enterprise clients, and it is only a matter of time before it overtakes the biggest incumbents. However, while enterprise clients represent the majority of payment volume, they represent the minority of revenue for merchant acquirers.

Adyen does not have the organizational capacity to serve small businesses. Instead, they aim to become a partner of choice for “platforms” serving SMBs. Think marketplaces like eBay and Etsy, and POS software providers like Toast and Lightspeed. The bet is that small businesses won’t buy financial services directly; those services will be embedded in the software they rely on to run their business.

If this bet plays out, and Adyen manages to capitalize on this opportunity, it has a long runway ahead! Let’s dive in!

Jevgenijs

p.s. if you have feedback, just reply to this email or ping me on X/Twitter

Adyen $ADYEY ( ▼ 5.75% ) is a next-generation merchant acquirer, but calling it that doesn’t quite do it justice. The company is scaling fast, broadening its product suite, and expanding globally. Adyen is the type of company that the Fintech revolution was supposed to deliver.

Image source: Adyen Investor Day 2023

“We set out building Adyen to someday power every payment. Today, our financial technology is on its way to becoming the infrastructure behind the world’s most seamless transactions – online, in person, and the experiences moving fluidly in-between. From our vantage, the runway ahead remains clear, and we will continue executing against it.”

Adyen means "start again" in Sranan Tongo, a language spoken in the former Dutch colony of Suriname. The founders of Adyen built and sold another payments company before, and Adyen was their attempt to "start again" and build a next-generation payments processor.

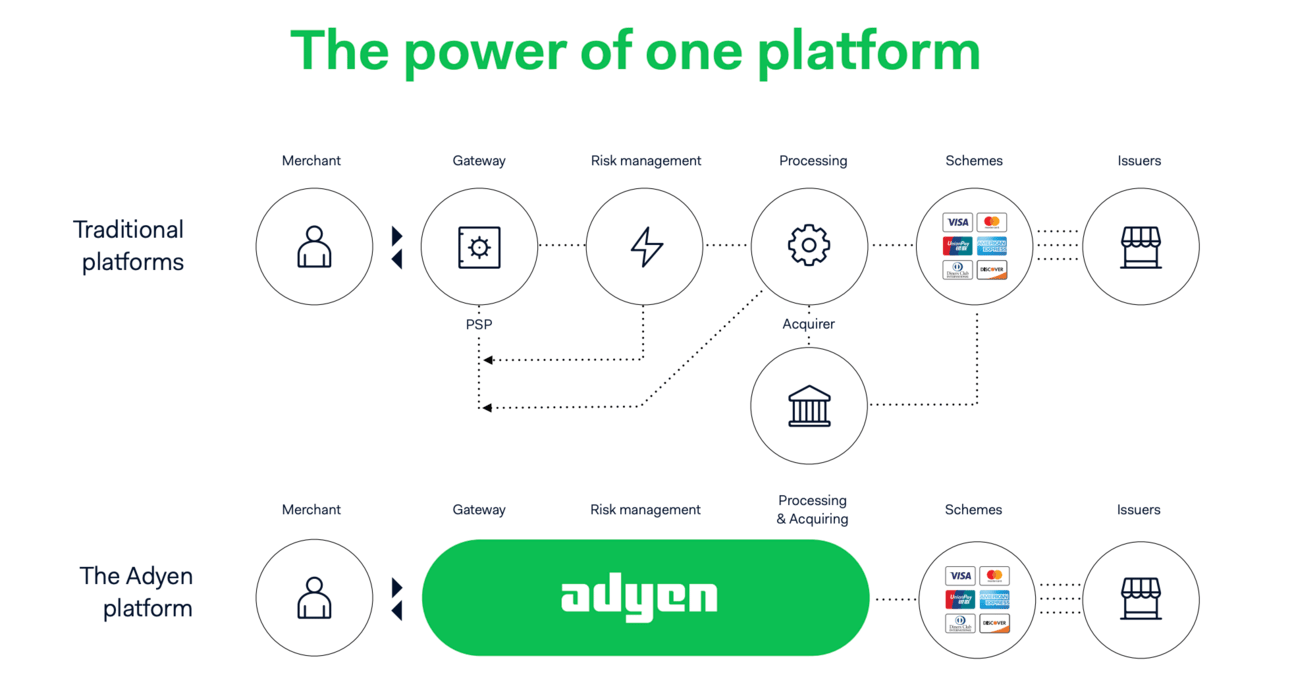

Adyen set itself apart by building a single, modern platform that handles the entire payment flow end-to-end. It’s the exact opposite of most incumbent processors, who grow through acquisitions and end up with fragmented, hard-to-integrate platforms. A trivial idea that remains novel today.

Image source: Adyen Capital Markets Day 2020

“Adyen has reimagined fragmented, multi-party ecosystems with a single solution for payments and financial management. Our technology allows customers to focus on their core business while we handle the increasingly complex payment landscape…To achieve this, we built our own platform entirely in-house, informed by the needs of modern enterprises and their customers.”

In their attempt to create a truly end-to-end platform, Adyen also became a bank and got direct access to card and non-card payment rails in the U.S., the UK, and the EU. For instance, Adyen is one of the few Fintech players with access to FedNow. With banking licenses and direct access to payment rails, Adyen has further reduced its reliance on third parties.

Image source: Adyen

“AfP’s competitive advantage begins with our in-built licenses. As one of the few non-traditional banks able to connect directly to FedNow – for which we qualified thanks to our banking license – we need only to rely on our own infrastructure and direct connections, eliminating third-party dependencies.”

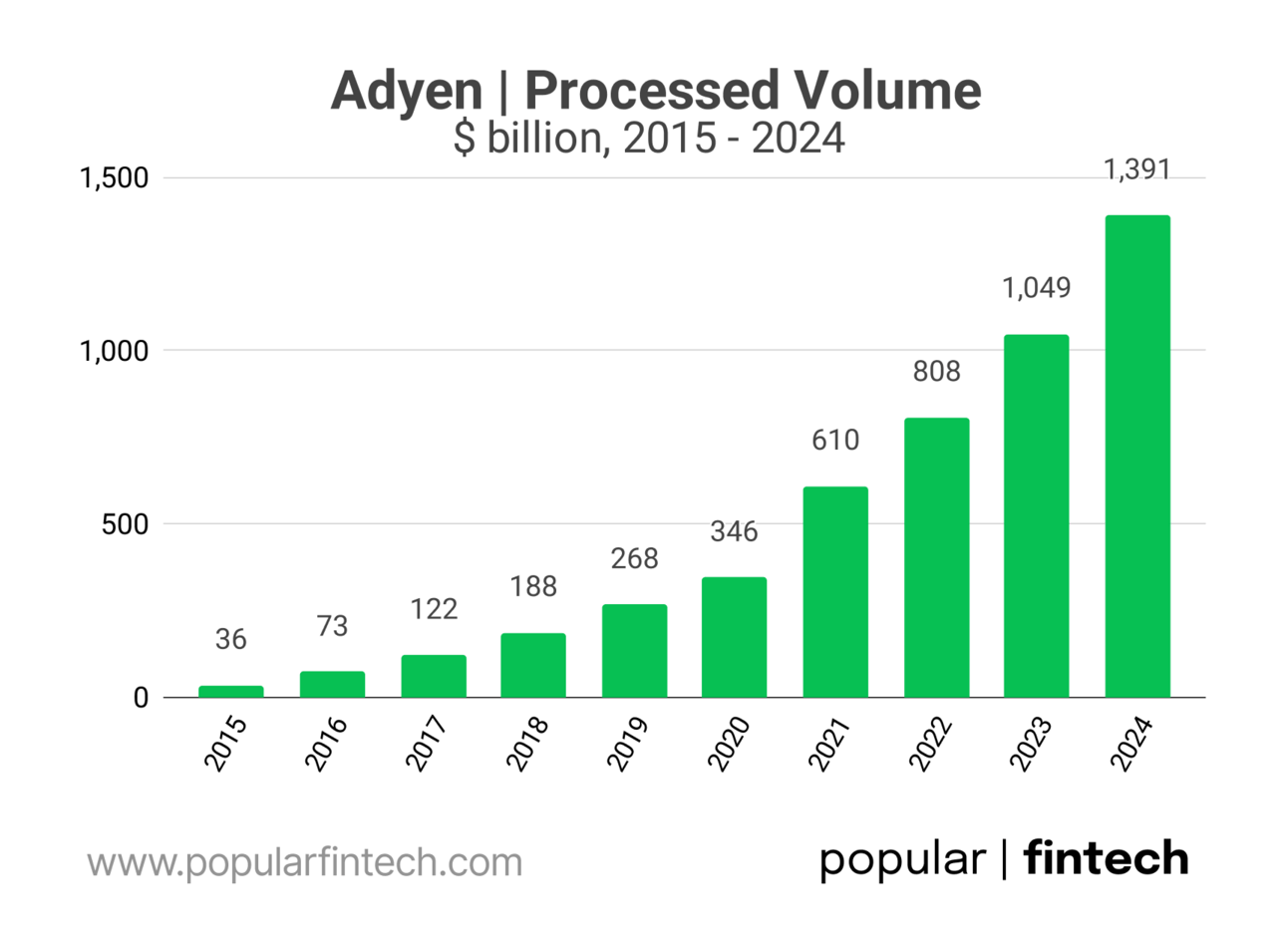

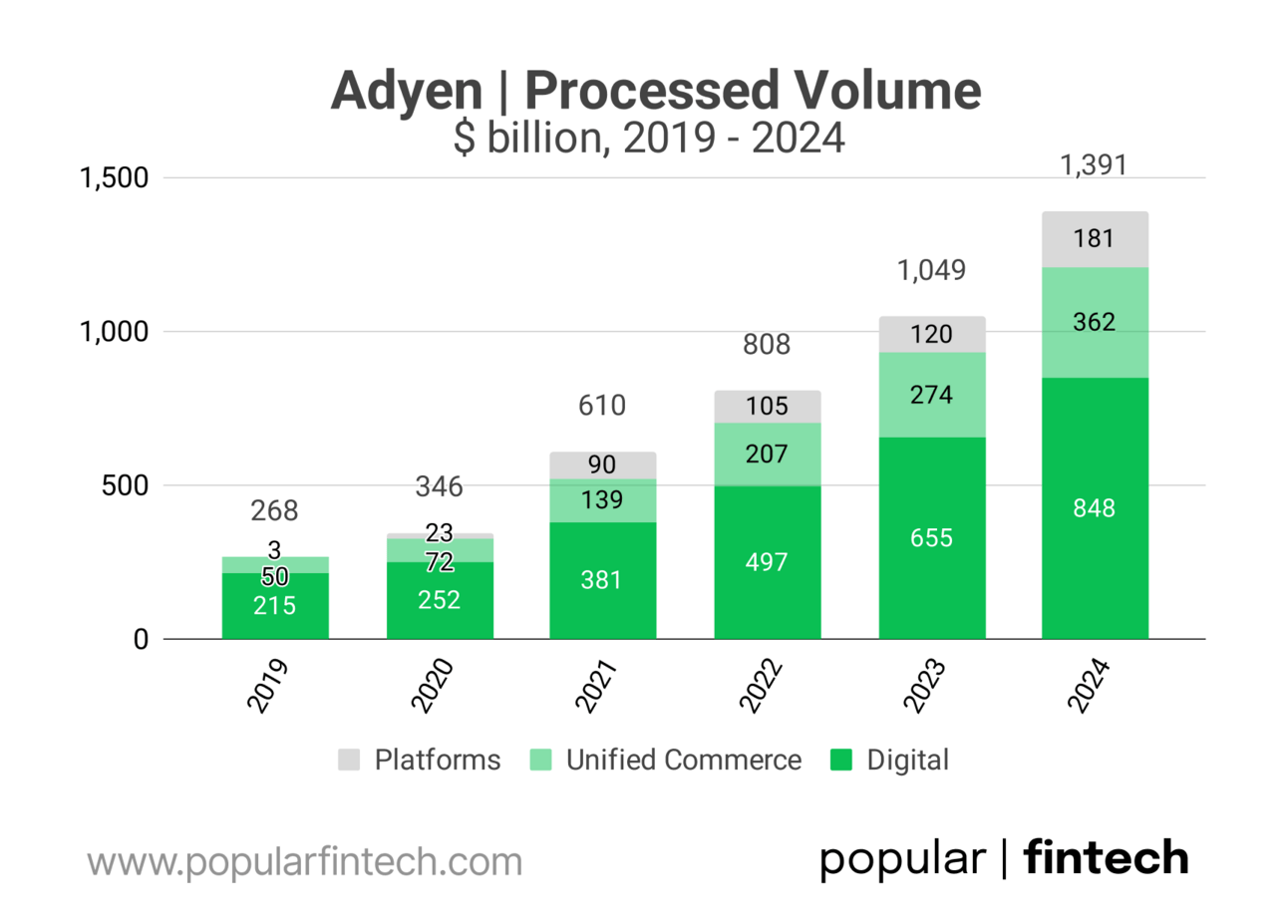

Adyen’s approach has been working. Thus, the payment volume processed by the company grew almost 40x over the past 9 years, from $36 billion in 2015 to $1.39 trillion in 2024.

In the last few years, Adyen’s payment volumes have closely mirrored Stripe’s (Stripe processed “over $1 trillion” in 2023 and $1.4 trillion in 2024, according to the company’s annual letters).

“In 2024, we were pleased to surpass the 1 trillion EUR mark of global payments transactions processed, underscoring the scale and depth of insights that enable us to continually expand the intelligence of our platform by orders of magnitude each year.”

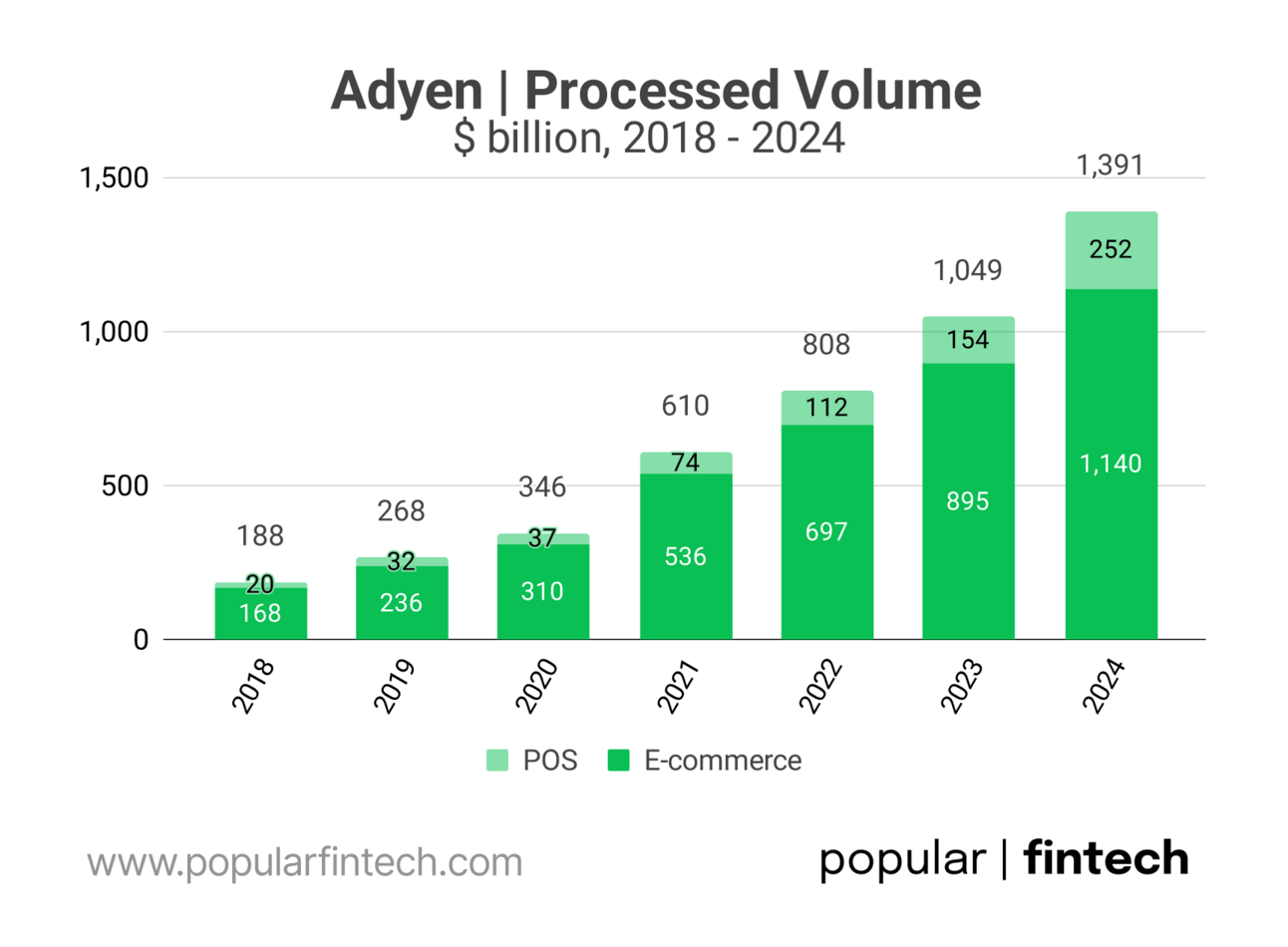

Adyen started as an online acquirer, but is quickly diversifying into in-store payments. Thus, in 2024, they processed $252 billion in “card-present” transactions (18% of the total volume). Adyen serves omnichannel merchants through its “Unified Commerce” offering, helping merchants accept payments online and in-store.

“Although the digital revolution is well underway, nearly 80% of payments still take place in person today. Adyen therefore continues to differentiate its product to best power immersive experiences across physical payment touchpoints.”

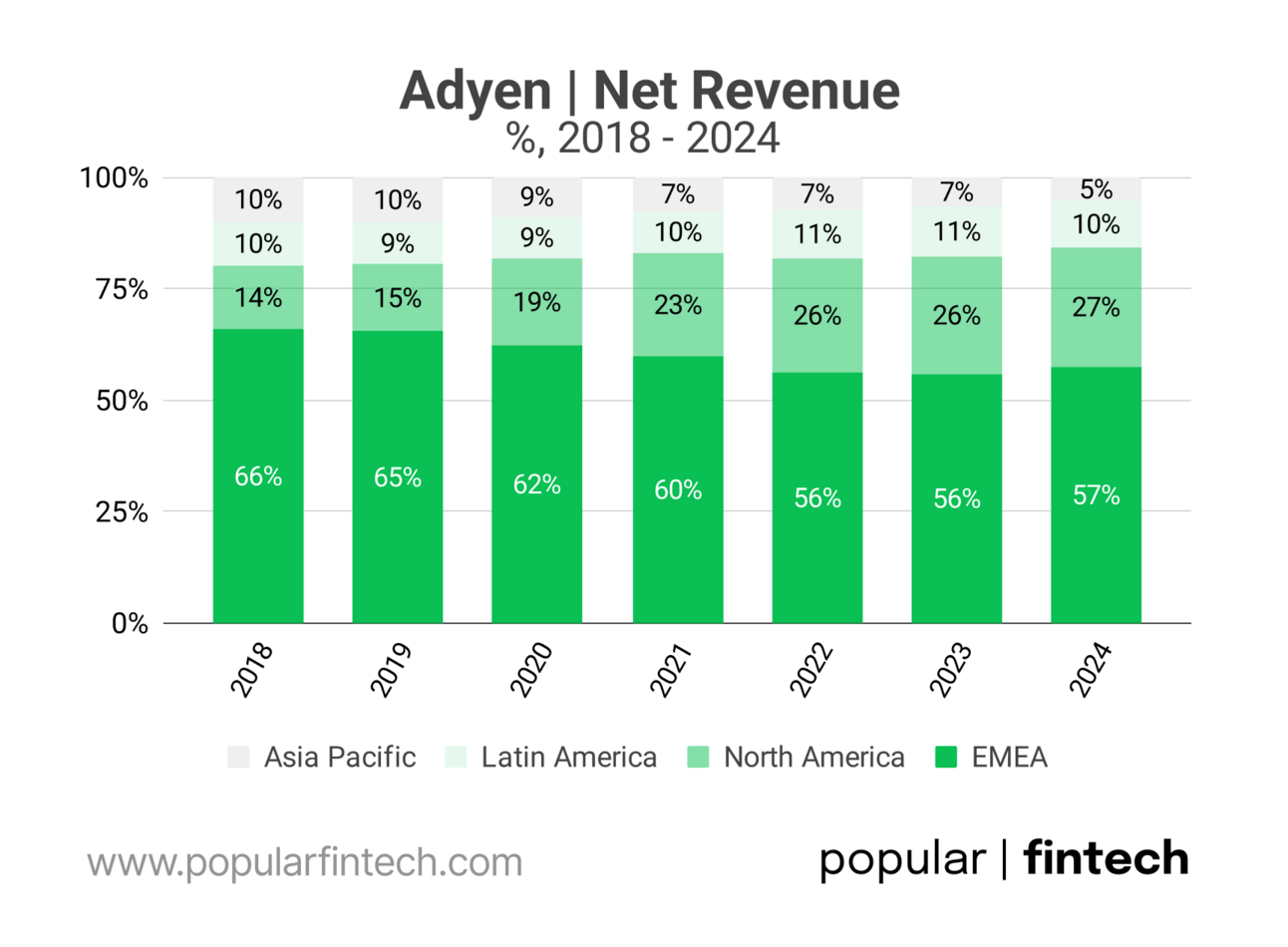

Adyen is a European (Dutch) company. Europe remains the company’s largest market, but it is rapidly expanding globally, including the United States. As a result, more than 40% of Adyen’s net revenue came from outside Europe in 2024, a figure that would be even higher if not for the continued strong growth in its home market.

“We continue strategically investing to expand our presence in highgrowth markets like the US, as well as nascent regions such as Brazil and India. In 2024, we attained our Online Payment Aggregator license in India, as well as announcing the opening of a technology hub in Bengaluru. These achievements place us in a prime position to accelerate payment innovation in the world’s fastest-growing e-commerce market.”

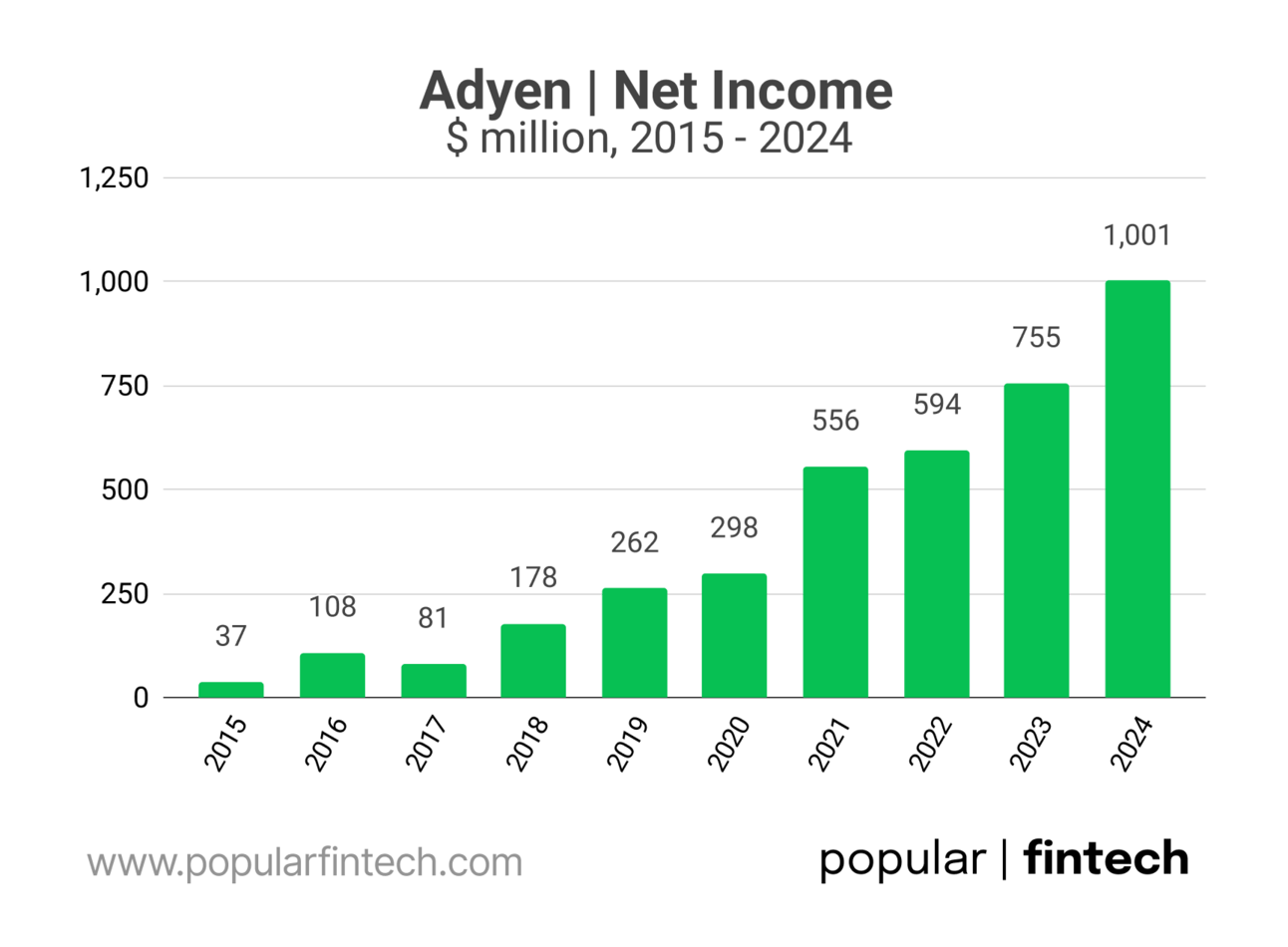

This growth also translated into stellar financial performance. Thus, the company’s net income increased from $37 million in 2015 to $1 billion in 2024. Since its IPO, Adyen’s stock (+207%) has outperformed both the Nasdaq Composite (+111%) and its peers, Visa (+156%) and Mastercard (+169%).

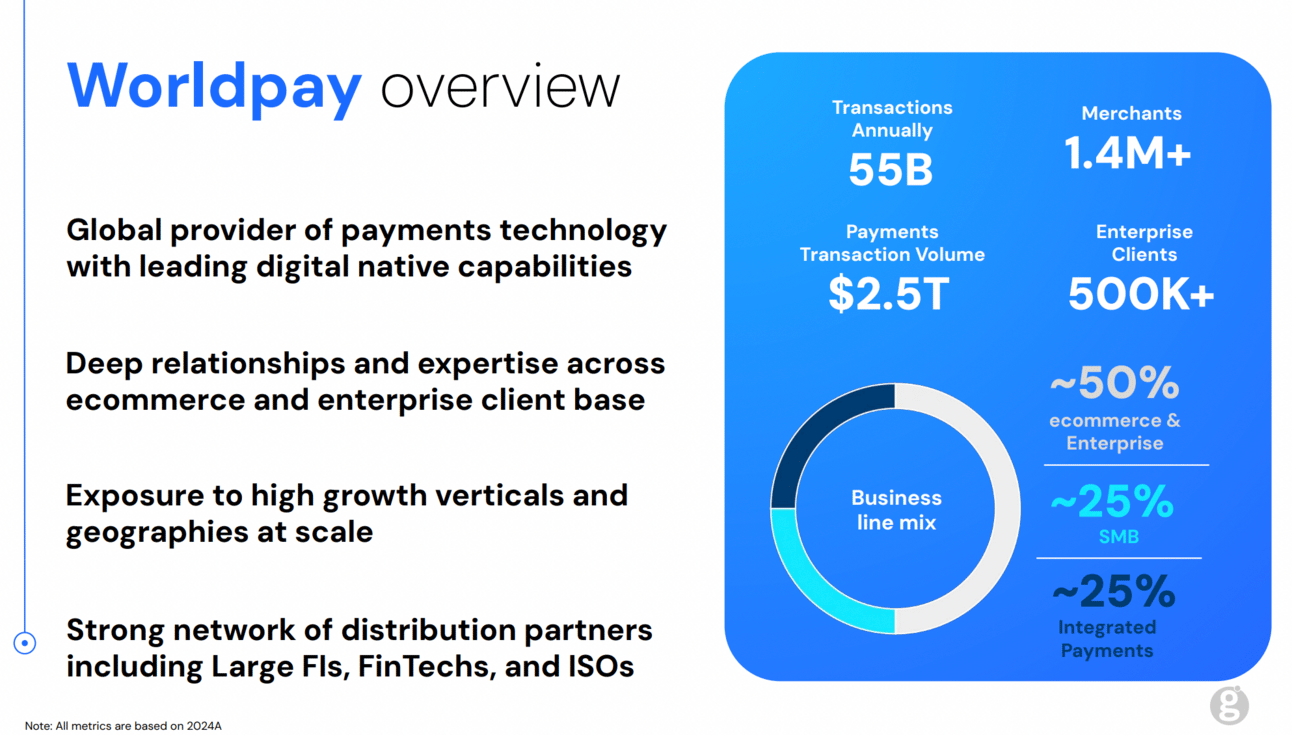

By the way, the founders of Adyen sold their first company to Worldpay, the exact type of incumbent they now compete with. And here’s the kicker: Worldpay is a patchwork of acquisitions, has changed hands multiple times, was underinvested while owned by FIS… and still processes $2.5 trillion in payments annually.

Image source: Global Payments

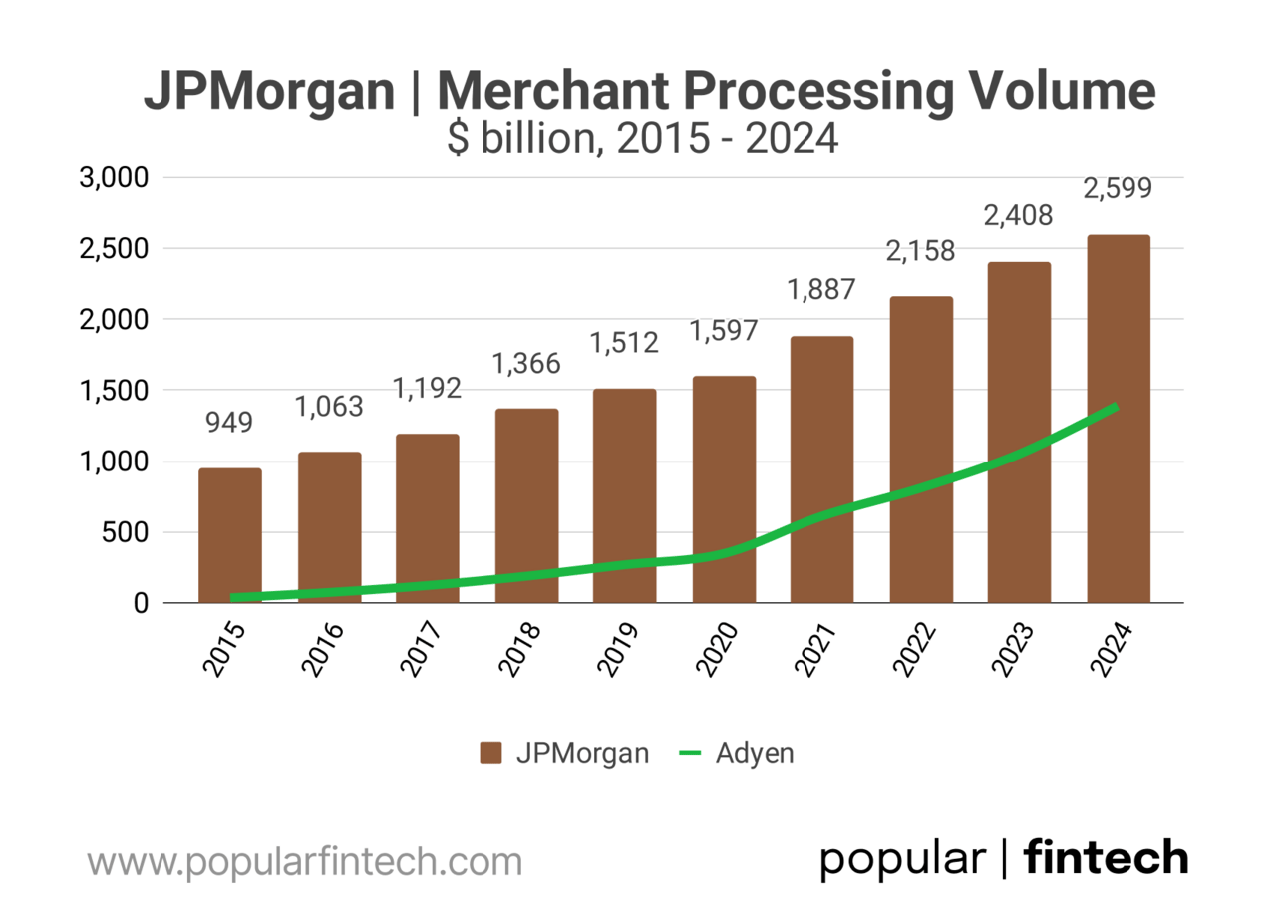

Another competitor is JPMorgan Payments, which seems to be the only incumbent that manages to (somewhat) compete with Adyen and Stripe. However, Adyen and Stripe are objectively winning. Thus, in 2015, JPMorgan processed 27 times more volume than Adyen. By 2024, that gap had narrowed to less than 2 times.

I believe it’s fair to say that Adyen has cracked the code on serving enterprise merchants, and it’s likely only a matter of time before it overtakes the incumbents in scale. Adyen will continue growing its share in online payments and will continue tapping into in-store commerce.

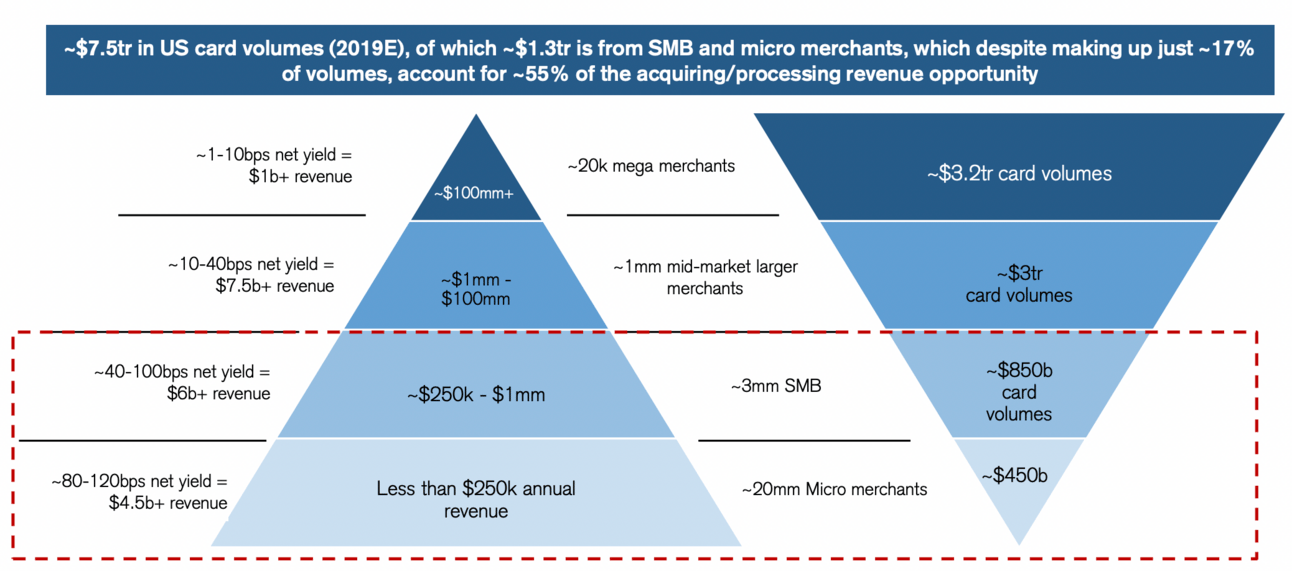

However, as UBS (previously Credit Suisse) often points out with their well-known pyramid - enterprise merchants drive the majority of payment volume, but contribute only a minority of revenue for merchant acquirers.

Thus, UBS estimates that the “total US merchant acquiring net revenue in 2023 was ~$35 billion based on total US acquiring volume of ~$12.3 trillion.” Over 60% of this revenue is attributable to merchants with under $1 million in annual revenue.

Image source: Credit Suisse, “Payments, Processors, & FinTech”

p.s. if anyone can help me get the latest version of this report, this will be much appreciated! 🙏🏻

“We continue to believe that software-led distribution is increasingly becoming the channel required to participate in the ~70% of industry revenues sourced via underlying SMBs, of which the vast majority could ultimately be running through a software platform (i.e., vertical- or horizontal-Software as a Service (SaaS) company, Independent software vendor (ISV), marketplace, etc.) longer term.”

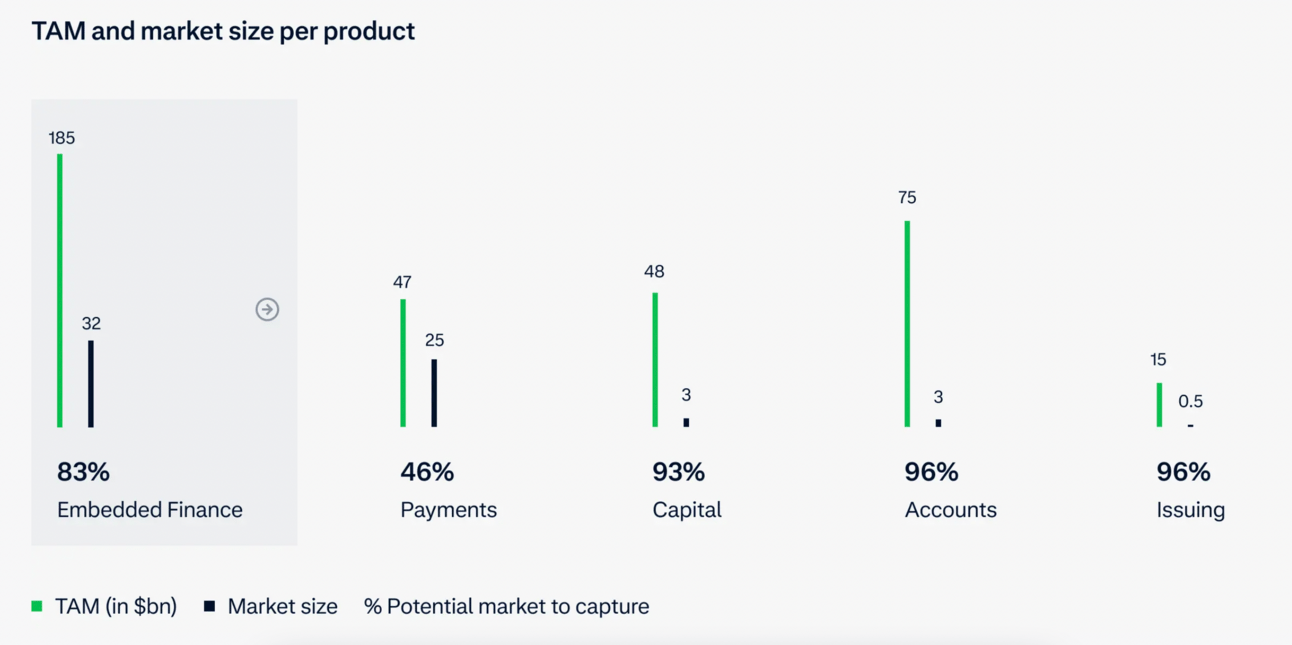

I would say it is now a consensus that the best way to reach small businesses is not by partnering with banks, but by embedding financial services into the software that they use to run their businesses. Hence, a ridiculously large estimate of the $185 billion TAM for embedded finance.

“The SaaS landscape is transforming how SMBs receive banking services. Now occupying a central role in SMB workflows, platforms are no longer just tools but business lifelines. By streamlining core processes and tailoring financial services to their needs, platforms address a gap left by traditional banks struggling to serve this sector.”

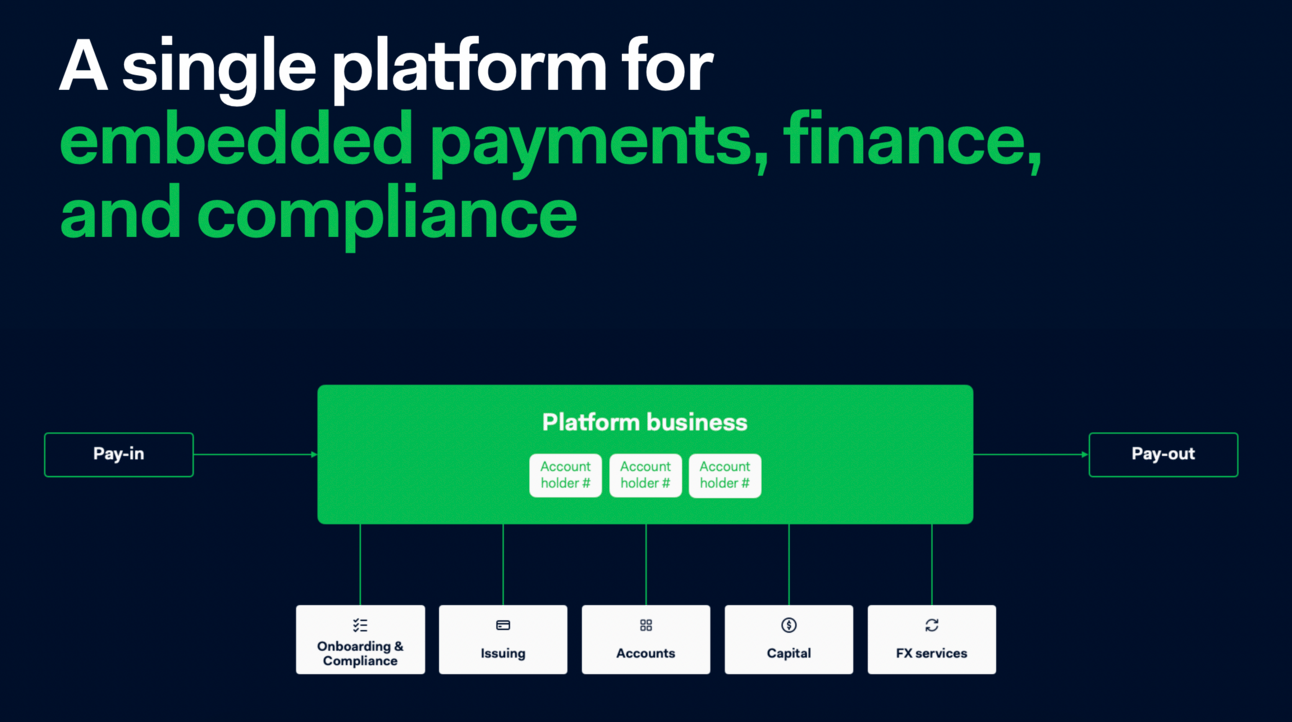

So, how does Adyen participate in this opportunity? Through its “Adyen for Platforms” offering, which allows platforms and marketplaces to embed financial services into their own products for SMBs.

Image source: Adyen Investor Day 2023

“Adyen for Platforms uniquely combines the strengths of the Digital and Unified Commerce technology that came before it. We enable platforms and marketplace businesses to process payments across online, in-person, and mobile channels, and to do so at scale for their sub-merchants and users.”

The company launched “Adyen for Platforms” back in 2016, initially partnering with GoFundMe. In 2018, Adyen managed to win eBay from PayPal, getting a massive boost to its platform business.

Image source: Adyen Capital Markets Day 2022

“We launched together with GoFundMe and slowly and steadily grew our business until 2.5 years in, eBay knocked on our door and we ended up winning the deal. eBay at that point in time, $19 billion in GMV, was quite a mountain to climb for our fairly young product, which up until then was like more a side project of the company.”

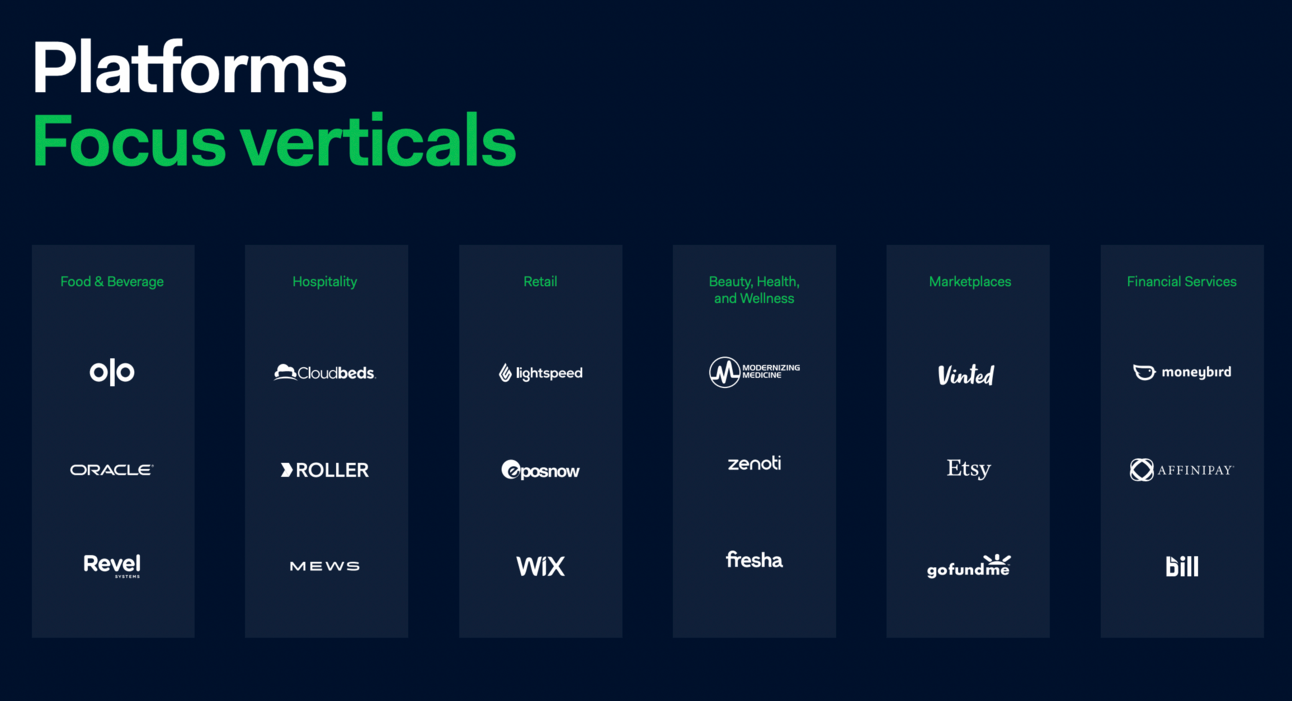

“Adyen for Platforms” is now a well-diversified business, serving platforms across Food & Beverage (Olo, Toast), Hospitality (Mews, Roller), Retail (Epos Now, Wix), and Financial services (Bill, Moneybird) verticals and multiple marketplaces (Etsy, Vinted, eBay).

Image source: Adyen Investor Day 2023

The platform also offers a wide range of services, going well beyond payments. These services include accounts, issuing, FX, and Adyen Capital, all available through a single platform.

Image source: Adyen Investor Day 2023

“The AfP journey begins with embedded payments, but can quickly expand to include our financial product suite. We shared a pinnacle example of this evolution in H2, when we partnered with the rapidly scaling spend management and procurement platform, Spendesk, to accelerate SMB innovation with both embedded payments and financial services.”

At the end of 2024, “Adyen for Platforms” served 28 platforms with over €1 billion in annual payment volume, up from 18 platforms in 2023. “Adyen for Platforms” indirectly serves 145,000 SMBs (clients of platform clients), up from 88,000 SMBs at the end of 2023.

Image source: Adyen Investor Day 2023

…and handles $181 billion in payment volume, growing faster than any other segment (although growing from a much smaller base)….

However, saying that Adyen has fully figured out the platform’s business is not correct. For instance, Toast in the US is still using Worldpay and JPMorgan Payments despite working with Adyen in Europe. And Block works with Adyen on the Cash App side, yet keeps using JPMorgan Payments as the main processor for Square.

Image source: Toast

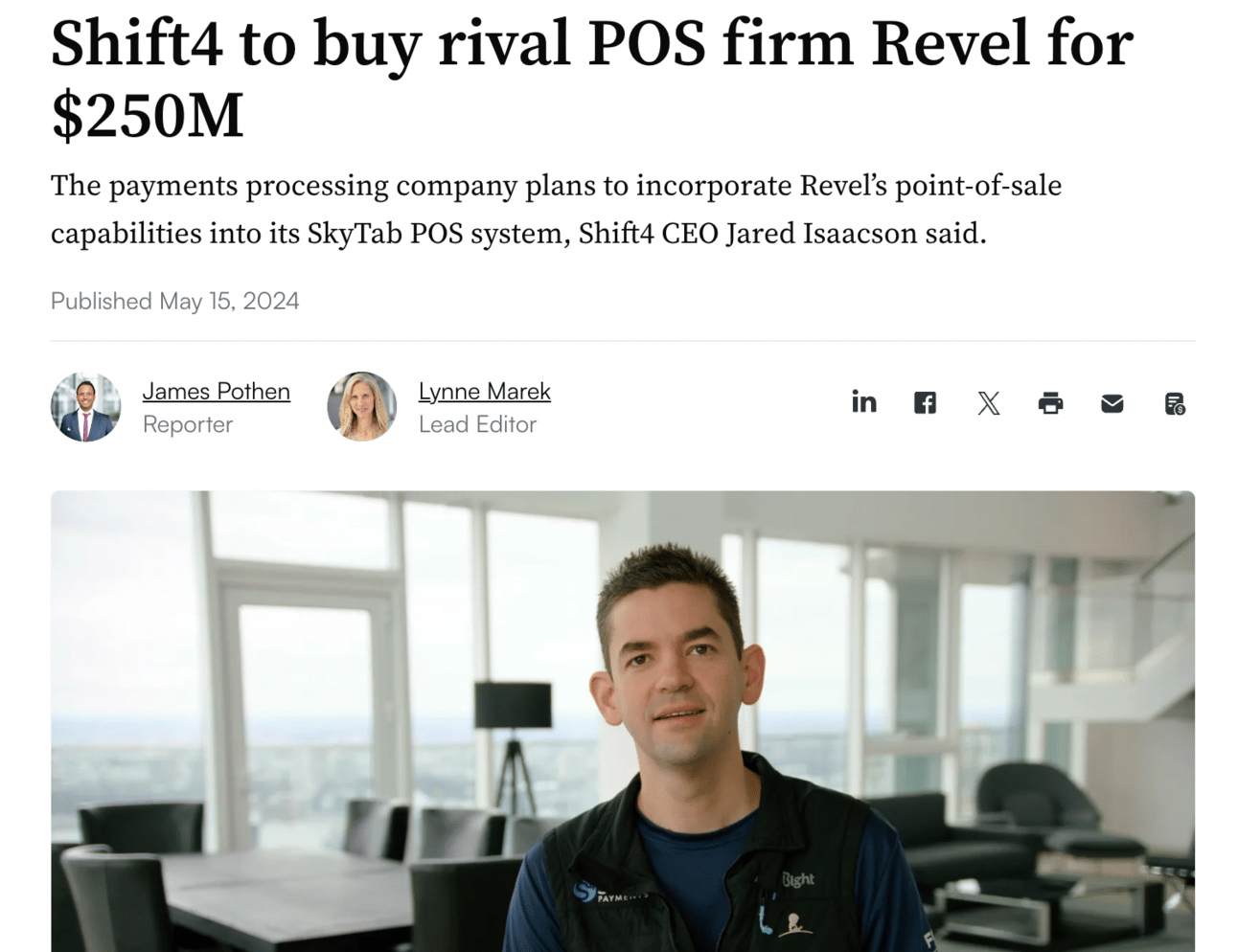

Shift4 also acquired one of Adyen’s platform clients, Revel. The goal is to migrate Revel’s clients to Shift4’s end-to-end offering, SkyTab. Given how common acquisitions are in this industry, I wouldn’t consider this deal extraordinary.

I recently wrote about Shift4 going into direct competition with Adyen. The difference is…Shift4 isn’t afraid of working with small businesses directly.

Image source: Payments Dive

And finally, while I was writing this article, eBay announced a partnership with Checkout.com. Perhaps, this partnership is not exclusive (large merchants tend to work with multiple acquirers), but still…

Image source: Checkout.com

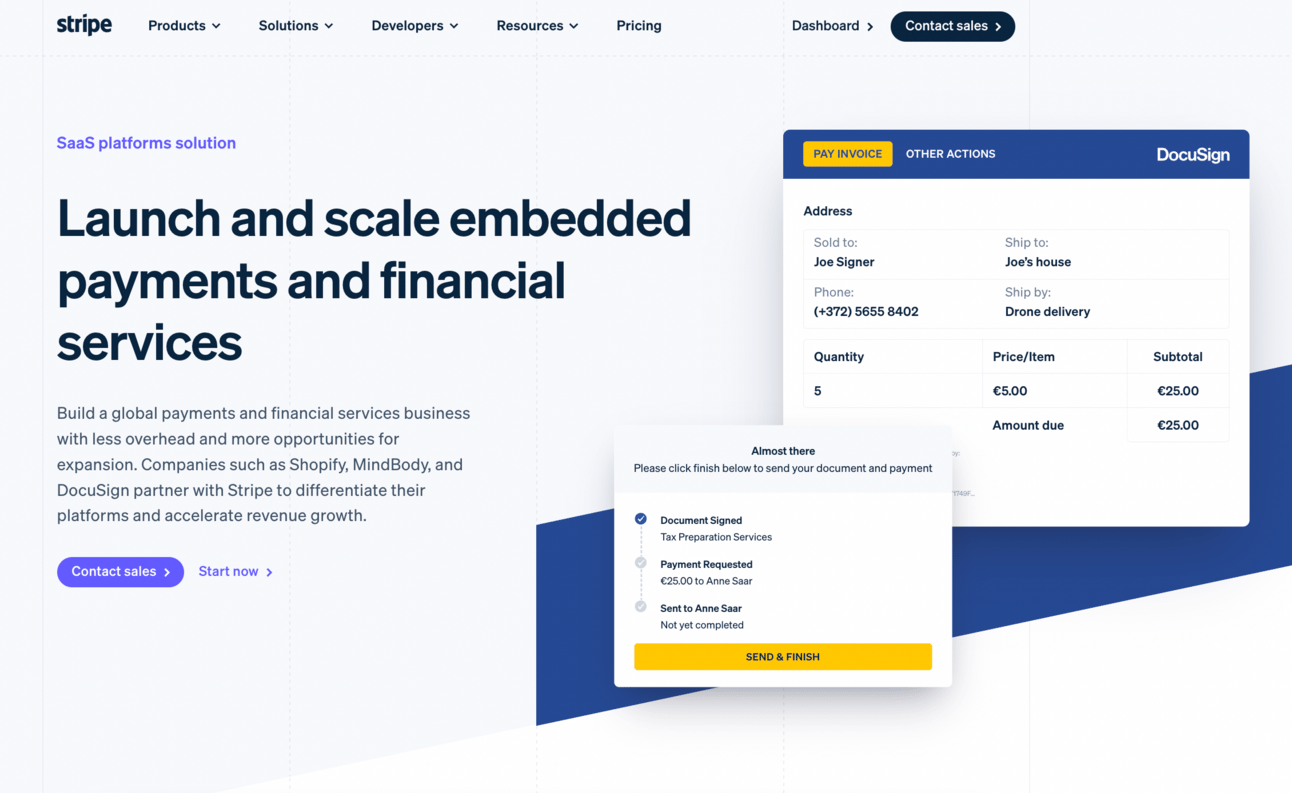

And let’s also not forget about the competition with Stripe, which also has “Stripe for Platforms” offering, sometimes serves the same clients (e.g., Lightspeed Commerce and Wix), and doesn’t shy of working with small businesses directly.

Image source: Stripe for Platforms

So…I think Adyen winning on the enterprise merchant segment is kind of a given, which is reflected in the company’s stock price. However, the opportunity for “Adyen for Platforms” might be even bigger. And Adyen's success in this pursuit is not (yet) guaranteed.

And this makes “Adyen for Platforms” a super exciting area to follow!

Cover image source: Adyen

Disclaimer: The views expressed here are my own and do not represent the views of my employer. The information contained in this newsletter is intended for educational and informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions. Read the full disclaimer here.